It looks like there’s a new sheriff in town when it comes to Bitcoin trading, because Asia-Pacific retail investors are leaving the US and Europe in the dust.

The adoption is growing

Gemini shared a new study, in collaboration with Glassnode, and they revealed that APAC’s retail Bitcoin trading is booming.

While the US and Europe are seeing a slowdown, APAC is expanding faster than you can say “blockchain”. So, what’s the secret sauce? Why is Asia suddenly the place to be for Bitcoin enthusiasts?

Well, a few factors are at play here. First off, APAC’s digital economy is growing like crazy, and more people are becoming aware of cryptocurrencies.

Plus, advancements in technology have made it easier than ever for individual investors to jump into the market.

Business-friendly environment, technological advancement

Also, there are some pretty important regulatory shifts, as some APAC countries have been rolling out the red carpet for Bitcoin, creating clearer guidelines for investors and businesses.

Of course, institutional investors still have a big influence on Bitcoin flows in the US, especially with the arrival of the spot Bitcoin ETFs, but in the APAC region, retail traders are proving that they’re a force to be reckoned with.

Changing positions, new favs?

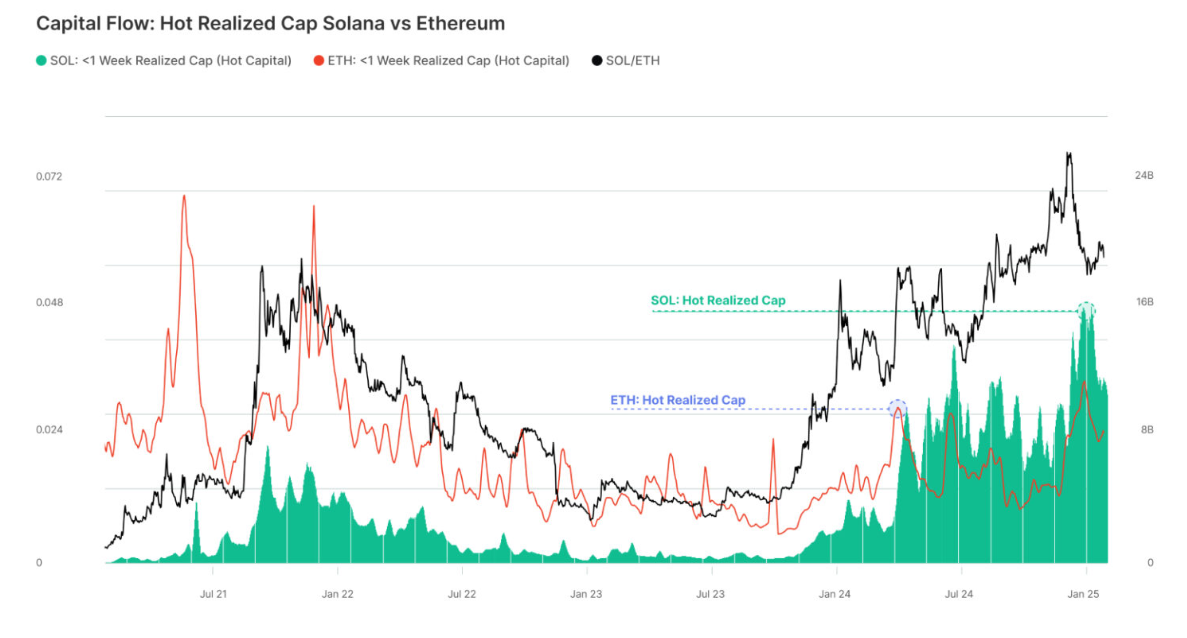

The report also dropped a bombshell, telling Solana has officially surpassed Ethereum in retail investor capital for the first time. It seems like all that active capital flowing into Solana is paying off big time.

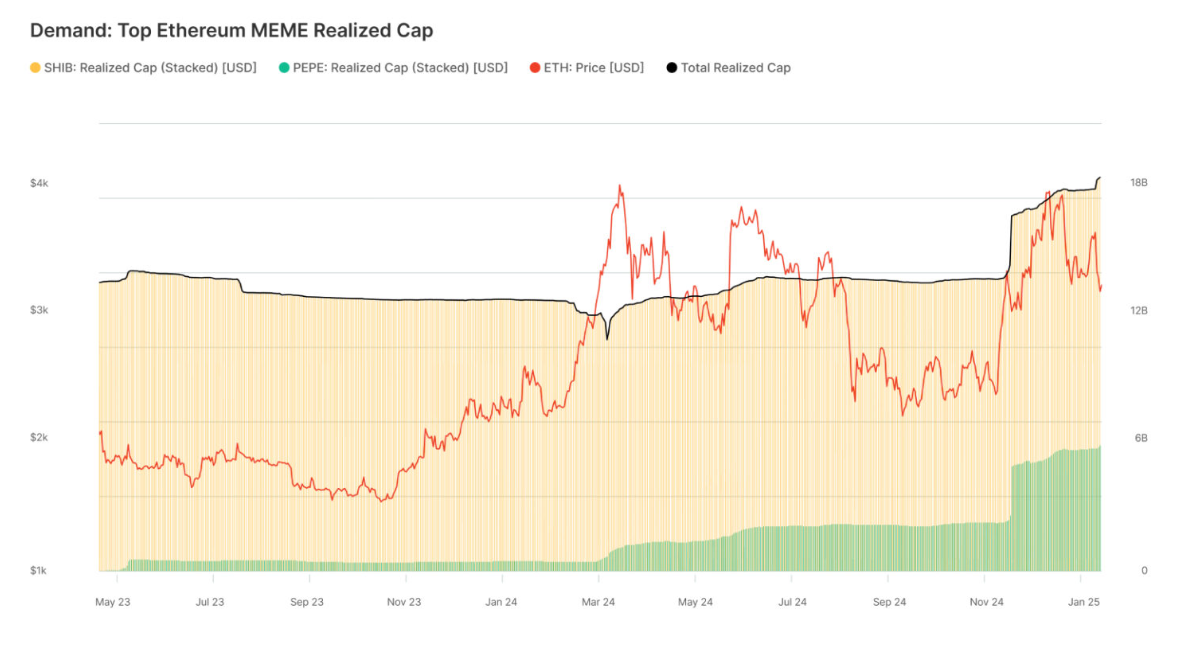

And who can forget about memecoins? They’ve been stealing the show in the 2024 market cycle, raking in the highest capital inflows among all the altcoins.

Shiba Inu’s and Pepe’s combined market capitalization has skyrocketed since January 2024, jumping from $12.7 billion to $18.4 billion, with a 45% increase.