Listen, you ever get that feeling in the office when the boss is pacing, eyes darting, like something big’s about to go down?

That’s Ethereum right now, except instead of a quarterly report, we’re talking billions on the line, and everyone’s holding their breath.

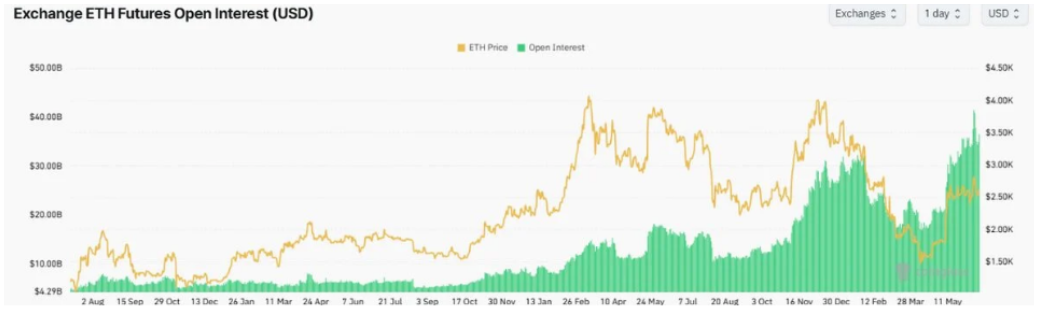

Open interest skyrockets

Ethereum futures open interest just shot up to $36.56 billion. That’s not chump change, my friend.

That’s the kind of number that makes even the most seasoned Wall Street types sit up and spill their coffee.

Over just three days, traders piled into leveraged positions, betting on where ETH will head next. It’s like everyone’s suddenly decided to play high-stakes poker, and the pot keeps growing.

Price bounces back, resistance looms

Now, ETH didn’t just sit there looking pretty. It jumped 4.5% in a single session, smashing back above $2,600 and brushing up against a resistance line that’s been haunting traders for over a year.

Picture that one stubborn printer in the office that jams every time you need it most, yeah, that’s this resistance level.

The price is sandwiched between the 50-week and 200-week moving averages, and if it breaks out, we could see a real run.

But with trading volume looking a little anemic, the bulls might need to hit the gym before they can really push through.

Meanwhile, U.S. spot Ethereum ETFs saw their first tiny outflow in nearly three weeks, just $2.18 million.

But don’t let that fool you. Weekly inflows still hit $528 million, and total assets in these funds have blown past $10 billion.

That’s a lot of institutional confidence, my friend. It’s like when the whole office chips in for Friday pizza, everyone’s got skin in the game.

Tokenized treasuries and tablecoins are Wall Street’s new toys

BlackRock and Fidelity are rolling out new products, tokenized treasuries, stablecoin-backed funds, all tied to Ethereum.

The goal? Make it easier for big institutions to join the party. Suddenly, Ethereum isn’t just a playground for DeFi nerds or crypto degens, it’s got real-world applications, and the suits are taking notice.

In the time of writing, ETH is chilling at $2,560, a 1,5% bump in the last 24 hours. But don’t get too comfortable.

Futures volumes are growing, and when this much money is leveraged, even a small price move can trigger a cascade of liquidations.

Think of it like the office fantasy football league, one upset, and suddenly everyone’s scrambling. Today’s calm can turn into chaos at the drop of a hat. We hope it won’t.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.