Major players like BlackRock and MARA Holdings have jumped at the chance to buy Bitcoin as its price retreated.

On December 5, Bitcoin fell to $92,957, but that didn’t stop these firms from making some serious moves in the market.

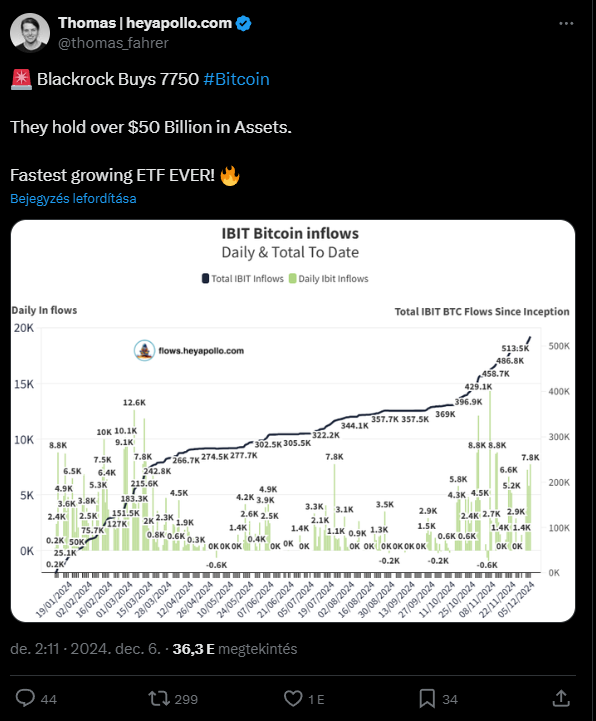

BlackRock’s black Friday discount

The iShares Bitcoin Trust, managed by BlackRock, is now backed by over $48.9 billion worth of Bitcoin, and the company alone snagged 7,750 Bitcoin as investors rushed to buy shares of its spot Bitcoin ETF. This brings the firm’s total Bitcoin holdings to a pretty nice amount.

Fastest growing ETF ever, exclaimed Thomas Fahrer, founder of Apollo, a crypto markets firm that keeps tabs on the spot Bitcoin ETF sector.

Not to be outdone, Bitcoin miner MARA Holdings also got in on the action, purchasing 1,423 Bitcoin, worth around $139.5 million, over just a couple of days. These transactions took place on December 5 and 6.

This buying spree followed the closing of MARA’s second $850 million convertible note offering, which they plan to use to bulk up their Bitcoin stash.

Now holding 22,108 Bitcoin, MARA has seen 162% increase in its holdings compared to last month.

The company has shifted to a new strategy that focuses on retaining all the Bitcoin it mines and using various capital market tools to boost its reserves, just like MicroStrategy has done.

Whales buying

These companies aren’t alone, an anonymous crypto whale also took advantage of the price dip by buying 600 Bitcoin, worth nearly $58.9 million.

This mysterious buyer didn’t hold any Bitcoin in their wallet until they made their first transaction on November 24.

Just a day before this whale’s purchase, health-tech firm Semler Scientific bought 303 Bitcoin at an average price of $96,779 on December 4, just hours before Bitcoin topped at $100,000.

With this latest purchase, Semler’s total holdings now sit at 1,873 Bitcoin, valued at around $182.8 million.

Corporate strategic reserve

Collectively, firms like Semler Scientific hold about 527,026 Bitcoin, which accounts for roughly 2.66% of the total supply.

In the time of writing, Bitcoin is trading at approximately $97,580, down about 5% in the last 24 hours.

With big players making bigger moves and prices fluctuating, it’s clear that the crypto market isn’t boring at all now.