Binance is on the liquidity battlefield, and some says this fight might just be the opening bell for Bitcoin’s next bull run.

The stage? The exchange with the deepest, richest Bitcoin order book on the planet.

The stakes? Sky-high. The players? Traders moving Bitcoin in and out, setting the tempo. And the script? It’s flashing signs of a big breakout.

Inflows spiked

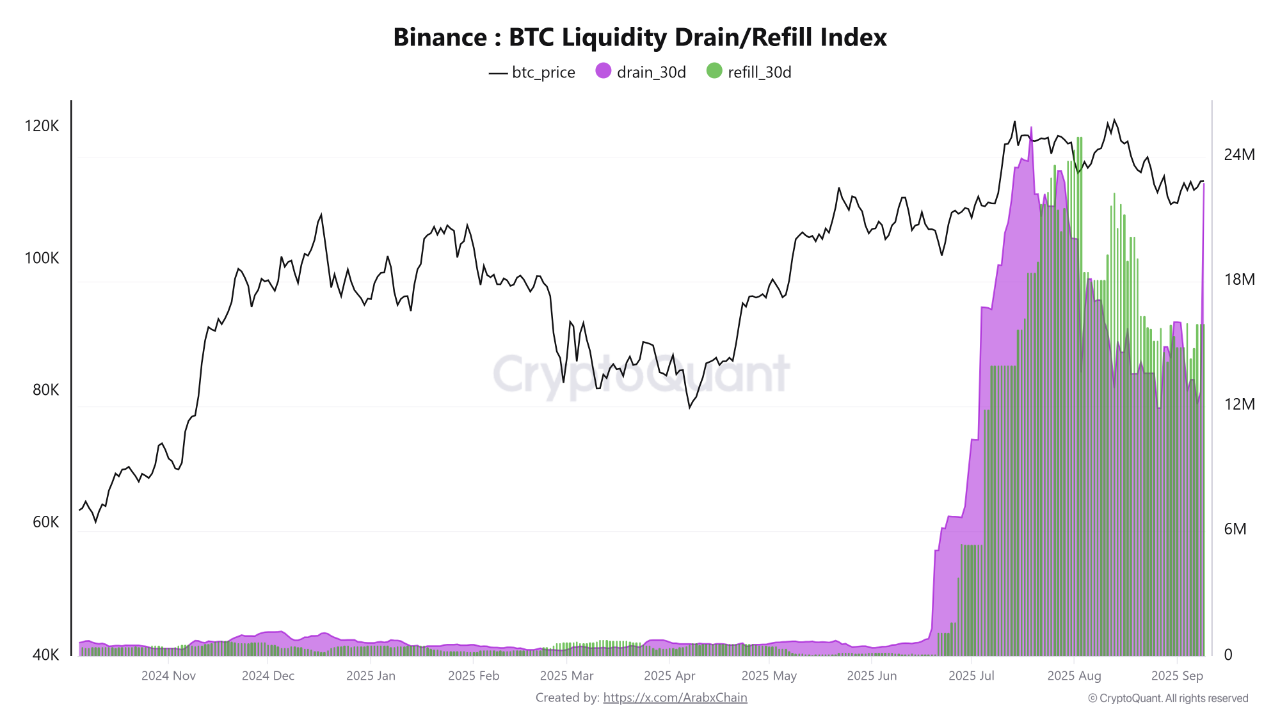

So, experts highlighted that earlier this year, August to be exact, Binance’s 30-day inflows spiked sharply, outpacing withdrawals for a cool couple of weeks.

This meant sellers were likely ready to pounce, possibly hedging their bets as Bitcoin neared $120,000.

Imagine a sports bar quiet before the big game, everyone getting into position, waiting for that critical play.

Liquidity drain

But then, the crowd’s mood shifted. Inflows slowed down, and the back-and-forth between Bitcoin coming in and going out found a kind of a balance. Prices stabilized, simmering without much drama.

Yet, here’s where it gets spicy, because by early September, suddenly, withdrawals jumped, $22 million BTC pulled off Binance within 30 days.

That’s a liquidity drain of serious proportions while deposits stayed quiet. Fewer coins hanging out on Binance means supply tightens like a drum.

And when demand’s holding steady? Oh boy, that’s the recipe for a runners-up to first-place dash. Scarcity meets eagerness, a classic market cocktail flashy enough to light up the charts.

What’s more crazy is Bitcoin’s price remained stubbornly steady through all this tugging and pushing. It’s like the calm before a storm.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Fewer coins

So, what’s next? Analysts and industry commentators say if Binance keeps bleeding Bitcoin out without fresh inflows to refill, the squeeze probably intensifies.

Buyers start biting harder with fewer coins to snatch up.

It’s a classic setup, liquidity traps tightening, pressure mounting, the stage set for a sharp rally.

Either way, Binance’s liquidity dance isn’t just a footnote. It’s more like the quiet whisper that a big move could be coming. A quiet signal that isn’t that quiet after all.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: September 12, 2025 • 🕓 Last updated: September 12, 2025

✉️ Contact: [email protected]