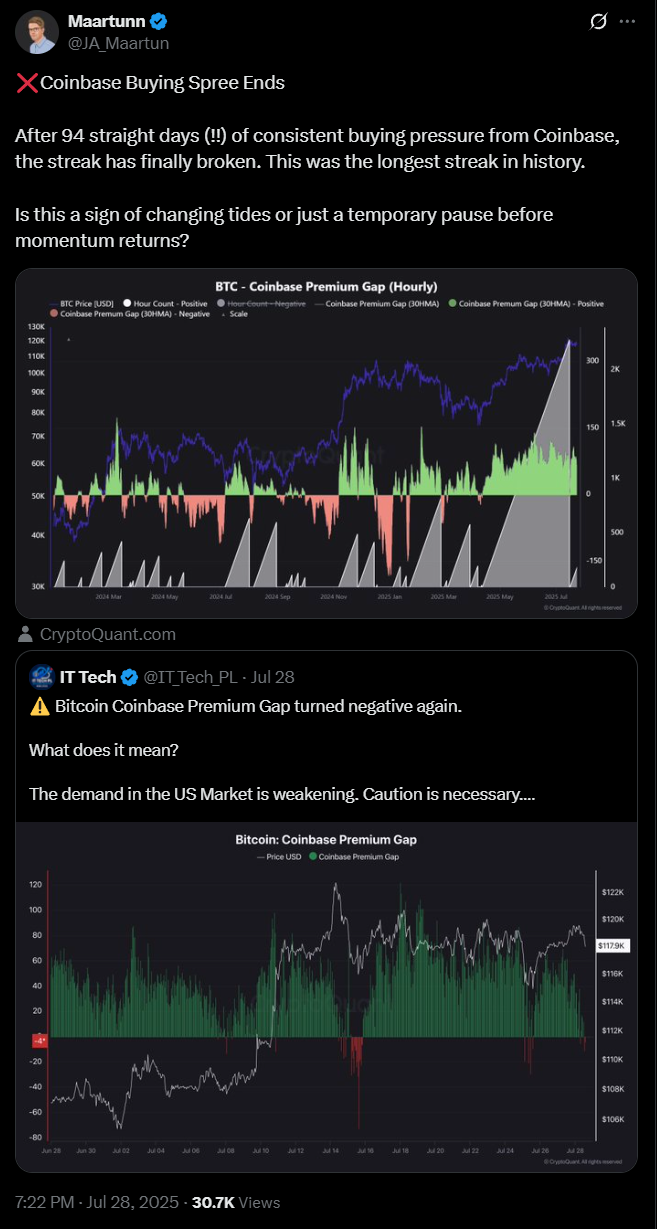

Bitcoin’s been on quite the buying spree on Coinbase for 94 days. Coinbase users were snapping up Bitcoin, pushing its price higher there than on other global platforms like Binance.

This difference, known fancy-like as the Bitcoin Coinbase Premium Gap, has been a trusty indicator showing where the whales, the big players are swimming.

Taking a breather?

Now, what’s this Coinbase Premium Gap? Think of it as the price difference between Bitcoin sold in the U.S., mostly Coinbase and the rest of the world, on Binance, for example.

When Coinbase’s price ticks higher, it means U.S. buyers are hungry, flexing their muscle more than the global crowd.

That’s a sign of strong buying pressure stateside. Conversely, if the gap dips negative, it tells us Binance’s customers are the ones scooping up BTC, and the U.S. market might be cooling off.

And after holding that positive streak for months on end, the Coinbase Premium Gap finally took a trip earlier this week, into negative territory. That’s breaking the longest streak in crypto history.

That 94-day run? It’s over. US institutional appetite looks like it’s taking a breather, or worse, shifting gears.

The U.S. market is weakening

So what does this mean for Bitcoin? Well, if U.S. investors start selling more than buying, given their usual heavyweight role, it’s no small potatoes. It’s a potential red flag for BTC prices.

Since early 2024, these big fish have often steered the market’s moves, so a reversal in their behavior might signal some turbulence ahead. Prepare for dips.

Popular cryptocurrency analyst IT Tech pulled up a close-up chart showing multiple dips of the Premium Gap into negative land over the past month.

The latest drop happened just recently, and the message from the street is clear, experts say the U.S. market is weakening.

Temporary?

Imagine your favorite office poker game, if the biggest players suddenly fold or stop betting, the whole vibe changes.

You start looking around, wondering, what’s going on? That’s the mood here. Is this temporary? We don’t know.

A mere pause before the whales dive back in? We don’t know. Or a trend shift signaling more selling pressure and less bullish U.S. buying?

Guess what? The jury’s out. This break in Coinbase’s premium streak is a spotlight shining on shifting U.S. institutional sentiment. And now it doesn’t looks nice.

Frequently Asked Questions (FAQ)

What is the Coinbase Premium Gap?

The Coinbase Premium Gap is the price difference between Bitcoin traded on U.S.-based Coinbase and global platforms like Binance. A positive gap indicates stronger buying pressure from U.S. investors.

Why is the Coinbase Premium Gap significant?

It serves as a market sentiment indicator. A positive gap means U.S. institutions are aggressively buying Bitcoin, while a negative gap can signal waning demand or potential selling pressure from the U.S. market.

What happened after the 94-day premium streak?

The Coinbase Premium Gap turned negative, ending a record 94-day streak. This suggests that U.S. institutional demand for Bitcoin may be slowing down or temporarily pausing.

Could this shift affect Bitcoin’s price?

Yes. U.S. institutional investors have been a major force in driving Bitcoin’s price. A decrease in their buying activity could lead to increased volatility or potential downward pressure on BTC.

Is this change in premium permanent?

It’s unclear. The drop could be a temporary pause or the beginning of a broader trend. Analysts are watching closely to see whether U.S. demand rebounds or continues to weaken.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 3, 2025 • 🕓 Last updated: August 3, 2025

✉️ Contact: [email protected]