Investors are still heavily investing in spot Bitcoin ETFs in the U.S., but Ethereum ETFs are experiencing withdrawals. Experts say this could be a diverging trend.

Bitcoin ETFs good

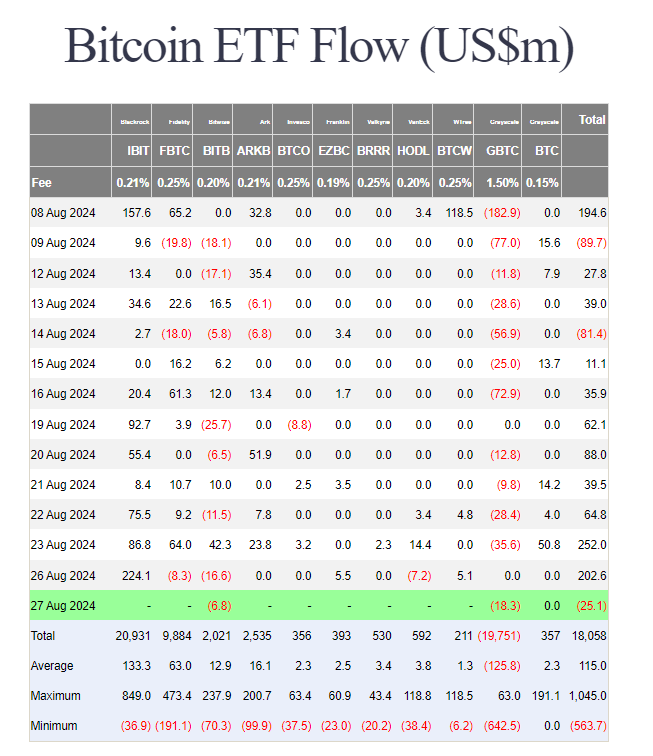

Earlier in this week, U.S. spot Bitcoin ETFs received $202.6 million in new investments on Monday.

This is the second-highest daily inflow for the month and extended the streak of positive inflows to eight consecutive days.

In the past 14 trading days, 12 have seen more money flowing into Bitcoin ETFs, even though Bitcoin’s price remained relatively flat.

In the social media some are already joking it would be pretty good stablecoin.

The king of the hill

The largest inflow on Monday was seen in the BlackRock iShares Bitcoin Trust, with $224 million, its biggest daily increase since July.

The Franklin Bitcoin ETF and the WisdomTree Bitcoin Fund also saw positive inflows, with $5.5 million and $5.1 million.

In contrast, ETFs from Fidelity, Bitwise, and VanEck saw combined outflows of $32 million, and Grayscale’s Bitcoin ETFs recorded no net flows.

Crypto investment products are also seeing kind of a resurgence globally. CoinShares reported that digital asset investment products worldwide saw $533 million in inflows last week.

This growth in investments, the optimism was caused by the U.S. Federal Reserve’s shift in monetary policy, with Fed Chair Jerome Powell hinting that a cut in interest rates could happen in September. Which means, eventually the printer go brrr.

Ethereum ETFs bad

While Bitcoin ETFs are benefiting from increased interest, U.S. spot Ethereum ETFs are experiencing a different path. Less fun, more bumpy.

Monday was the eighth consecutive day of outflows for Ethereum ETFs, with $13.2 million being withdrawn, primarily from Grayscale’s ETHE fund.

Other funds, including those from Fidelity and Franklin, also saw minor outflows, while the rest recorded no net flows.

Grayscale’s ETHE fund shrink by $2.5 billion, a decline that was expected but seems far from over.

The ETH’s price climbed to $2,800 over the weekend following the August 5 crash, but then the asset since dipped again, dropping 1.8% to $2,685.