Once upon a time in Uptober, that glorious month when leaves fall and Bitcoin soared, BTC exploded onto the scene with a meteor-like blast.

It shot past its August ATH, hitting $126,000 on October 6.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Cue champagne and wild celebrations from hodlers and traders alike. But, as every hero faces trials, our shiny crypto champion soon stumbled down a rocky path, shedding over $23,000 in just a week.

We’re not done yet

So, here’s the million-dollar question, or rather, the $126,000 question. Was that dizzying high the grand finale of this bull market, or is Bitcoin just catching its breath before a second act?

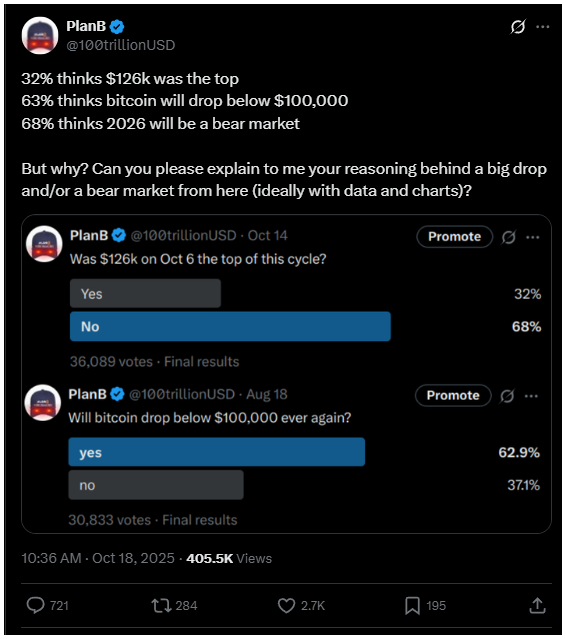

The oracle of the crypto realm, PlanB, threw this question into the ring, polling the masses.

Out of 36,089 voters, a solid 68% said “Hold on, we’re not done yet!” believing Bitcoin still has plenty of gas left in the tank this cycle.

But the plot thickens. A previous survey by the master mind behind the famous BTC Stock-to-Flow model revealed a more cautious crew.

Nearly 63% of 30,833 voters predicted Bitcoin might dip back below $100,000. This bearish flavor prompted a scramble for explanations.

Liquidity policies

Some players pointed at the old crypto crystal ball, historical halving cycles and familiar peak timings.

Others dove into the messy realm of liquidity, where the real puppeteers midwife price moves in cloaks of institutional strategy and market jiggery-pokery.

Popular crypto expert in the social media, Adlegoff84 laid it out with a touch of nihilistic elegance.

Bitcoin’s price dance “no longer reflects organic demand; it reflects the timing of institutional liquidity operations.”

The scene is like a carefully choreographed ballet of ETFs, custodial products, perpetual funding, and central-bank beat-setting liquidity policies.

“The so-called bear market risk? Ah, that’s just liquidity rotation—profit-taking before the bigger capital dance resumes.”

Supply and demand

Charts only catch the moves, but liquidity reveals the puppet master’s true motives. PlanB nodded in full agreement, sealing the deal on this insider perspective.

So, guys, the story isn’t finished. Whether Bitcoin rockets higher or waltzes back down below $100K, it’s clear the game is far more about savvy liquidity orchestration than simple supply and demand.

I agree 100%: it is all about rebalancing and rotations (and mandates), and would indeed that is very bullish. I would love to see these rotations/rebalancing in a chart (but of course that is very difficult because we do not have the data).

— PlanB (@100trillionUSD) October 18, 2025

💬 Editor’s Comment:

You can feel the tension in the air — the thrill of hitting $126K and the sting of tumbling right after. But honestly, this feels less like an ending and more like an intermission.

The market’s rhythm has always been about liquidity flows, not fairy tales.

If Bitcoin’s history has taught us anything, it’s that “the end” usually means “not yet.” Buckle up — Uptober’s encore might still be waiting backstage.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: October 20, 2025 • 🕓 Last updated: October 20, 2025

✉️ Contact: [email protected]