The old-timers in the Bitcoin game, the ones who’ve been holding tight for three to five years, are back in action, moving $2.16 billion worth of BTC. These seasoned holders aren’t just sitting on their digital gold anymore.

But what’s the deal? Are they cashing out for a quick buck, or just shuffling their chips for the next big move?

Reward

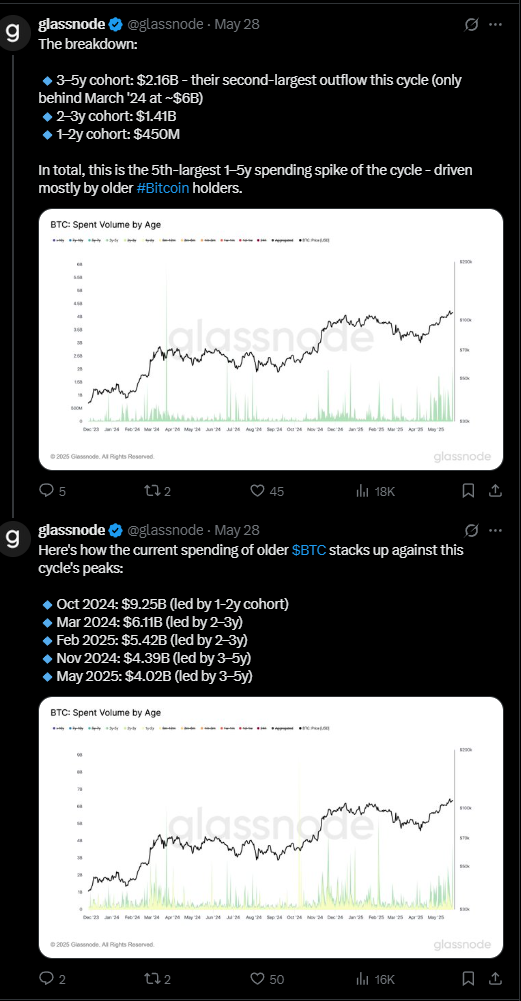

Glassnode, the big brains in crypto data revealed thattThe total Bitcoin spending from holders who’ve had their coins between one and five years just hit $4.02 billion.

That’s the highest we’ve seen since February.

It’s like the veterans are waking up from a long nap, stretching their legs, and deciding it’s time to make some moves.

Now, this isn’t some small blip. It’s the fifth-largest spending surge in this entire bull cycle. And guess who’s leading the charge? The three- to five-year holders.

These guys have been known to make big moves right after a rally. Remember March, October, November 2024, and February 2025? Yeah, those were their moments to shine, unloading serious chunks of Bitcoin.

It’s time to realizing some profit?

Back in October, the one- to two-year holders went wild, moving a massive $9.25 billion.

The two- to three-year group followed with $6.11 billion in March and $5.42 billion in February.

November saw the three- to five-year crowd spend $4.39 billion. And now, this latest $2.16 billion outflow from the three- to five-year holders is their second-biggest move this cycle, just behind a $6 billion outflow in March 2024.

Meanwhile, the younger cohorts aren’t sitting still either. The two- to three-year holders have spent about $1.41 billion, and the one- to two-year group chipped in with $450 million this time around.

Up or down?

But what does this all mean? Is Bitcoin about to take a dip or just catch its breath? Well, BTC has been sliding a bit, dropping over 4% from its recent high of nearly $112,000.

Right now, in the time of writing it’s hovering around $104,540, down about 4.5% for the week and 2.3% in the last 24 hours.

If these old-school holders are just reallocating, shuffling their assets to gear up for another climb, then expect Bitcoin to chill and consolidate for a bit.

But if they’re cashing out to lock in profits, watch out. We could see a deeper correction, maybe dipping below $106,000.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.