The cryptocurrency market has recently seen intriguing developments in Bitcoin mining.

The difficulty has decreased, a phenomenon that usually suggests an easier environment for miners, but now this has coincided with a decline in miner revenue.

This posing questions about the sustainability and future direction of Bitcoin mining.

Mining Revenue Decline

Despite the decreased mining difficulty, which theoretically should benefit miners by reducing operational costs and increasing profit margins, the revenue for Bitcoin miners has dropped.

This drop in revenue can be attributed to the recent fluctuations in Bitcoin’s price, which fell below $70,000.

Lower prices mean that the rewards miners receive for adding new blocks to the blockchain are worth less in fiat terms, impacting their overall earnings.

Bitcoin Miners’ Holding Strategy

Despite the decline in revenue and the price drop, Bitcoin miners are not offloading their holdings.

Their strategy is puzzling at first glance, but it may indicate a deeper confidence in Bitcoin’s long-term value.

Miners might be anticipating future price increases, which would make their current holdings more valuable, and this suggests that miners believe in the potential for a price rebound, indicating their long-term confidence in Bitcoin.

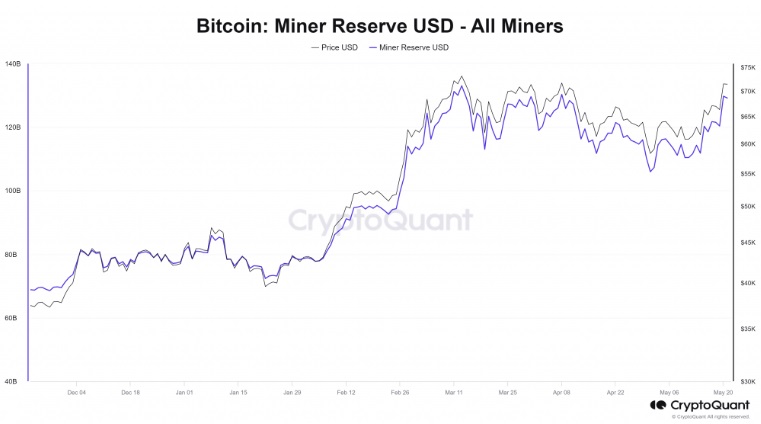

Increase in Bitcoin Miner Reserves Value

While the exact amount of Bitcoin held by miners has not changed significantly, the overall value of their reserves has increased due to the recent price rise.

This increase in the value of miner reserves is considered as a positive signal, reinforcing the common view that miners are strategically holding onto their assets in expectation of future gains.

This trend reflects an optimistic approach, as miners seem to be preparing for potential market rebounds, a coming rally.

Bitcoin Price Volatility and Miners

The volatility in Bitcoin’s price remains an important aspect of the market.

Recent price swings have highlighted the inherent unpredictability of Bitcoin’s price, and miners’ decision to hold onto their Bitcoin despite revenue declines and price drops highlights their resilience and speculative approach to future price movements.

It’s also possible this volatility can lead to potential selling pressure in the future. If Bitcoin’s price continues to decline, miners might be forced to sell their holdings to cover operational costs, potentially driving prices down further.

Ha a Bitcoin ára tovább csökken, a bányászok kénytelenek lesznek eladni részesedéseiket, hogy fedezzék a működési költségeket, ami tovább csökkentheti az árakat.

Diamond Hands, Long-Term Confidence

Miners’ current strategy of holding rather than selling indicates a significant level of confidence in Bitcoin’s long-term value, what could be based on historical trends of price recoveries and the belief in Bitcoin’s continued growth and adoption.

Their success still depends on numerous factors including market sentiment, regulatory changes, and broader economic conditions.

Implications for the Future

The actions of Bitcoin miners have several potential implications for the whole cryptomarket.

If miners continue to hold their Bitcoin, it could signal to other investors that there is a strong belief in future price increases, possibly stabilizing market sentiment.

Conversely, if miners start selling off their holdings due to prolonged revenue declines, it could create a downward spiral, further accelerating price drops.