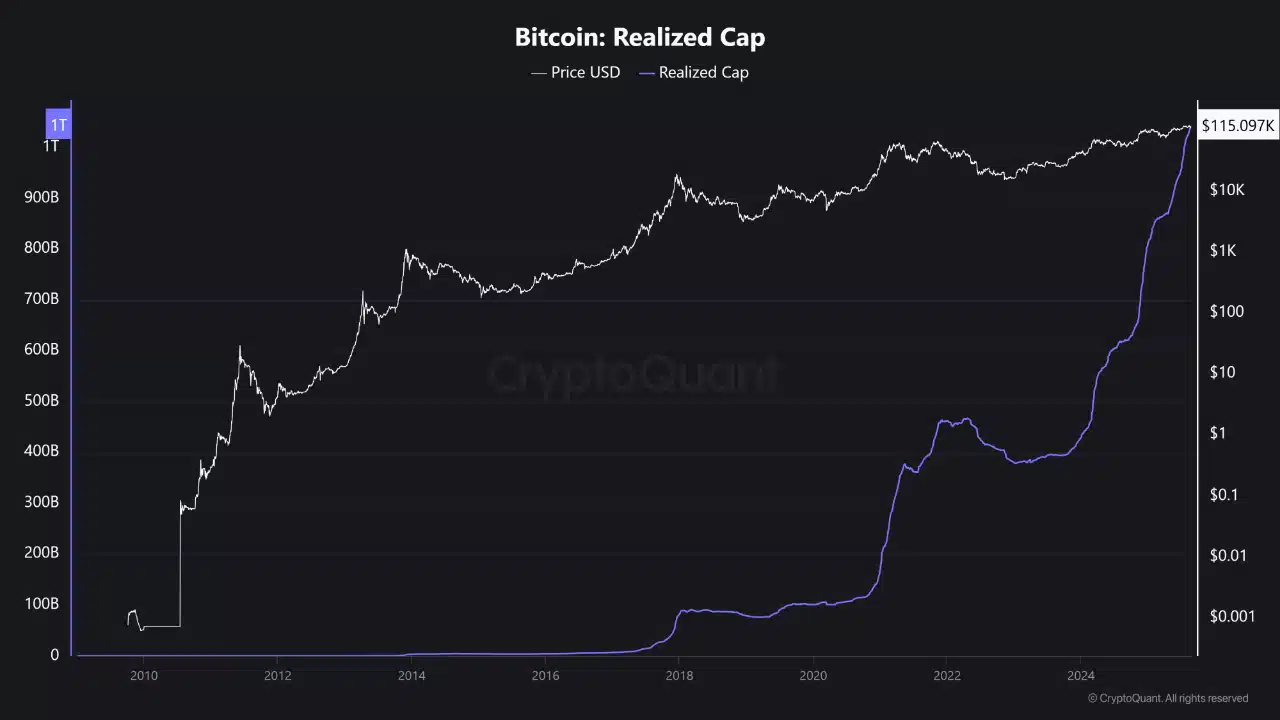

Bitcoin just hit a milestone that’s got Wall Street whispering, because its realized market cap crossed $1 trillion.

Not the usual price headline, no sir. This realized cap?

It’s like the real pulse of Bitcoin, measuring the value of coins based on the last time they moved, reflecting actual money flowing into the network, not just hype.

Global stage

Now, this is a big, flashy number, but also tells a story. Investors are holding on to their bags, some at higher prices, showing real confidence.

It’s like your favorite character in a crime show finally making that big, steady move instead of reckless leaps.

If this momentum keeps climbing, the realized cap marching toward $2 trillion could rewrite Bitcoin’s position on the global stage. We’re talking redefinition, guys.

$2 billion worth of short positions

But on the other hand, Alphractal shared that Bitcoin’s 30-day active supply, the heartbeat of how many coins are switching hands, has cooled off after weeks of wild activity.

Bitcoin 30-Day Active Supply Has Cooled Off

The 30-Day Active Supply measures the number of unique coins that moved at least once over the past month.

This metric acts as a thermometer of market interest in BTC:

🔺 When it rises → it signals new money circulating and stronger… pic.twitter.com/ACTOElScia— Alphractal (@Alphractal) August 23, 2025

It’s like the calm before the storm in every classic tale, moments of quiet tend to spark the drama that follows.

When trading slows, it’s a sign the market’s catching its breath, gearing up for whatever’s next.

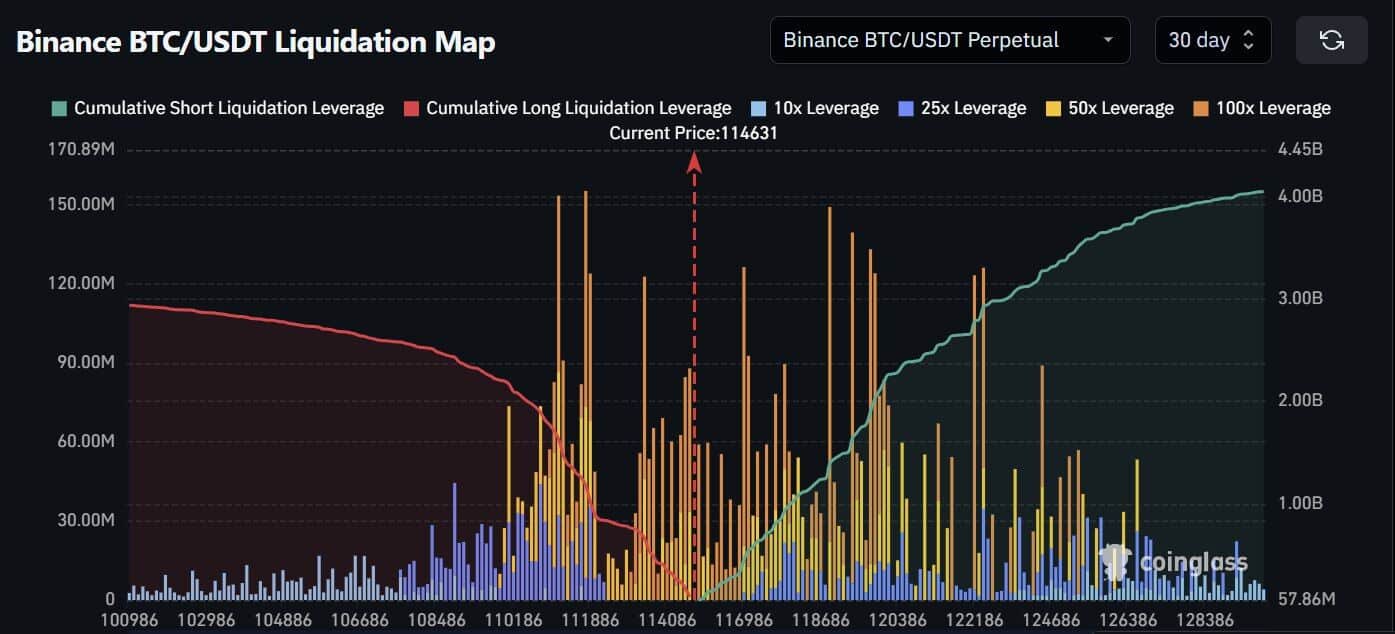

And here’s where the suspense thickens, nearly $2 billion worth of short positions are stacked, waiting to be crushed if Bitcoin bangs its way up to $120,000.

This, guys, is the classic setup for a short squeeze, a sudden rush as shorts scramble to cover losses, often fueling even bigger price jumps. A quiet market now can flip into fireworks without warning.

Price action

Experts say this silent, relaxed phase is far from mundane, it’s a ticking time bomb.

Based on history, when these shorts get squeezed, volatility spikes, and price action can come roaring in like a runaway train. The next breakout? Could hit faster than we think.

So, yes, Bitcoin hitting its $1 trillion realized cap is no small feat. Yet with billions at stake on the short side and a cooling active supply, the market’s playing possum before a possible thunderclap. Be prepared!

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 26, 2025 • 🕓 Last updated: August 26, 2025

✉️ Contact: [email protected]