BlackRock’s iShares Ethereum Trust, the ETHA slowly approaches the $1 billion inflow milestone.

BlackRock’s major milestone is also Ethereum’s

Launched on less than a month ago, on July 23, BlackRock’s ETHA offers investors an easy way to gain exposure to Ethereum through their traditional brokerage account.

The offering removes many of the complexities typically associated with direct cryptocurrency investments, such as high trading costs and complicated tax reporting, or self custody.

As a result, ETHA has become an appealing option for both crypto investors and those exploring digital assets for the first time.

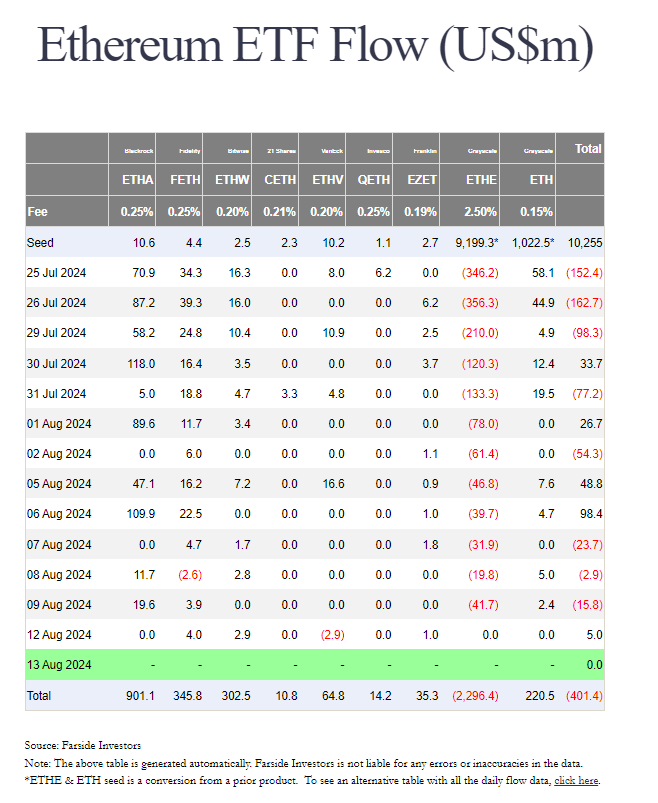

Thanks to this, ETHA’s inflows have reached an impressive $901 million, signaling BlackRock’s dominance in the Ethereum ETF space.

This puts ETHA ahead of other major players like Fidelity Investments, Bitwise, Grayscale Investments, and VanEck.

Of course, there were initial challenges, like periods of minimal revenue, but ETHA has consistently attracted substantial inflows.

This success is largely due to BlackRock’s reputation as a leading asset manager with vast influence in the financial sector.

Ethereum price reaction to ETF success

ETHA’s success has indeed generated excitement, but Ethereum’s price has responded in a more or less complex manner.

The anticipation of the spot Ethereum ETF market boosted investor interest, pushing Ethereum’s price above $3,400.

But this hype was short-lived as heavy selling pressure soon followed, causing the price to drop.

After the ETH ETFs launched, the price fell to $2,800 and continued to decline, reaching as low as $2,500.

Analysts think this sharp downturn came from institutional investors selling off their ETH holdings, possibly to take advantage of market volatility or to adjust their portfolios in light of new opportunities.

Of course, it’s just speculation, but luckily Ethereum is showing signs of recovery, with a 6.7% increase in the past 24 hours, bringing Ethereum’s price up to $2,700 at the time of writing.

This price jump was accompanied by a 44.55% surge in trading volume, suggesting renewed investor interest and potential market stabilization soon.

The future of Ethereum ETFs

The milestone reached by BlackRock’s ETHA is undoubtedly a big moment for both Ethereum ETFs and the whole crypto market.

Many experts believe this growing momentum could positively influence Ethereum’s price over time, and for investors, ETHA’s success offers a hint about the potential of regulated crypto investment products to attract substantial capital, even in the face of market fluctuations.