Binance Coin just threw a networking bash no one saw coming. As the crypto jungle trembles with uncertainty, BNB is dancing like it’s got something to prove.

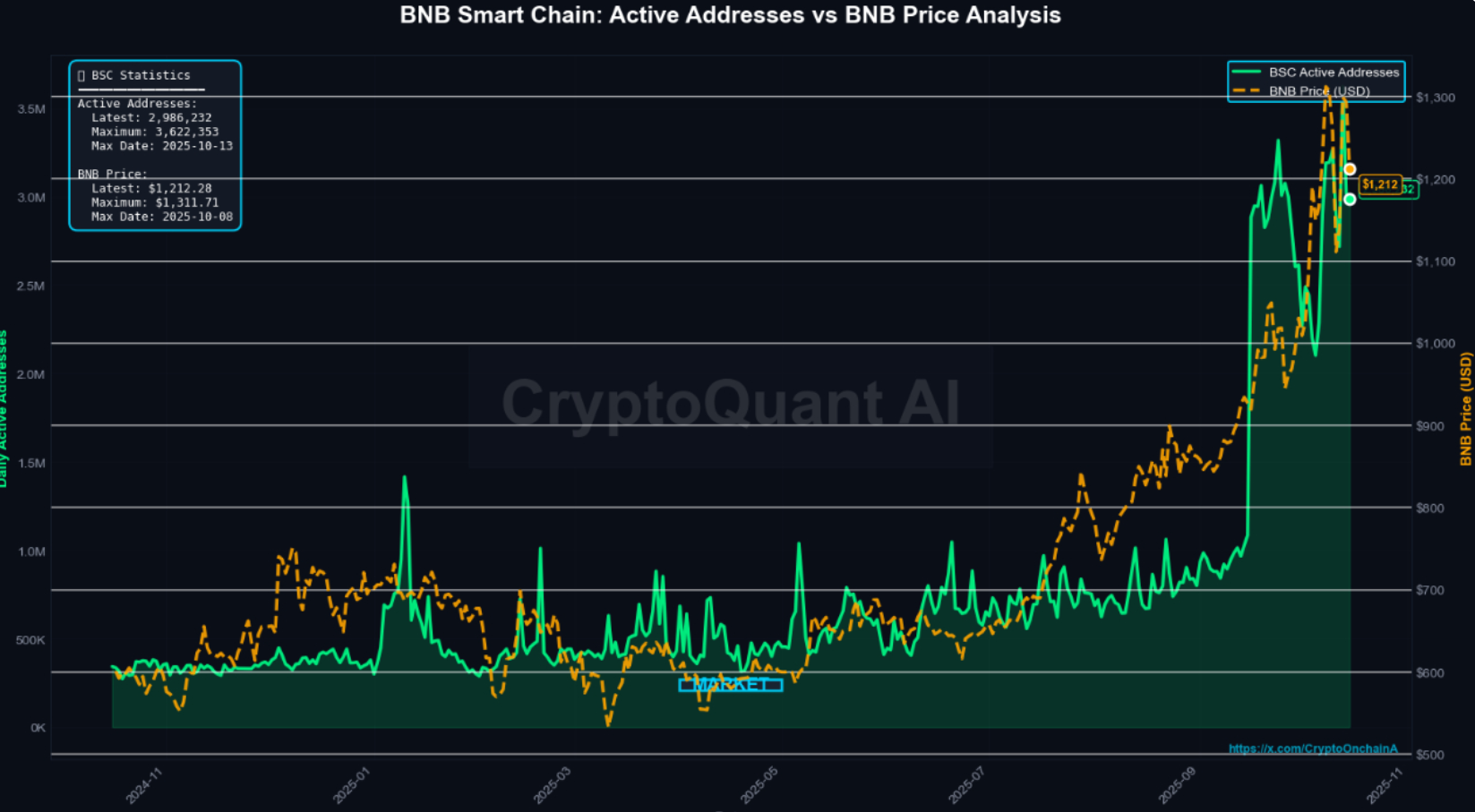

On October 13th, the BNB Smart Chain smashed records, hitting a 3.62 million daily active addresses.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Perfect timing

This frenzy didn’t happen overnight, mind you. Since June, BNB has been quietly creeping upward, then suddenly exploded after mid-September.

It hit an all-time price high at $1,311 on October 8th, right before users flooded the network like it was the last Bitcoin pizza party on Earth.

The timing is suspiciously perfect, a clear love affair between BNB’s price and how many users are jumping into the chain.

Experts say rising prices often spark FOMO, which cranks up trading, DeFi antics, and retail user engagement across BSC.

Analysts are sharpening their pencils, anxiously waiting to see if this growth in addresses can survive the inevitable market wobbles.

If user buzz keeps humming above 3 million daily, BNB could lock in its gains and build a fortress of support to fend off the crypto gremlins.

Price jumps and address activity

Data magician CryptoOnchain revealed a plot twist, and said that since September, BNB’s network activity and price have started moving like synchronized swimmers, almost too perfectly aligned.

Back in the day, price jumps and address activity danced to different beats, but now they’re practically holding hands. The price peaked just before the user explosion. Classic FOMO in action.

Of course, after the hype, BNB’s price cooled off to around $1,212, and addresses slipped below 3 million.

The million-dollar question still remains, can BNB keep this user momentum alive?

Staying above 3 million active addresses could mean the party’s just getting started, regardless of the current price drama.

Signs of overheating?

But don’t write off BNB yet. Analysts say it’s clinging to its 50-day moving average near $1,018, a lifeline tied to the September breakout zone.

Losing this support could open a rabbit hole down to $900, where the 100-day average waits like a grumpy bouncer.

Momentum traders probably cashed out after seeing signs of overheat, but the long game looks quite promising.

The 200-day moving average, chilling near $768, keeps the bigger picture bullish. If BNB can hold above $1,000 and rally again, bulls might charge toward $1,200 to $1,250.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: October 19, 2025 • 🕓 Last updated: October 19, 2025

✉️ Contact: [email protected]