Imagine waking up to find out your bank has been hacked for a $1.4 billion.

Sounds like a nightmare, but that’s exactly what happened to Bybit, one of the biggest crypto exchanges, when it lost over 400,000 Ether in on of the largest crypto hacks ever.

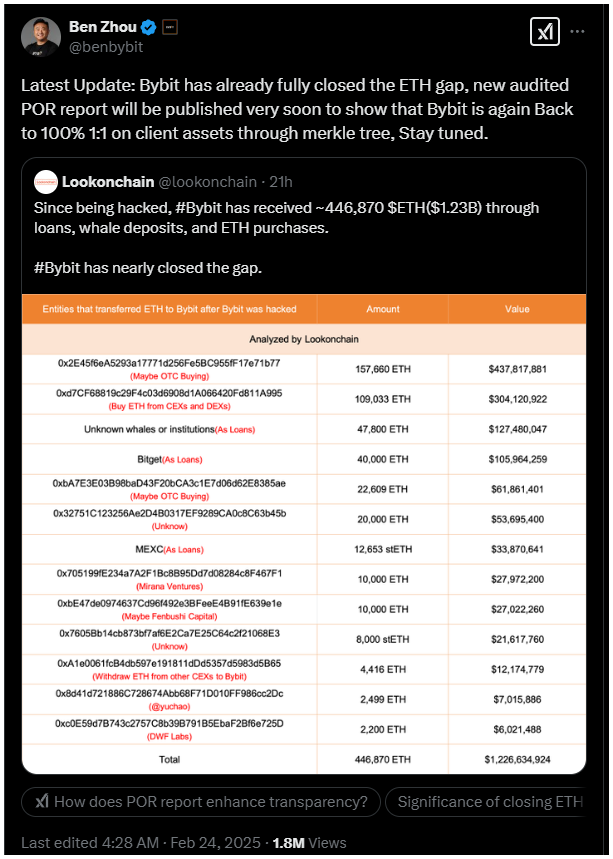

But here’s the surprising part, Bybit has managed to fully restore its ETH reserves.

The money is here

So, how did they pull off this magic trick? Bybit used a combination of loans, deposits from big investors, and direct ETH purchases to fill the gap.

It’s like calling in all your friends to help cover a massive bill. CEO Ben Zhou confirmed that the exchange has covered the deficit, ensuring that customer assets are fully backed, withdrawals are working.

The hack itself was pretty sophisticated. Allegedly linked to North Korea’s Lazarus Group, the attackers exploited a vulnerability in Bybit’s multi-signature approval process.

They created a fake user interface that hid a malicious smart contract, allowing them to divert funds to their own accounts. It was like a high-tech heist movie, but in real life.

Call to arms

To handle the crisis, Bybit quickly secured a so-called bridge loan from industry partners, and this allowed them to process withdrawals and keep the platform running smoothly.

CEO Zhou reassured users that the exchange’s reserves and earnings were enough to cover the losses.

Now, Bybit is promising a proof of reserves to show that all customer assets are fully covered. It’s like getting a report card for your bank, proving it’s safe and sound.

Adapt, survive, overcome

This whole ordeal is a reminder that even in the wild world of crypto, resilience and quick thinking can make all the difference.

Bybit’s comeback shows that with the right support and strategy, even the biggest setbacks can be overcome.

Have you read it yet? SEC drops OpenSea investigation

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.