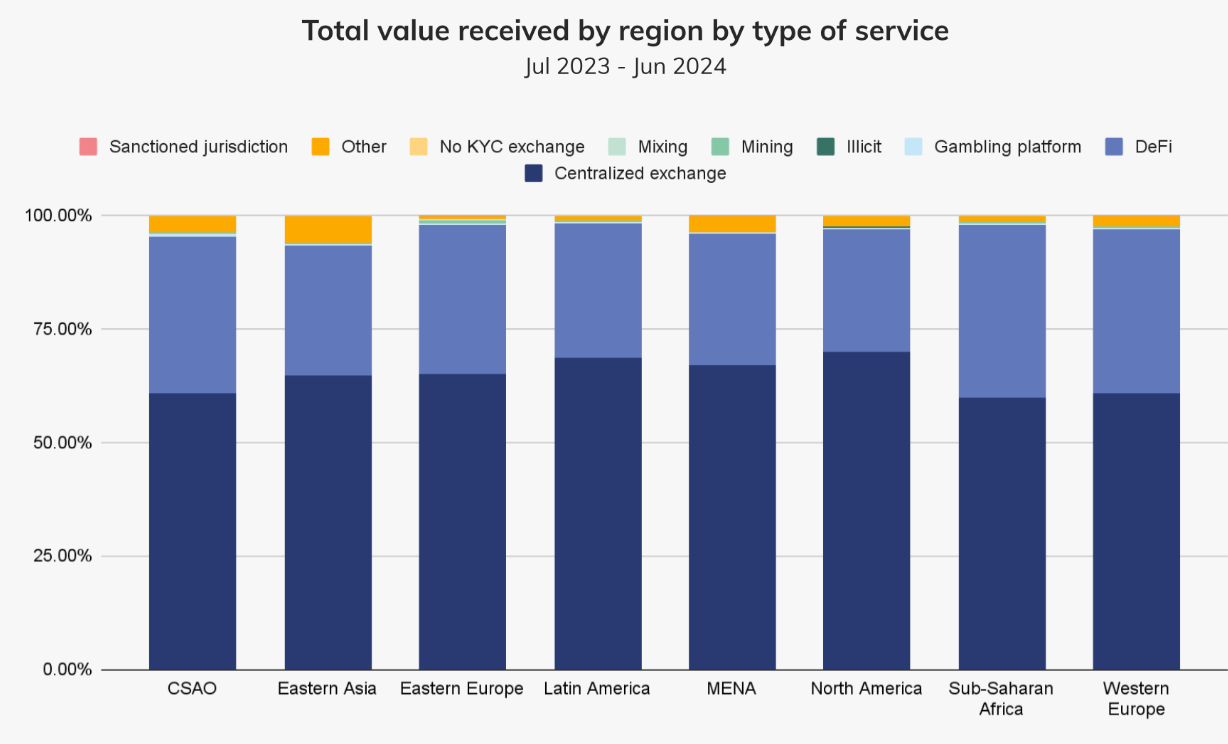

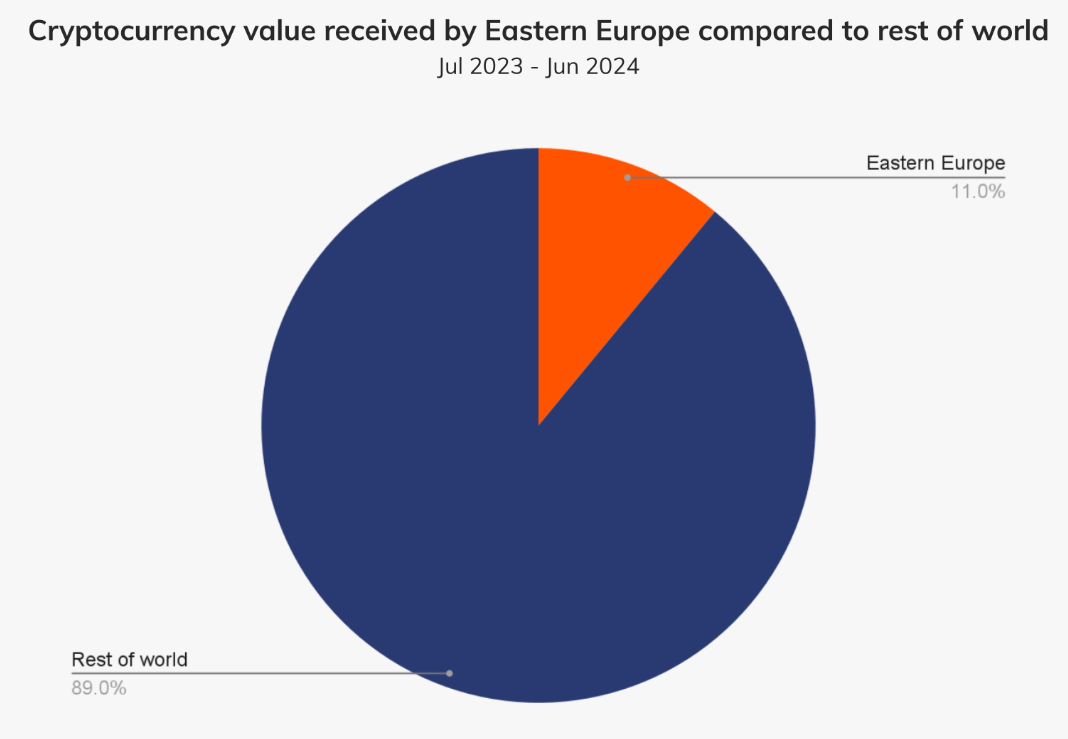

Eastern Europe is emerging as the fourth-largest cryptocurrency market globally. This region now accounts for over 11% of the total cryptocurrency value received worldwide, and it’s all thanks to a growth in DeFi activity.

A growing market

Chainalysis shared their new report, and told that Eastern Europe received more than $499 billion in crypto between July 2023 and June 2024.

Out of this amount, over $165 billion—about a third—came from DeFi transactions. It’s clear that crypto adoption is on the rise in this part of the world!

The increased retail interest in cryptocurrencies could bring even more capital into the space, but while DeFi is gaining traction, centralized exchanges are still reaping the most benefits, pulling in over $324 billion from those digital asset transactions.

Ukraine and Russia lead the charge

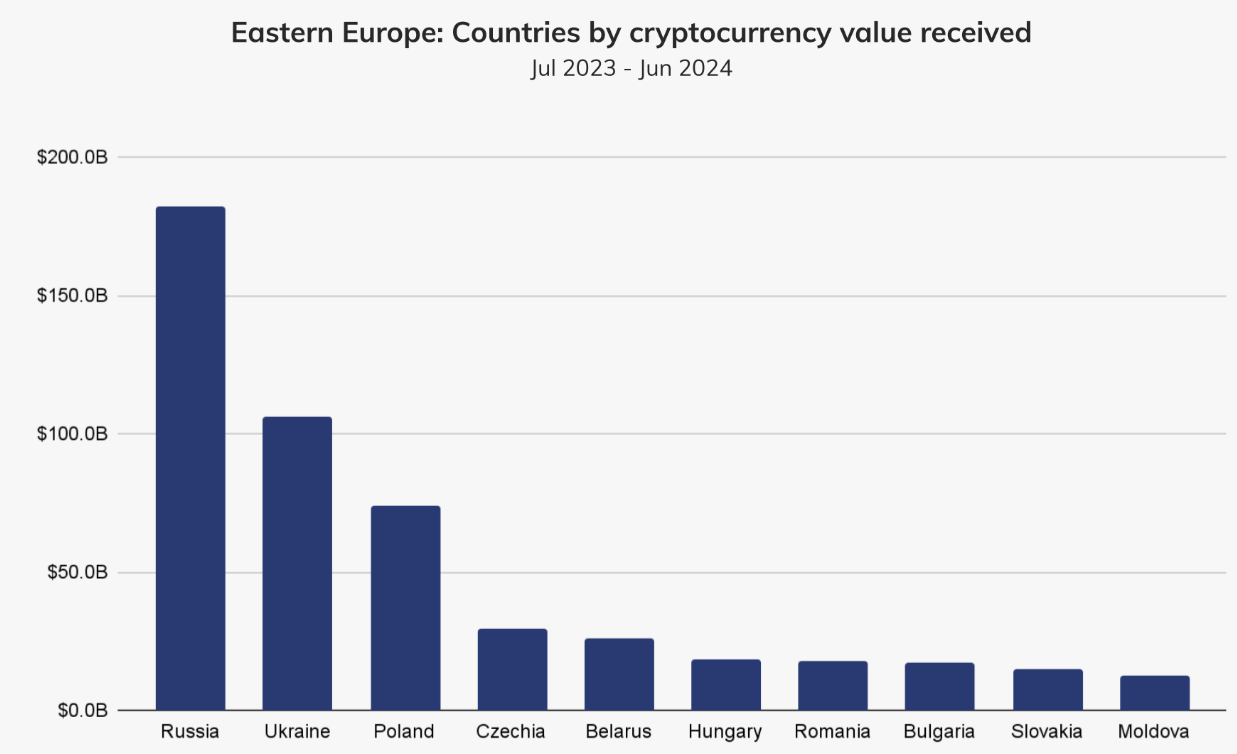

When it comes to transaction value, Russia and Ukraine are at the forefront in Eastern Europe.

Despite ongoing conflicts and international sanctions against Russia, crypto adoption in both countries remains huge and growing.

Russia alone received more than $182 billion in crypto flows, while Ukraine wasn’t far behind with over $106 billion. In Ukraine, much of this growth has been driven by institutional and professional transfers.

Chainalysis reports that large institutional transfers over $10 million, along with mid-sized transfers between $1 million and $10 million, made up a big chunk of transactions in 2024.

Crypto as a safe haven

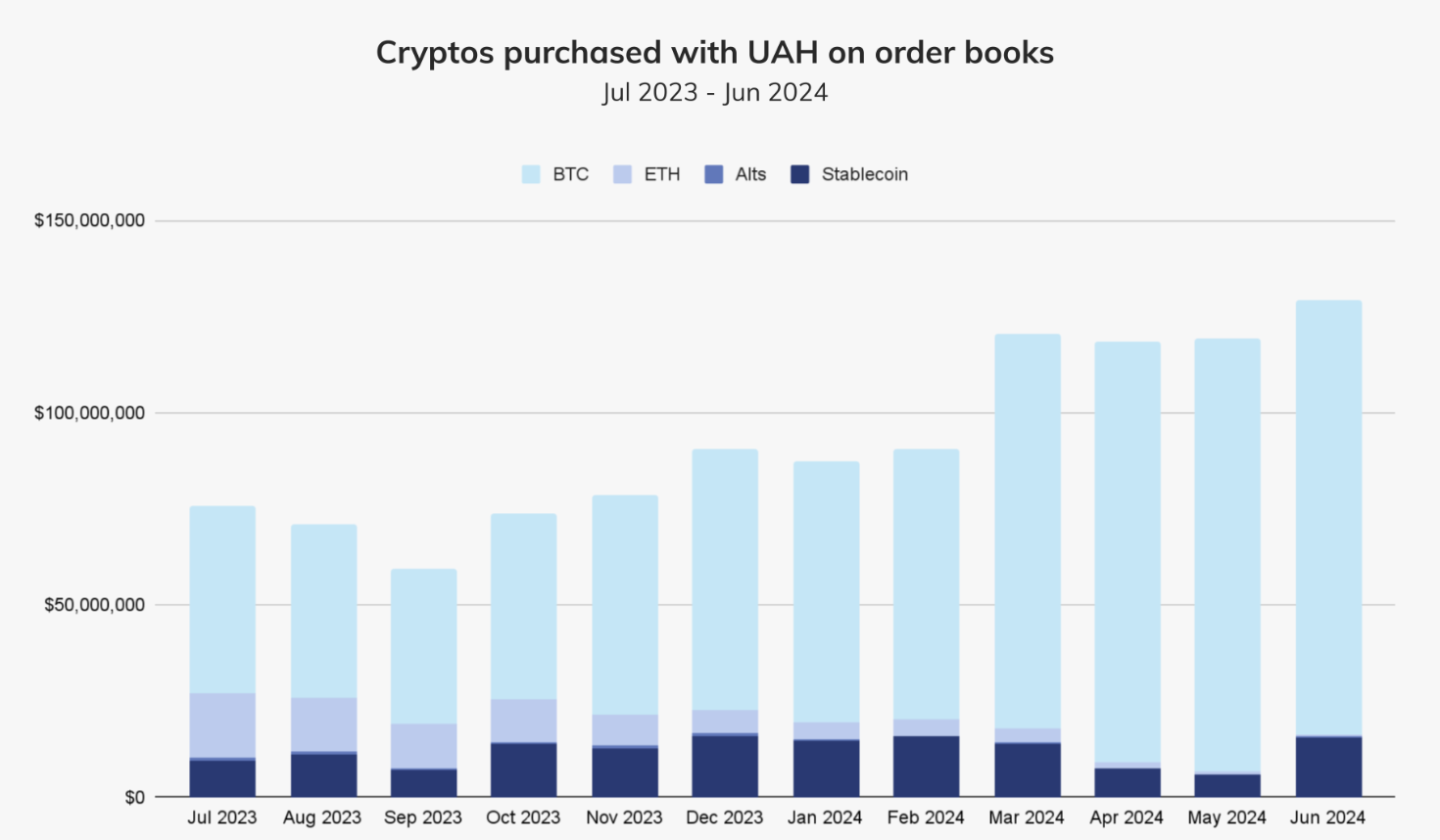

Local centralized exchanges are still active despite the challenges posed by war. Take WhiteBIT, for example, it has a solid presence in Ukraine alongside other exchanges.

A spokesperson from WhiteBIT noted that institutional and professional crypto transfers have surged as many people seek financial stability amid the ongoing conflict.

Cryptocurrencies are increasingly seen as safer alternatives during these times.

This trend is influenced not just by local issues but also by global factors like market volatility and inflation.

Plus, there’s growing institutional interest in Bitcoin ETFs from major firms like BlackRock.

Looking at the data, Bitcoin purchases using the Ukrainian hryvnia have skyrocketed over the past year, surpassing $882 million.

This uptick in Bitcoin transactions comes on the heels of significant inflation—over 26%—in the hryvnia by December 2022, which has since slowed down in early 2024.