So guys, imagine a crypto whirlwind where a flamboyant blockchain mogul named Justin Sun finds himself dancing dangerously close to the political spotlight and regulatory wrath.

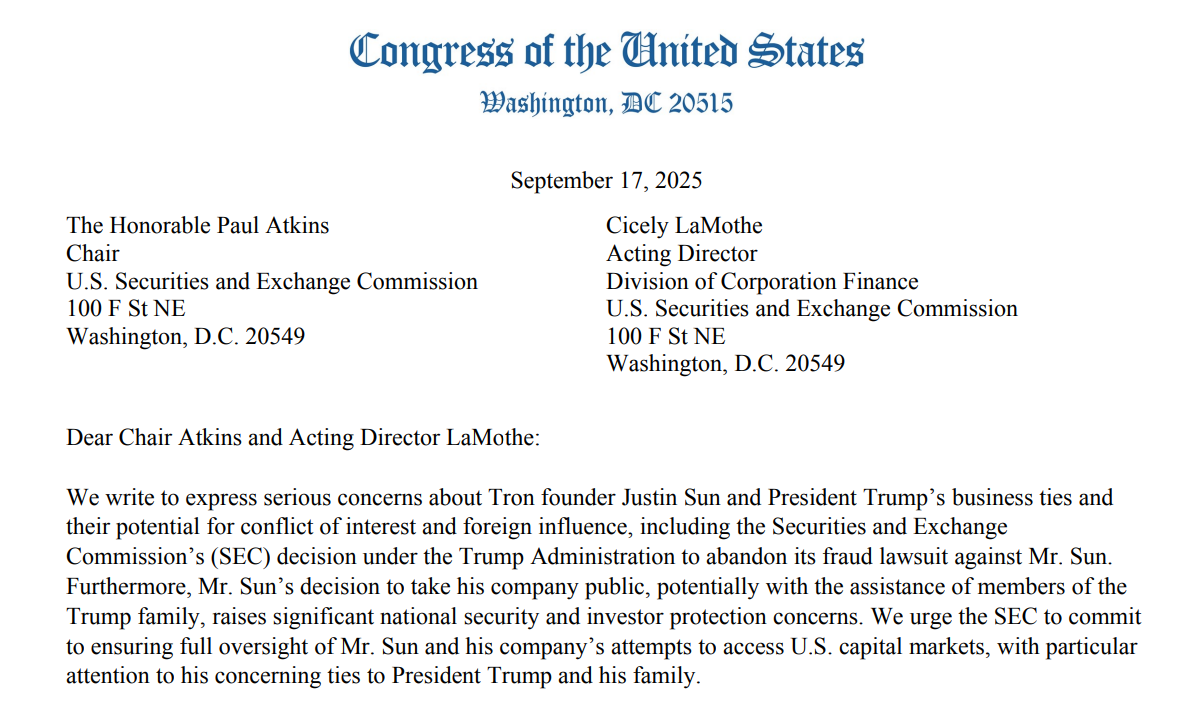

The U.S. Capitol just sent a sharply worded letter to the SEC, demanding answers, and the stage is set for a showdown involving TRON, DeFi drama, and a certain president.

Shadowy dealings on TRON?

The hero, or should I say the antagonist? Justin Sun, founder of TRON, the blockchain beast under a microscope.

Since 2021, Sun’s been tangled in a Justice Department investigation, with the SEC filing fraud charges in 2023 surrounding his pet crypto, TRX.

But life in crypto isn’t just about tokens. Have you heard the rumors about shadowy dealings?

The FinCEN flagged TRON as a playground for criminal schemes. Sun’s reportedly got a personal no entry sign for the U.S., avoiding arrest like a fugitive.

Enter the plot twist, post-2024, after Trump’s triumphant return to the White House, Sun turns into the biggest investor in World Liberty Financial, a DeFi project cozying up to the Trump family.

With a hefty $75 million stake, Sun allegedly fueled a tidy $400 million payday for Trump himself.

Oh, and he casually threw his weight behind the meme coin named TRUMP, because why not add a little meme magic to this financial soap opera?

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Conflict of interest?

And this is exactly where things get spicy. The SEC, after this Trump-linked cash infusion, mysteriously dropped its lawsuit against Sun.

Cue lawmakers waving red flags, suspecting conflicts of interest and whispering about cozy chats between regulators and Trump’s inner circle.

Since September 2025, WLFI tokens have surfaced on Coinbase and Kraken, pumping roughly $5 billion into Trump’s coffers.

The worry? Sun’s heavyweight status could let him mess with token prices, leaving everyday investors riding a rollercoaster without a seatbelt.

Blacklisted Ethereum-address

Congress isn’t sitting quietly. They’ve summoned the SEC to spill secrets by October 2, this year, questions include whether there were backdoor chats between SEC officials and the White House or Trump, any secret dialogues with Sun before dropping those charges, how many complaints against Sun have piled up, and whether banning TRON in the U.S. is on the table.

Adding more fuel to the fire, note this juicy footnote, blockchain sleuths at Arkham report that World Liberty Financial blacklisted Sun’s Ethereum address after he allegedly tried to move $9 million in WLFI tokens.

Drama, drama, drama. In crypto and politics, this story is a spicy cocktail of power, money, and digital mischief.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: September 22, 2025 • 🕓 Last updated: September 22, 2025

✉️ Contact: [email protected]

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.