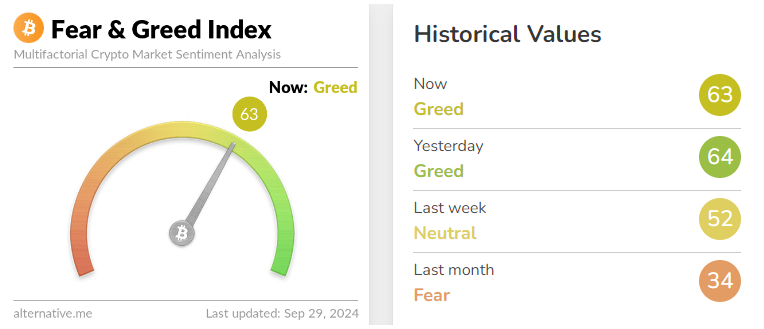

The Crypto Fear and Greed Index just jumped back into the Greed territory after spending August in a state of Fear.

In fact, it hit a yearly low of just 17 on August 6, but now the index is soaring with a score of 63, thanks to Bitcoin briefly touching the $66,000 level.

Understanding the shift in sentiment

The Crypto Fear and Greed Index was created to show how people are feeling about Bitcoin and the overall crypto market. It’ literally trying to measure the sentiment.

The highest score is 100, while the lowest is 0. August was a tough month for crypto enthusiasts, with the index struggling to get above 60.

That low score of 17 coincided with Bitcoin trading around $53,000. The last time the index was above 64 was on July 30, when Bitcoin was also near $66,000.

This index measures things that influence traders’ and investors’ emotions. It looks at factors like Google Trends, surveys, market momentum, social media activity, and market volatility.

According to its data sources page, the index is calculated using 25% market volatility, 25% market momentum, and 15% social media trends along with other indicators. It’s quite complex!

Market rally, where art thou?

Analyst and head of research at 10x Research, Markus Thielen mentioned that he believes we might see a crypto rally in Q4.

He thinks Bitcoin’s return above $65,000 could spark some serious fear of missing out, the infamous FOMO, for traders. Over the past month, Bitcoin gained around 11%, marking its best performance since March.

Charles Edwards from Capriole thinks something similar, as he predicts that we’ll see big money flowing back into Bitcoin as traders move away from gold and stocks.

The capital flows back into Bitcoin from gold and stocks over the next 6 months will be relentless.

— Charles Edwards (@caprioleio) September 27, 2024

“The capital flows back into Bitcoin from gold and stocks over the next six months will be relentless.”

The best performing asset

VanEck even ranked Bitcoin as the top-performing asset this year, leaving traditional investments in the dust.

Spot BTC prices have surged by an impressive 124% over the last year. But there’s a catch, as VanEck noted that recent downturns have left some investors feeling a bit nervous.

We don’t know if they were tried not being paper hands, to be honest.

Lots of users, traders, and analysts now think that if this trend continues and more people jump back into Bitcoin as they fear missing out on potential gains, finally we could see even more exciting developments in the crypto space. If exciting developments mean higher prices.