NYC Token launched on Monday and then fell about 80% in its first hour, according to reports that tracked the early trading.

Soon after the drop, rug pull accusations spread online. Those claims focused on liquidity, meaning the pool of funds used for trading. Critics said the launch looked like a liquidity removal event.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Separate reporting cited trackers that pointed to about $2.5 million withdrawn from a wallet linked to the trading pool before or during the crash.

The same coverage said the token spiked near $0.50 and then fell under $0.09 before steadying later.

Another report said the token’s market cap briefly reached about $580 million during the initial surge. It then slid fast as the price broke down.

Eric Adams denial clashes with NYC Token “rebalanced liquidity” statement

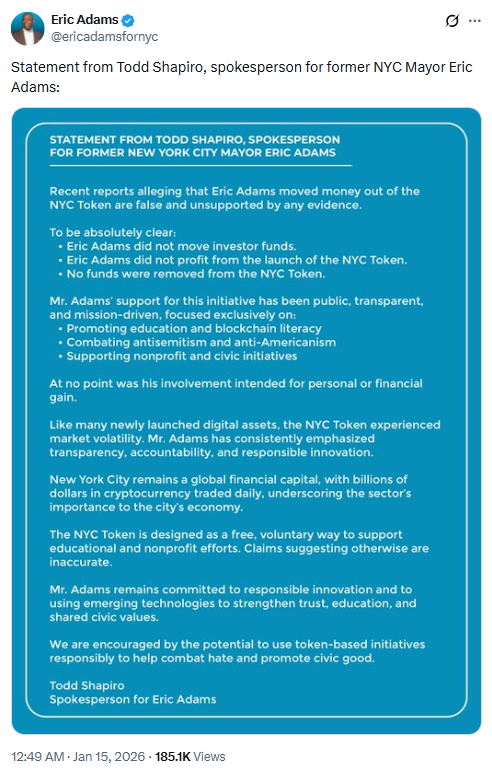

A spokesperson for Eric Adams rejected claims that he moved money or profited. “To be absolutely clear: Eric Adams did not move investor funds.

Eric Adams did not profit from the launch of the NYC Token. No funds were removed from the NYC Token,” spokesperson Todd Shapiro said in a statement shared on X.

Shapiro also said the allegations were “false and unsupported by evidence.” He linked the sharp move to “market volatility.” He also said Adams did not join for “personal or financial gain.”

However, the NYC Token account used different wording earlier. That account said it “rebalanced the liquidity” after strong demand at launch. It also said it added more funds to the liquidity pool.

That mismatch became a key focus in the public debate. Shapiro said “no funds were removed,” while the NYC Token account described direct liquidity actions.

After the initial collapse, reporting cited DEXScreener data showing the Solana token trading around $0.13 and moving sideways near that area.

Another outlet said more than $400 million was wiped from the token’s market cap from early highs, based on the swing between the peak and the post crash range.

In related coverage, Eric Adams said the token’s proceeds would support nonprofits and education programs. He linked the plan to efforts focused on antisemitism and what he called “anti Americanism.”

The same plan also included scholarships for New York City students in underserved communities, according to the interview and follow up reports.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: January 15, 2026 • 🕓 Last updated: January 15, 2026