Ethereum traded near $3,257 on the daily Bitstamp chart dated Jan. 7, after pushing back into a key Fibonacci retracement area that traders often treat as a decision zone.

Price also held above the rising support line drawn from the late December base, while the 50 day EMA sat near $3,132, keeping the short term structure tilted higher.

The chart’s Fibonacci swing shows the 0.618 retracement at about $3,244 and the 0.50 level near $3,535.

ETH moved back above the 0.618 mark and into the $3,244 to $3,535 band, which many traders label the golden zone. As a result, the market shifted from recovery into a direct test of overhead resistance rather than open space.

At the same time, ETH respected a rising purple trendline under recent daily lows. That line now acts as the main uptrend check.

If ETH stays above it, the series of higher lows remains intact, and the uptrend attempt stays valid. However, a daily break and close below that rising support would weaken the structure and put nearby horizontal levels back in focus.

The right side levels on the chart frame the next pivots. ETH traded above $3,212 support and above the 50 day EMA near $3,132, while additional supports sit near $3,106, $3,048, and $2,877.

On the upside, the next marked resistance sits near $3,599, which lines up as the nearest major level to clear if the move in the golden zone continues.

Momentum gauges also improved. The RSI rose to about 64.7, which shows stronger upside pressure than the prior range, although it still sits below the typical overbought threshold near 70.

Volume remained moderate on the snapshot, so follow through would likely depend on whether ETH can hold above the trendline while pressing into resistance inside the golden zone.

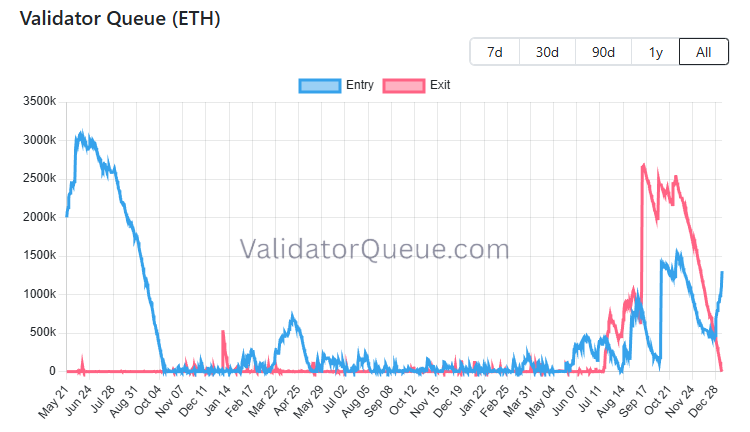

Ethereum validator exits fall as entry queue stays elevated

Ethereum’s validator exit queue dropped sharply in late December, while the entry queue remained elevated, according to data from ValidatorQueue.com shared by CryptoGoos on Jan. 7.

The chart shows exit requests falling toward zero after peaking above 2,500 earlier in November, signaling a slowdown in validators leaving the network.

At the same time, validator entries continued to rise. The entry line rebounded from mid December lows and climbed back above 1,000, indicating renewed interest in staking ETH rather than withdrawing it.

This divergence reduced net selling pressure linked to validator exits, which often coincide with ETH being unlocked and potentially sold.

Earlier in 2024, exit activity surged during periods of market weakness, while entries declined. However, the latest data reflects a shift.

Exit demand faded even as price stabilized, suggesting validators chose to remain staked instead of rotating out.

Meanwhile, entry demand picked up alongside improving price structure, reinforcing the imbalance between incoming and outgoing validators.

The chart also highlights that previous exit spikes tended to align with local price stress.

The recent compression in exits, combined with steady entries, points to reduced structural selling from the staking layer.

As a result, ETH supply returning to the market from validator withdrawals appears limited compared with prior months.

ValidatorQueue.com data covers both full exits and partial withdrawals. The sharp contraction in the exit queue indicates fewer validators are requesting full withdrawals, while new validators continue to line up to join the network.

This shift marks a notable change in Ethereum’s staking dynamics heading into early 2026.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: January 7, 2026 • 🕓 Last updated: January 7, 2026