Well-known crypto analysts have observed large investors, known as whales, buying over 240,000 ETH during a recent price drop.

They argue this massive purchase, worth around $840 million, shows a strong belief in Ethereum’s long-term value and also a possible short term price spike.

Real world usage, real profit

Crypto applications on the Ethereum blockchain are now generating revenues comparable to several public companies, and many industry commentators think these applications are becoming essential for daily financial and digital activities, marking an important milestone in mainstream cryptocurrency adoption.

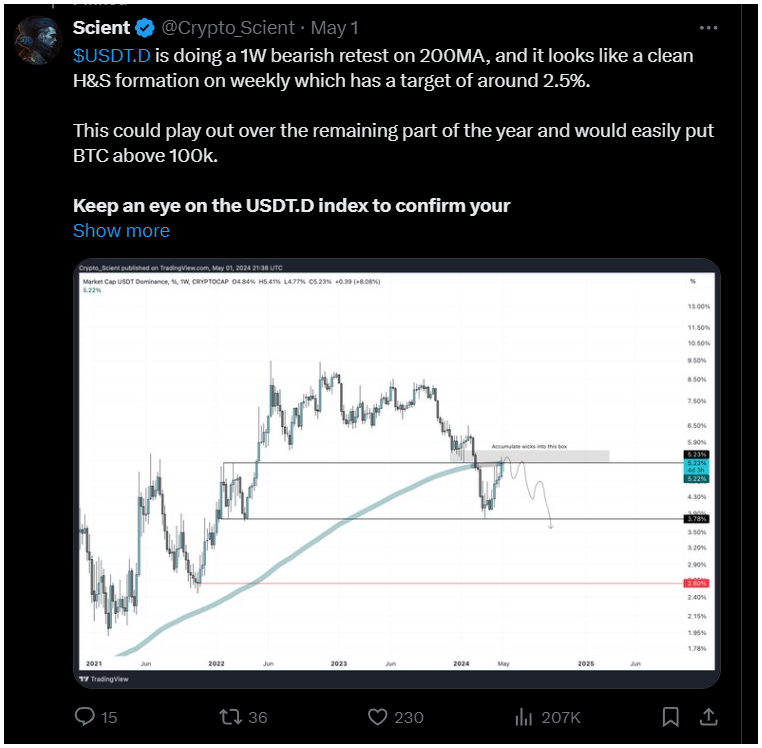

What does the chart say?

Crypto analyst Crypto_Scient pointed out in recent days that Ethereum is consolidating around a strong level of $3,650.

This area is closely watched for predicting the next price move, as most of the traders believe if Ethereum falls below $3,660 and stays there, it might drop to the way lower $3,200 support level.

But if it rises and stays above $3,700, a bullish trend could develop, tempting more traders and investors to buy.

The recent price drop has been smaller than expected, leaving Ethereum in a better position compared to Bitcoin.

Ethereum is holding and bouncing from its 12-hour 200 Moving Average (MA) and has tapped into the 1-day Fair Value Gap (FVG) during the recent dip.

Local support is around $3,450. If Ethereum continues to stay above this level, it might move towards $3,660 in the coming days.

Turning the $3,660 level into support would confirm a bullish trend, likely attracting more buyers.

Slow decline, but continuous adoption

As of the latest update, Ethereum’s price is in the $3,500-$3,600 range with a 24-hour trading volume of $15 billion.

This is a small increase in the past 24 hours but a 6.69% decline over the past week.

Whales buying ETH during the price dip shows strong confidence in Ethereum’s potential.

Based ont he common view, the ability of Ethereum-based applications to generate revenues, and profit, comparable to traditional public companies further prove their viability in the financial sector.