Ethereum’s playing a tense game right now, waiting for the right moment to strike. The price?

It’s stuck in this tight squeeze between $1,540 and $1,630 and it’s like a battleground where millions of ETH tokens have been bought and held.

We’re talking about over 7.9 million ETH sitting in that range, like a standoff between the bulls and bears, each waiting for the other to blink.

Heat

In the last day, things barely moved, ETH slipped a measly 0.37%. That’s like watching paint dry, but don’t let that fool you.

This calm before the storm means one thing: when it breaks out, it’s gonna be a big move, one way or the other.

Digging deeper, the IOMAP chart shows a solid support zone between $1,513 and $1,585.

Here, 6.6 million ETH holders are in the money, feeling pretty comfortable. But just above, between $1,585 and $1,630, there’s resistance, 3.37 million addresses holding nearly 8 million ETH at a loss.

It’s like a wall of tough guys blocking the way, and ETH has to muscle through if it wants to run.

Since January 2025, Ethereum’s been stuck in a downtrend channel, picture a slippery slope that keeps pushing the price down every time it tries to climb.

ETH’s been flirting with the middle of that channel, but neither side ready to take full control.

If the bulls can’t bust above $1,630, this bearish trend stays in charge. On the flip side, if things go south, $1,475 is waiting like a safety net, or maybe a trapdoor.

Moby Dick

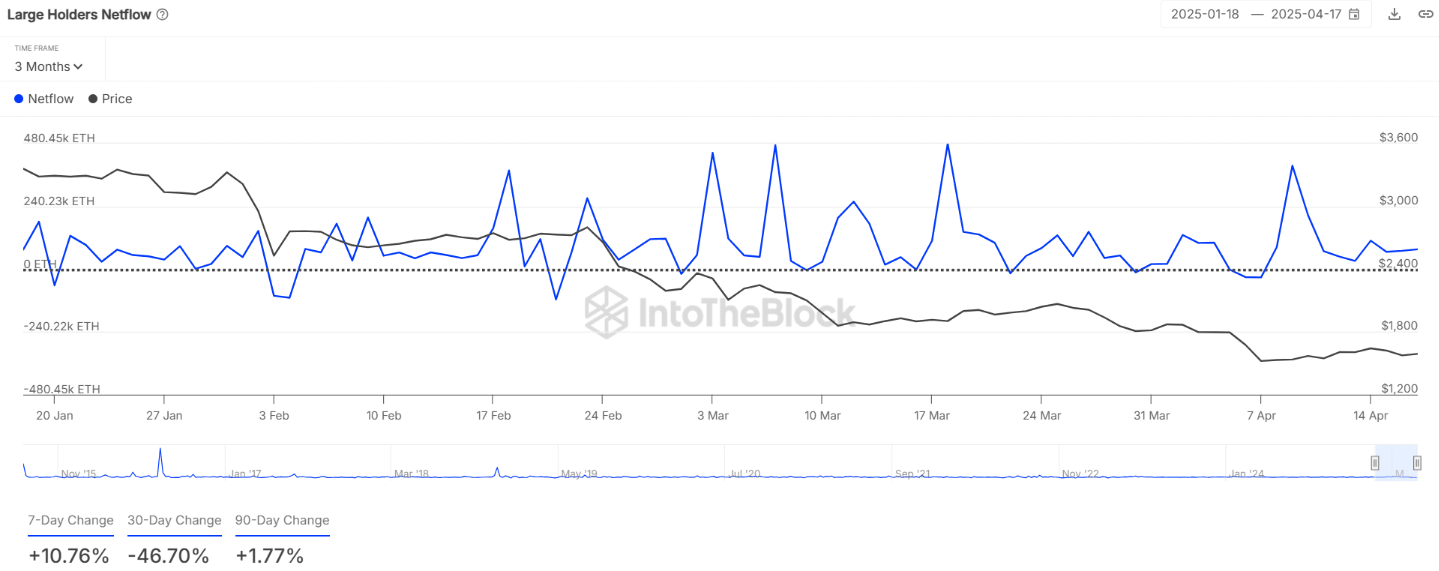

And what about the whales? Those big players are sending mixed signals. In the past week, they’ve been scooping up a bit more ETH, a 10% increase in netflows, hinting at some accumulation.

But zoom out to 30 days, and it’s a quite different story. A 46.7% drop showing they’ve been offloading a lot.

The 90-day picture is just barely positive, so these guys are cautious, no doubt.

Meanwhile, leverage traders are getting more aggressive. The leverage ratio ticked up to 0.7009, a 1% jump in 24 hours.

Translation? More traders are betting big, and if ETH breaks out, we could see a crazy ride with liquidations flying left and right.

Into darkness

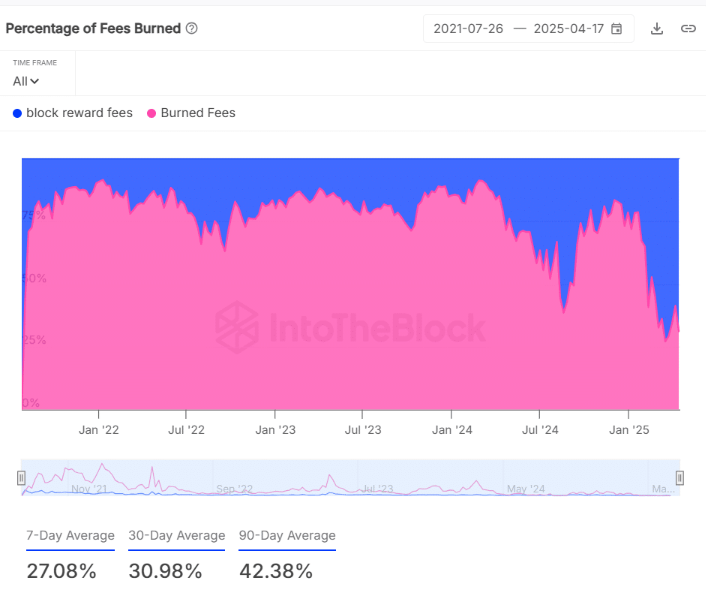

Ethereum’s deflationary mojo is fading. The percentage of ETH fees burned has dropped sharply, the 7-day average burn rate is down to 27%, way below the 90-day average of 42%.

Less burning means less scarcity pressure, and that’s not great news for bulls hoping for a sustained rally.

So, ETH’s at a crossroads. Bulls need to break above $1,630 to open the door to $1,860 and beyond.

Fail that, and $1,540 could crumble, dragging the price down to $1,475 or worse.

Have you read it yet? Coinbase urges Australia to stop dabbling, and start leading on crypto

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.