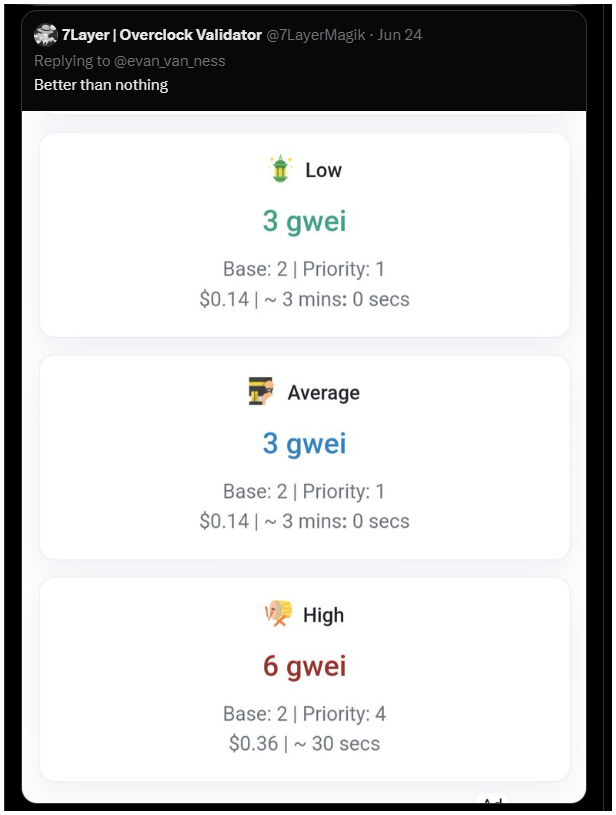

In the weekend, Ethereum recorded its lowest transaction fees since 2016. According to Etherscan, the average gas fee is now just 3 Gwei, or about $0.14.

The land of fees

Gas fees on Ethereum are neccesary for executing transactions and smart contract interactions, by incentivizing validators to staking their Ethereum and generating blocks.

But there is a catch. High fees, especially during the 2021 bull run driven by NFTs and DeFi, led many users to seek cheaper alternatives like Solana, because Ethereum was practically unusable.

Modern problems require modern solutions

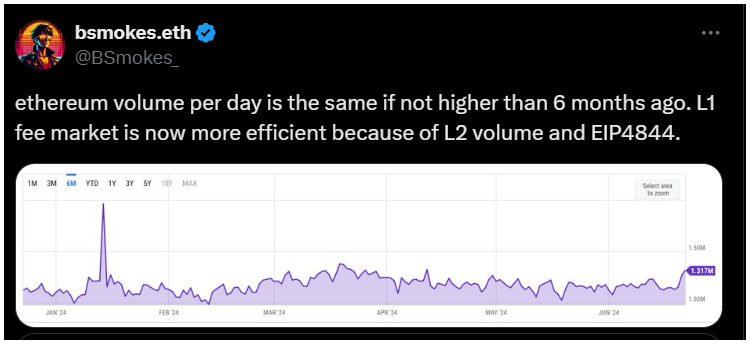

Analysts think several factors have contributed to this drop. One major reason is the improved efficiency of the Layer-1 market, boosted by increased Layer-2 activity and the introduction of “blob transactions” through Ethereum Improvement Proposal (EIP) 4844.

This proposal has greatly supported Ethereum’s scalability, allowing more transactions at way lower costs.

Brian Smocovich, founder of Pistachio Fi, noted on social media that although gas fees may still spike above 15 Gwei during high activity, the overall market has become more efficient post-EIP 4844, leading to cheaper days.

It’s not ultrasound money anymore

The decline in gas fees has serious implications for Ethereum’s tokenomics.

Lower fees mean the network is no longer deflationary, as the minimal amount of fees burned challenges the previous ultrasound money narrative.

It was never ultrasound by the way, as the sound money phrase refers to the reliability, not the supply.

Now the data from ultrasound.money shows that the Ethereum network added 14,393 ETH over the past week, with an annual supply growth rate of 0.62%.

The total supply of Ethereum is currently 120,185,061 ETH, so it’s very likely a new peak will be reached in 2024.

Despite the changing narrative, many suggest with its low gas fees and increased transaction efficiency, Ethereum is on a positive path.

Chances are strong Ethereum is set to maintain its position as a leading blockchain platform, no matter how many Ethereum-killer, how many competitor will showing up.