Ethereum’s on-chain trading volume skyrocketing by 85% since the beginning of November.

But despite this impressive surge, ETH itself seems to be lagging behind. So, what’s going on here?

A post-election boost

After the US elections, Ethereum’s on-chain volume jumped from $3.84 billion on November 1 to $7.13 billion by November 15.

This uptick is largely attributed to several factors, including big inflows into Bitcoin and Ethereum ETFs, along with the not-so-unexpected victory of Donald Trump in the US presidential election.

While this surge is promising, it’s important to remember that ETH is still far from its all-time high of $4,891.

Some analysts suggest that while the activity is encouraging, a rally to $4,000 before the end of the year might take a little longer.

Riding the waves

Just a week after the election results came in, ETH climbed above $3,300, even hitting a daily high increase of 5%.

On election day itself, it surged by an impressive 12%. Of course, rapid gains like these can often signal a potential correction ahead, and usually doesn’t last long.

Sure enough, over the next week, ETH pulled back to around $3,000, wiping out much of those gains.

But as any seasoned crypto investor knows, every dip can be an opportunity! The bulls took advantage of this pullback and pushed ETH back up nearly 10% the next day to around $3,357.

Resistance

Ethereum last tested the strong $3,400 resistance level about four months ago and has since been trading between $2,200 and $2,600.

The post-election excitement has positioned ETH for a potential breakout above $3K thanks to that massive surge in volume we mentioned earlier.

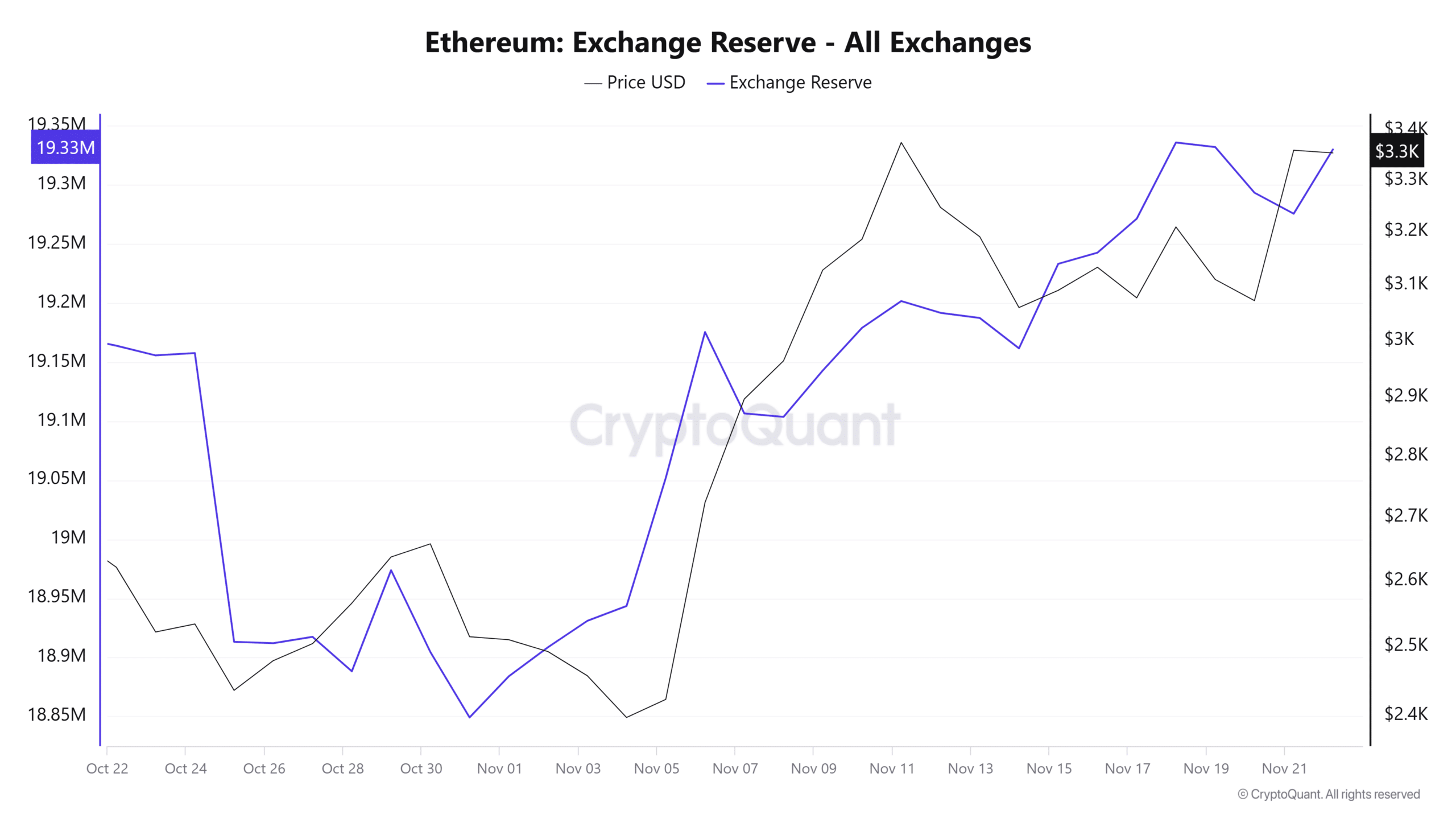

But there’s a catch, as Ethereum’s exchange reserves are creeping up, indicating rising selling pressure.

This could lead to a consolidation phase where buying and selling balance each other out.

For ETH to truly break through that $3,400 resistance level and make a run toward $4K, two key things need to happen: first, large holders need to start accumulating more tokens to soak up that selling pressure, and second, Bitcoin needs to break through the $100K barrier to boost overall market confidence.