On June 24, the Federal Reserve said it would remove “reputational risk” as a factor in bank supervision.

The central bank issued a statement confirming that it had begun reviewing its materials to eliminate this term.

In place of the vague label, the Fed will shift to detailed assessments based on financial, operational, and legal risk.

The decision comes more than a year after the collapse of crypto-friendly banks like Silvergate, Signature, and Silicon Valley Bank.

During this period, dozens of crypto and fintech firms were reportedly denied banking services. Many pointed to a revived version of a past regulatory campaign—Operation Chokepoint 2.0.

Industry groups argued that reputational risk became a tool to debank firms without clear legal violations.

The Fed now plans to train examiners on the updated guidance and apply the new approach uniformly across institutions it oversees.

Operation Chokepoint 2.0 Targeted Crypto, Fintech Firms

After March 2023, over 30 crypto and technology firms reportedly lost access to U.S. banking.

This followed regulatory actions connected to the fallout from several bank failures. Critics labeled this environment Operation Chokepoint 2.0, referencing a 2013–2015 initiative that targeted specific industries viewed as high-risk.

Under that earlier campaign, federal agencies pressured banks to end ties with firms in sectors like payday lending and firearms.

Crypto industry groups claimed a similar pattern had returned. Banks appeared to avoid crypto clients over fears of extra scrutiny tied to reputational risk.

No formal documentation linked the Fed directly to the decisions. However, crypto businesses, including custodial and trading platforms, reported being “de-risked” without clear cause. The recent update aims to remove ambiguity around such decisions.

Fed Says Risk Management Rules Remain for Banks

The Federal Reserve Board clarified that its removal of reputational risk references only affects supervisory oversight—not internal bank policies. Institutions can still evaluate reputational threats in their own risk frameworks.

The Fed defines reputational risk as the chance that negative publicity—true or false—leads to customer loss, lawsuits, or revenue decline. These factors, however, will no longer guide the agency’s official supervisory reviews.

According to the statement, all supervised banks must continue to maintain robust risk management programs.

They must comply with federal laws and other applicable rules, regardless of changes in oversight language.

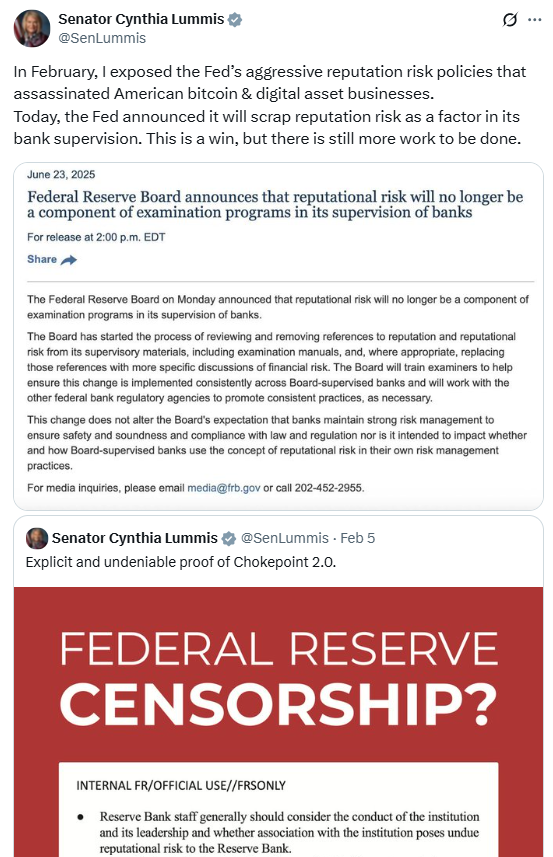

Senator Cynthia Lummis and Bankers Association Welcome the Move

Senator Cynthia Lummis (R-WY) responded to the Fed’s update with a statement on X.

“These aggressive policies assassinated American Bitcoin & digital asset businesses,”

she wrote.

“This is a win, but there is still more work to be done.”

Rob Nichols, President and CEO of the American Bankers Association (ABA), also backed the decision. He said in a statement,

“The change will make the supervisory process more transparent and consistent.”

Nichols added, “We have long believed banks should be able to make business decisions based on prudent risk management and the free market, not the individual perspectives of regulators.”

Both statements highlight concerns that reputational risk allowed federal supervisors to influence banking decisions beyond legal or financial grounds.

U.S. Regulators Ease Crypto Rules Across Multiple Agencies

The Fed’s shift aligns with recent moves by other regulators. In May 2025, the Office of the Comptroller of the Currency (OCC) confirmed that banks can trade digital assets for clients. Banks can also outsource crypto-related services to third parties under OCC supervision.

In March 2025, the Federal Deposit Insurance Corporation (FDIC) issued a letter clarifying that pre-approval is no longer required for crypto activity. This includes custody, trading, and other related offerings for FDIC-regulated entities.

Together, these updates point to a rollback of restrictions placed on crypto service providers after the 2023 banking crisis.

The industry has cited these developments in support of restoring basic banking access.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.