Two developments this week signal crypto’s gradual absorption into traditional banking infrastructure.

ING Adds Crypto ETPs

ING Germany expanded its crypto-linked ETP and ETN offerings, adding products from providers like Bitwise and VanEck.

The move wasn’t framed as a bold leap into the unknown. It looked like any other product extension.

Crypto exposure here doesn’t require a new app, a new account, or a new workflow.

It sits next to other financial products, accessed through the same interface customers already use.

That framing matters. Banks don’t rush into trends. They turn them into products only after risk teams, compliance officers, and lawyers are done asking questions.

So when crypto shows up as a standard bank offering, something has shifted underneath.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Xapo Sees Longer Loan Terms

Meanwhile, Xapo Bank reported clients are increasingly choosing longer-term bitcoin-backed loans.

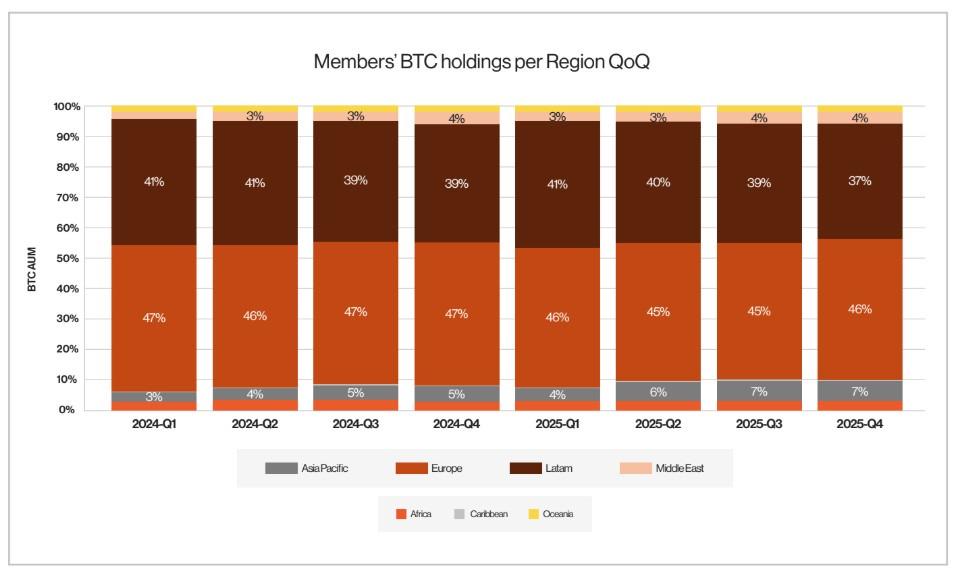

According to Xapo’s Digital Wealth Report, clients are using bitcoin-backed credit less as a tactical tool and more as part of broader wealth strategies.

Short-term loans usually move with the price. They assume fast exits. Longer maturities suggest something else. Planning. Asset management. A willingness to think past the next trade.

That kind of shift follows trust, repeat usage, and operational comfort. It doesn’t happen overnight. And it doesn’t happen when clients still see bitcoin primarily as a bet.

What It Signals

These aren’t experiments. Banks experiment quietly, but they expand publicly.

Neither ING nor Xapo presented these moves as tests or pilot programs. What’s taking shape is a pattern.

Crypto exposure through regulated products, credit tools designed for longer horizons, and familiar risk controls applied to unfamiliar assets.

The pieces line up once you see them together. On one side, access gets easier and blends into existing infrastructure.

On the other, lending terms stretch out because clients treat the collateral differently. Both point to the same shift.

Crypto is no longer treated as an exception. It’s treated as exposure. The kind you manage, diversify, and build around. Not the kind you speculate on and exit.

Both moves suggest crypto is being treated less as speculation and more as standard financial infrastructure.

Access through banks and longer loan terms point to the same outcome. Crypto is being handled like ordinary finance.

That transition rarely makes headlines, but it does something more durable. It turns exceptions into exposure. And once that happens, the conversation changes completely.

Crypto market researcher and external contributor at Kriptoworld

Wheel. Steam engine. Bitcoin.

📅 Published: February 4, 2026 • 🕓 Last updated: February 4, 2026

✉️ Contact: [email protected]

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.