Ethereum co-founder Joseph Lubin said Ether (ETH) could rise by 100 times and overtake Bitcoin (BTC) as a monetary base.

He shared his view in a Saturday post on X, explaining that Wall Street adoption of Ethereum would drive demand through staking and decentralized infrastructure.

Lubin said that financial institutions currently pay high costs to operate siloed systems. He explained that Ethereum can replace multiple infrastructure stacks by providing one shared base.

This shift, according to him, would require institutions to stake Ether, run validators, operate layer-2 networks, and deploy smart contracts.

“ETH will likely 100x from here. Probably much more,”

Lubin wrote. He added that traditional finance firms will need to move onto decentralized rails to handle agreements, processes, and financial instruments.

Wall Street Turns to Ether as “Wall Street Token”

Lubin’s comments follow remarks from Jan van Eck, CEO of VanEck, who called Ether the ‘Wall Street token’. Van Eck said banks must adopt Ethereum to enable stablecoin transfers or risk losing relevance in payments.

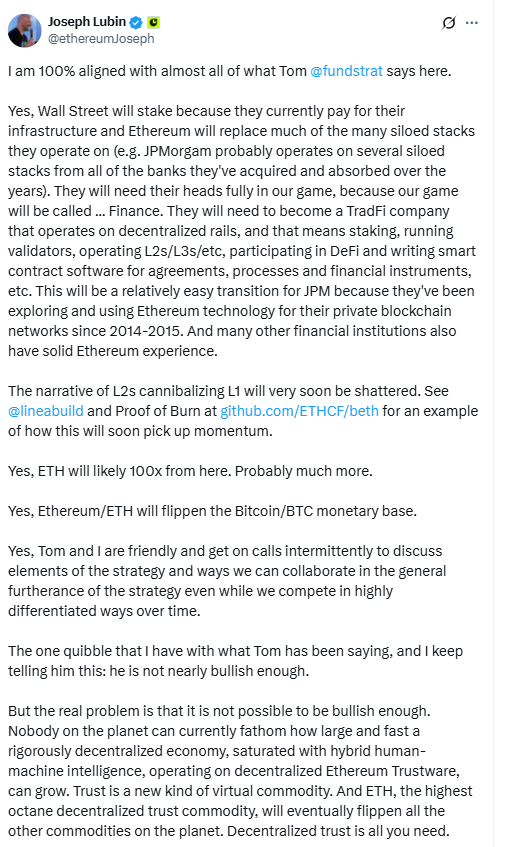

Lubin also backed Tom Lee, managing partner at Fundstrat Global Advisors, who said in August that Wall Street would adopt Ethereum for staking and network use. Lubin wrote:

“Yes, Ethereum/ETH will flippen the Bitcoin/BTC monetary base.”

Ether, however, is still far from Bitcoin’s market size. Ethereum’s market capitalization is about one-fourth that of Bitcoin.

Its share of the total crypto market has increased, doubling since April. Ethereum dominance now stands at 14.3%, data from TradingView shows.

Ether as a Decentralized Trust Commodity

Lubin also chairs Sharplink Gaming, the second-largest Ethereum treasury company. He described Ether as a decentralized trust commodity, saying that trust itself has become a new form of digital asset.

“Nobody on the planet can currently fathom how large and fast a rigorously decentralized economy, saturated with hybrid human-machine intelligence, operating on decentralized Ethereum Trustware, can grow,”

Lubin wrote. He added that ETH is the highest octane decentralized trust commodity and will eventually surpass other commodities.

His comments stress Ethereum’s use beyond payments, highlighting its role in staking, DeFi, and programmable contracts.

Institutions Increase Exposure to Ether

Institutional players have echoed Lubin’s views. Nassar Achkar, chief strategy officer at CoinW crypto exchange, said clients are increasingly allocating assets to Ether staking because of its role in tokenization ecosystems.

“Ethereum’s programmability and Wall Street’s adoption of its staking and DeFi rails could accelerate the flippening,”

Achkar stated. He said Ether can act as both a productive asset and a base layer for financial systems.

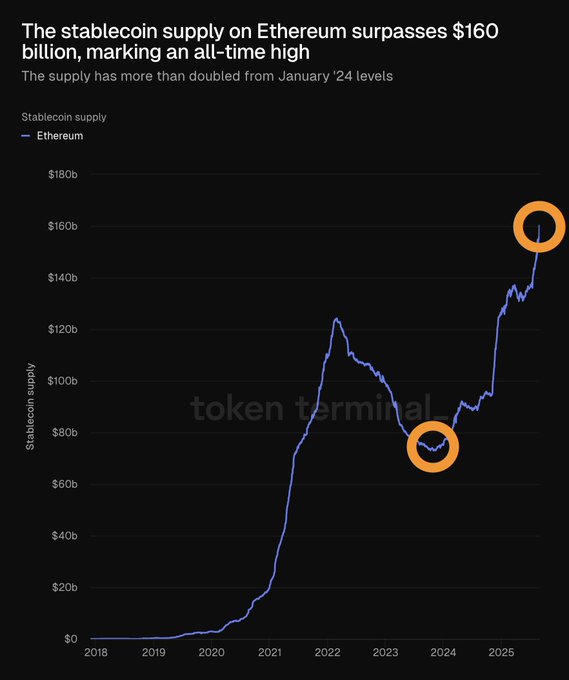

Stablecoin Supply on Ethereum Surpasses $160 Billion

Ethereum has also expanded its role in stablecoins. Data from Token Terminal shows that the supply of stablecoins on Ethereum reached $160 billion, a record high.

The figure has more than doubled since January 2024.

“Stablecoin demand seems exponential on Ethereum,”

said Tom Lee. The data underlines Ethereum’s position as the main network for dollar-pegged assets.

Ether Price Approaches $4,500 Before Pullback

Price data shows Ether rose near $4,500 over the weekend. The asset failed to break resistance and later moved back below $4,400 in Monday morning trading.

The price movement reflects ongoing market resistance, even as Ethereum adoption grows in staking, stablecoins, and DeFi infrastructure.

Ether’s position in Wall Street adoption strategies highlights its increasing role in global financial systems.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: September 1, 2025 • 🕓 Last updated: September 1, 2025