Metaplanet, Japan’s largest Bitcoin treasury company, has increased its Bitcoin holding to 20,000 BTC.

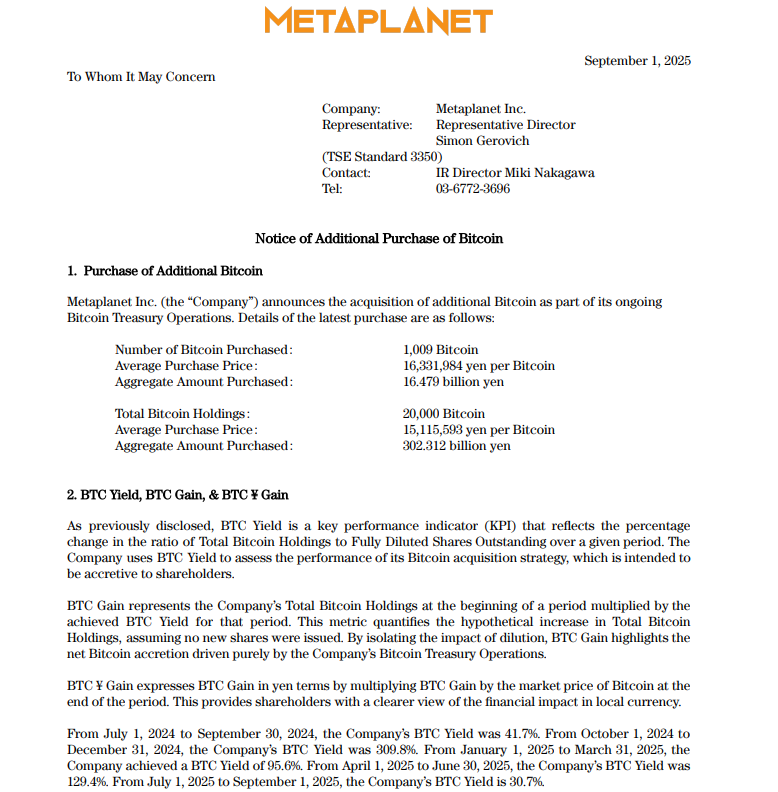

On Monday, the company announced the acquisition of 1,009 BTC at a cost of 16.479 billion yen, equal to nearly $112 million.

According to BitcoinTreasuries.net, the purchase places Metaplanet as the sixth-largest Bitcoin holding firm worldwide and the leading corporate holder in Japan.

The average purchase price was $102,607 per Bitcoin, leaving the company with a 6.75% profit compared with Bitcoin’s price at the time of reporting.

This new acquisition adds to Metaplanet’s existing Bitcoin holding, showing the company’s continued commitment to maintaining a large-scale treasury despite volatility in its stock price.

11.5 Million Metaplanet Shares Issued Through Evo Fund Warrants

Along with its Bitcoin holding increase, Metaplanet issued 11.5 million new shares. This was triggered by Evo Fund, an investor exercising warrants to purchase stock.

Evo Fund acquired 10 million shares at $5.67 and 1.5 million shares at just under $6, bringing the total to around $65.73 million.

The funds raised allowed Metaplanet to redeem approximately $20.4 million in bonds ahead of schedule. This repayment reduced part of the company’s debt while freeing up cash flow for other operations.

Evo Fund continues to hold rights for an additional 34.5 million shares, giving it the option to expand its investment further.

This positions Evo Fund as one of the most significant contributors to Metaplanet’s capital strategy tied to its Bitcoin holding.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Metaplanet Faces Market Pressure Amid Bitcoin Holding Growth

While the Bitcoin holding milestone is notable, Metaplanet’s stock price shows sharp declines. Since mid-June, the firm’s share value has dropped 54%, even as Bitcoin gained about 2% in the same period.

This decline impacts the fundraising model Metaplanet uses to build its Bitcoin holding. Lower share prices make warrant exercises less appealing to investors, reducing the firm’s access to liquidity. That constraint limits how quickly the company can expand its Bitcoin treasury.

Last week, Metaplanet disclosed plans to raise about 130.3 billion yen ($880 million) through a share offering in overseas markets.

At the same time, shareholders are voting on whether to approve the issuance of up to 555 million preferred shares, potentially raising 555 billion yen ($3.7 billion).

Metaplanet Ranks Among Largest Bitcoin Treasuries Worldwide

The Bitcoin holding strategy follows an approach first adopted by Strategy (formerly MicroStrategy).

The method involves issuing stock or debt to buy Bitcoin for corporate treasuries. Several companies worldwide have used this model, but it carries risks tied to stock market performance and Bitcoin’s price.

Falling stock prices or shrinking net asset value premiums can block new fundraising and force sales of Bitcoin holdings. In some cases, companies have faced margin calls or loan repayment challenges when prices turned against them.

Even under these conditions, Metaplanet’s 20,000 BTC holding secures its place among the world’s largest corporate Bitcoin treasuries.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: September 1, 2025 • 🕓 Last updated: September 1, 2025