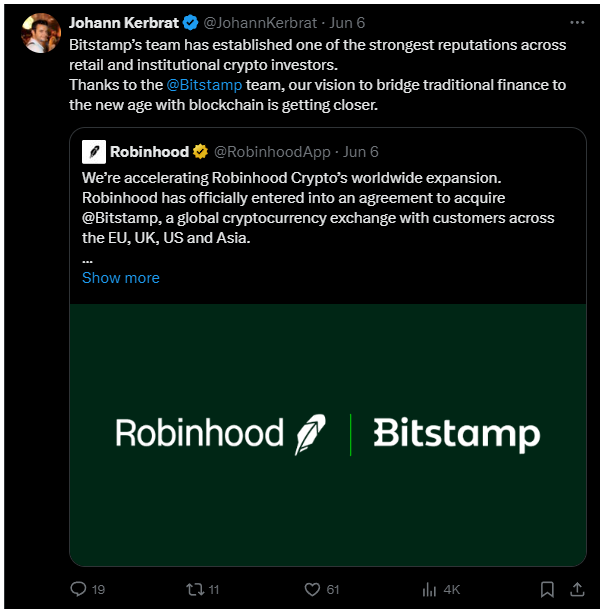

In a surprising move, Robinhood, one of the leading brokers in the United States, is set to acquire Bitstamp, a major cryptocurrency exchange based in Slovenia.

A brand new market

Johann Kerbrat, General Manager of Robinhood Crypto, stated, this acquisition marks a pivotal step for Robinhood in broadening its reach beyond American borders and tapping into the European market.

“Through this strategic combination, we are better positioned to expand our footprint outside of the US and welcome institutional customers to Robinhood.”

Bitstamp, founded in 2011, is one of the oldest cryptocurrency exchanges, but despite its longevity, it never fully recovered from a significant hack in 2015.

Bitstamp stands out among European crypto exchanges, alongside platforms like Bitfinex, which is closely associated with the USD stablecoin issuer Tether, and Bitpanda, an Austrian broker.

Bitpanda announced a partnership with Deutsche Bank to facilitate fiat deposits and withdrawals, reflecting a more favorable regulatory climate for cryptocurrencies in Europe, and Revolut has launched a full-fledged crypto exchange with competitive fees, rivalling platforms like Coinbase and Kraken. Or Bitstamp.

Innovation finds a way

Robinhood’s acquisition of Bitstamp might raise concerns in Europe about potential American tech dominance in the cryptocurrency sector, and the fear is that for many industry participants, similar to other tech industries, American firms might overshadow European entities, potentially stifling local competition and innovation.

Conversely, this acquisition highlights the need for competition within the American crypto market.

Coinbase enjoys a dominant position, with Kraken being its primary competitor, while Binance is recovering from the departure of its original founder and former CEO, Changpeng Zhao, who has gained notoriety as the wealthiest individual to serve four months in a U.S. prison.

Crypto doesn’t come to banks. Banks come to crypto.

Set to be finalized next year, this acquisition shows a trend of consolidation within the crypto industry, as many crypto exchanges have struggled to survive market downturns, but the involvement of traditional finance players like Robinhood suggests a wave of integrations might be forthcoming.

As the industry transitions to the bigger acceptance phase, we may see more like this.

While not an outright surrender, this development indicates that traditional finance is increasingly penetrating the crypto space.

Even though the Federal Reserve blocked crypto entities like Custodia from entering the banking sector, traditional finance firms like Robinhood are making significant steps.