Listen up, guys, in the wild west of crypto, stablecoins are becoming the go-to currencies in Latin America.

According to Bitso, a major exchange in the region, Circle’s USDC and Tether’s USDT are the new store of value for people looking to escape economic turmoil.

Stablecoins’ march

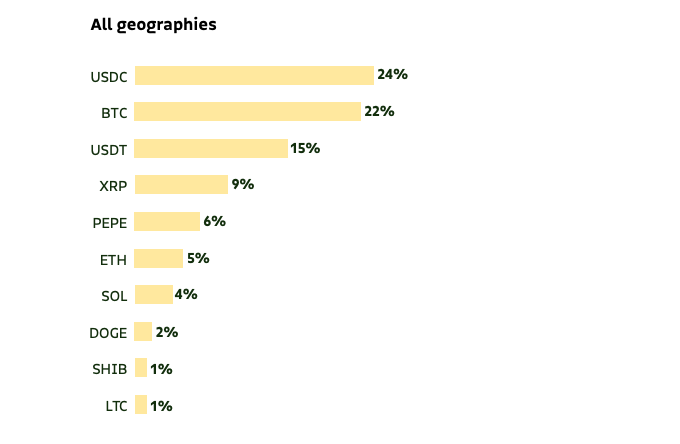

In 2024, these stablecoins accounted for 39% of all crypto purchases on Bitso, with USDC leading the pack at 24% and USDT following closely at 15%. Now, you might wonder why stablecoins are so hot right now.

Well, it’s simple, Latin America’s got some serious economic challenges, high inflation and currency devaluations are the norm.

People need something reliable, something that won’t lose value overnight. That’s where USDC and USDT come in. They’re like the safe houses in a neighborhood full of uncertainty.

Bitcoin for hodl, stablecoins for daily use

But what about Bitcoin, the king of crypto? Well, it’s not doing so great in Latin America. Its trading volume on Bitso dropped significantly in 2024, from 38% to 22%.

It seems people are adopting the hodl strategy, buying and holding onto Bitcoin for the long haul.

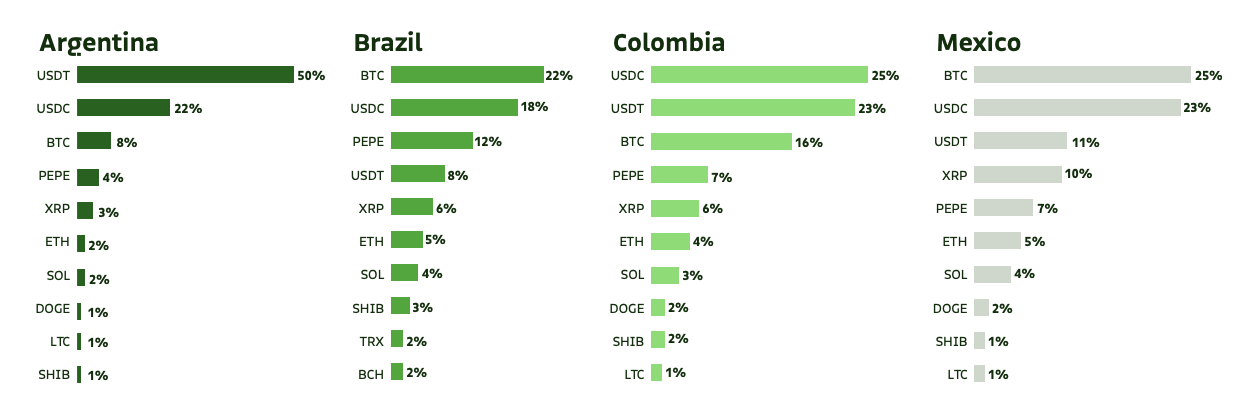

Meanwhile, stablecoins are where the action is. Argentina, for instance, is all about USDT, with 50% of crypto purchases being Tether’s stablecoin. That’s no surprise, given the country’s inflation rates are through the roof.

Reliability

Brazil and Mexico, on the other hand, are still Bitcoin fans, with BTC purchases making up 22% and 25% of their crypto buys, respectively.

But overall, stablecoins are the new darlings of Latin America’s crypto market. They’re not flashy, but they’re reliable, and in times of economic chaos, that’s exactly what people need.

So, if you’re looking for a safe bet in crypto, stablecoins might just be your ticket.

In the end, it’s all about stability in a world that’s anything but. Stablecoins are filling a gap that other cryptos can’t, and that’s why they’re thriving in Latin America.

Have you read it yet? Bitcoin takes a beating, so it’s Peter Schiff’s „I-told-you-so” moment

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.