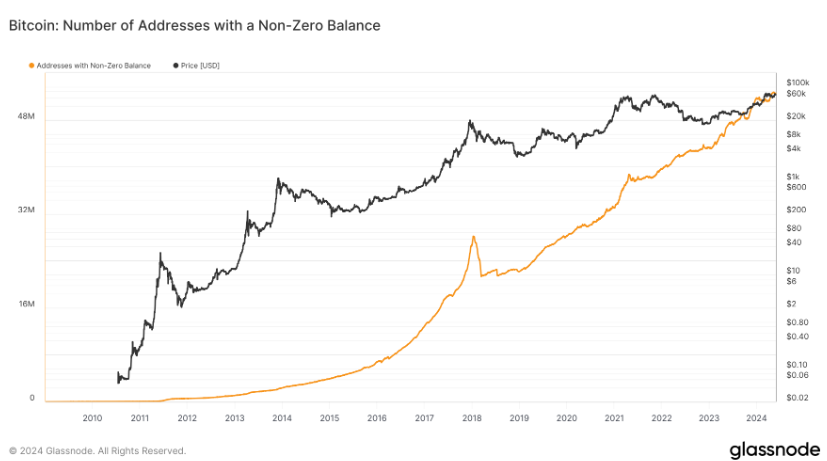

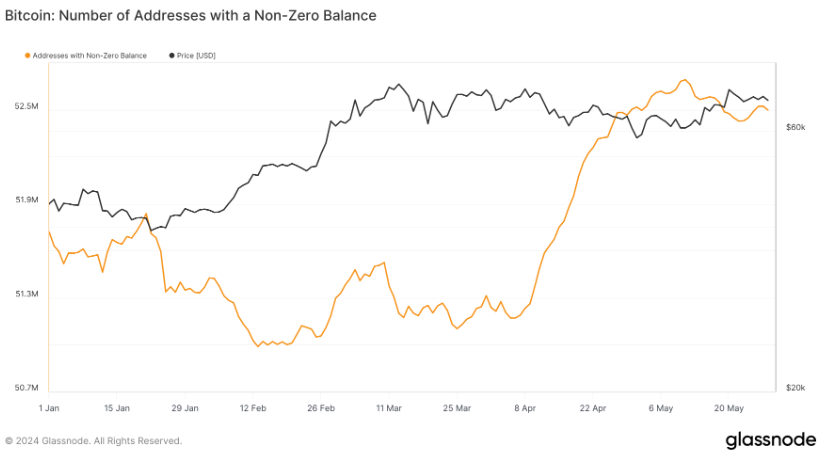

The number of Bitcoin addresses with a non-zero balance has now reached 52.5 million, with significant growth since 2020.

According to Glassnode, this increase in addresses shows a rising interest in the Bitcoin ecosystem.

Millions of new Bitcoin addresses

This metric tracks unique addresses holding a positive amount of Bitcoin, and since 2020, Bitcoin’s user base has expanded by 11 million new addresses.

This surge means growing confidence in Bitcoin, even as the market experiences periods of volatility, and well-known fact fluctuations in Bitcoin prices often correlate with changes in address balances.

It is important to note that a single user can own multiple Bitcoin addresses, as many wallets use a new address for each transaction by default, and some users distribute their holdings across multiple addresses for stronger security.

Consequently, while over 52.5 million active addresses is an impressive figure, the actual number of individual Bitcoin users is likely lower.

The numbers looks good, but they’re real?

Moreover, an address with a non-zero balance might hold only a few satoshis, often referred to as dust.

Given the current transaction fees, such small amounts are typically unspendable, which could lead to overestimation of active usage.

When filtering addresses with at least one dollar worth of Bitcoin (approximately 1500 satoshis), the number drops to around 47 million.

Further refining this to addresses holding at least $50 reduces the count to 26 million.

For those with a balance indicative of savings, let’s say around $1500 (about 2.2 million satoshis), the number of addresses decreases to 9 million.

Adoption is growing, and this is what matters

Next to these adjustments, the growth rate remains strong. Since 2020, the Bitcoin ecosystem has seen a steady increase in new addresses with non-zero balances, suggesting a sustained uptrend.

This growing number of addresses aligns with the overall market activities and regulatory developments that influence Bitcoin’s adoption and price.

As the market continues to growing, monitoring these metrics provides valuable insights into the health and direction of the Bitcoin ecosystem.

The increasing number of Bitcoin addresses, despite market volatility, it’s the proof of confidence in the cryptocurrency, pointing towards its strenghtening role in the global monetary system.