Another DeFi protocol is closing its doors.

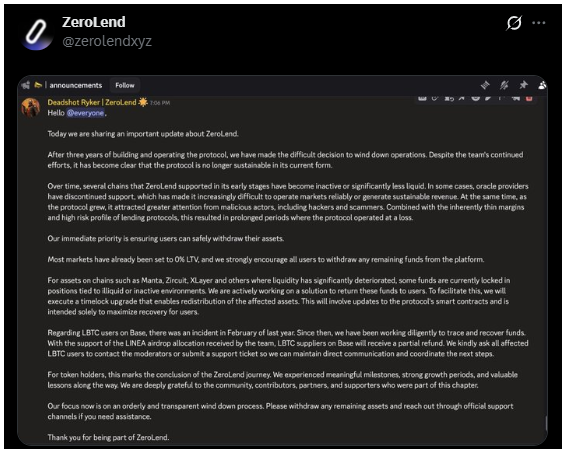

ZeroLend, a decentralized lending platform that operated for three years, has announced it is shutting down.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

The team cited unsustainable economics, security incidents, and low activity on chains like Manta and Zircuit as core reasons.

This is not a dramatic collapse. It is something quieter, and in some ways, more telling.

What went wrong

ZeroLend operated in a segment that once defined DeFi’s growth phase: decentralized lending.

The model looks simple on paper. Users deposit crypto, others borrow against collateral, the protocol earns fees. But the mechanics are fragile.

Yield depends on activity, activity depends on incentives, and incentives often depend on token emissions or liquidity rewards. When volumes drop, rewards shrink.

When rewards shrink, users leave. When users leave, liquidity dries up. Game over.

Security pressure adds another layer. Hacks, exploits, and bridge vulnerabilities have repeatedly hit DeFi protocols, and even if a project survives one incident, trust erodes.

In ZeroLend’s case, inactive chains and prior security issues made recovery harder.

The bigger pattern in DeFi

DeFi has matured in infrastructure, but sustainability remains uneven.

Some protocols have survived multiple market cycles. Others expanded aggressively across new chains without consistent demand.

Launching on multiple ecosystems sounds like growth. In practice, it can fragment liquidity and dilute user concentration, so if a chain fails to attract users, the protocol’s deployment there becomes idle capital.

Idle capital doesn’t pay yield. And yield is the engine of lending platforms.

What this means for retail users

If you use DeFi, this is a reminder to differentiate, not a reason to panic. Look at security track record, revenue sources beyond token emissions, and liquidity depth on the chains you actually use.

A lending platform that survives only because of aggressive emissions is structurally different from one with organic borrowing demand.

The DeFi ecosystem is no longer judged by how many protocols launch. It’s judged by which ones survive.

Three years used to feel like longevity in crypto. Now, survival requires durable economics, not just code and incentives.

Crypto market researcher and external contributor at Kriptoworld

Wheel. Steam engine. Bitcoin.

📅 Published: February 18, 2026 • 🕓 Last updated: February 18, 2026

✉️ Contact: [email protected]

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.