Lido is scaling back its crew by 15%. Fifteen freakin’ percent of their workforce is getting the ol’ heave-ho.

Now, if you’re scratching your head and thinking, hey, isn’t the market looking up, you’re not alone.

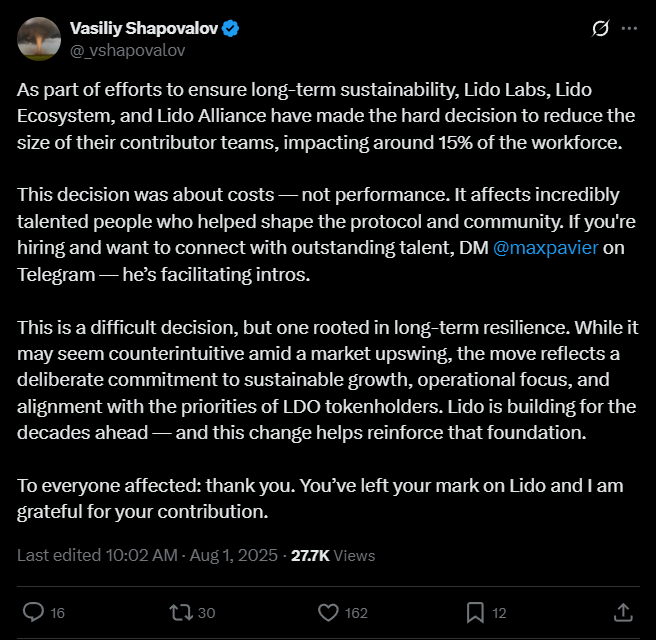

But the co-founder, Vasiliy Shapovalov, is clear as day, this ain’t about performance. Long term sustainabiliy, as they say.

The second biggest player

Lido burst onto the scene in 2020 with a slick solution, allowing Ethereum holders to keep their assets fluid while staking, avoiding that lock-up nightmare. No more frozen funds, just liquidity.

Fast forward to February, and they dropped the Lido v3 upgrade, rolling out modular smart contracts called “stVaults.” Fancy stuff, letting users craft advanced staking strategies like pros.

But here’s the rub, despite locking in a massive $31 billion in assets and pulling in about $90 million a year in revenue, yeah, the second biggest player in the liquid staking game, times are still tricky.

Sharper focus

Shapovalov said the layoffs hit contributor teams across Lido Labs, the Ecosystem, and the Alliance.

Not for lack of skill or effort, mind you, but to keep the ship sailing strong for the long haul.

Now, the LDO token had a bit of a roller-coaster in price, up 4.3% in the last day but down over 21% for the week.

Not exactly champagne news for holders. But look, trimming the fat now means Lido’s betting on sharper operational focus and a sturdier future rather than riding short-term hype.

It’s like cutting down on office coffee runs so you can pay the rent next month, you know what I mean?

Unstoppable

Now, Lido’s playing the long game, steering through choppy waters, so when the big waves of the crypto sea come, they’re ready.

Sure, a workforce cut stings like a slap from your boss when you barely survived Monday.

But sometimes, leadership means making the hard moves to survive and thrive.

So yeah, Lido’s leaner now, but their eyes are set on a future where Ethereum liquid staking is unstoppable.

Frequently Asked Questions (FAQ)

Why did Lido cut 15% of its workforce?

According to co-founder Vasiliy Shapovalov, the layoffs were not performance-based but aimed at long-term sustainability and sharper operational focus.

Which teams were affected by the layoffs?

Contributor teams across Lido Labs, the Ecosystem, and the Alliance were impacted.

Is Lido still a major player in liquid staking?

Yes. Lido remains the second-largest liquid staking protocol, with over $31 billion in assets locked and $90 million in annual revenue.

What’s the outlook for the LDO token?

The LDO token rose 4.3% in the last 24 hours but is still down over 21% for the week, showing short-term volatility amid restructuring efforts.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 5, 2025 • 🕓 Last updated: August 5, 2025

✉️ Contact: [email protected]