Ethereum, the so-called king of smart contracts, has been on fire lately. One minute, it’s down in the dumps near $1,750, the next it’s clawing back up to $1,850.

You think that’s just random? There’s more going on behind the curtain.

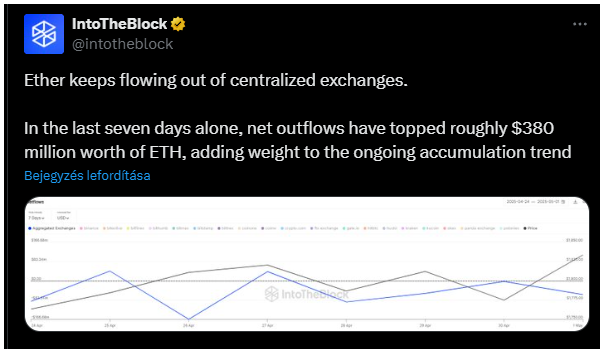

Exodus

In the past week, over $380 million worth of ETH has been yanked off centralized exchanges.

That’s not your average Joe cashing out for a new car. These are likely the big players, the ones who know how to move markets.

They’re stuffing their coins into cold wallets, out of reach, like a wise guy hiding his cash in the mattress.

Why? Because when investors pull their chips from the table, it usually means they’re betting on a bigger payday down the line.

For five days straight, exchanges saw more ETH leaving than coming in. The last time anyone brought more in than out? April 27.

And even then, it was just a blip, $50 million in, after $166 million out the day before. History says when this kind of exodus happens, a price rally isn’t far behind.

Crossroads

But don’t get too comfortable, because Ethereum’s market cap is sitting at $225.5 billion as of May 2, 2025, and it’s a far cry from the $365 billion it boasted a year ago, down nearly 40%.

Sure, it’s up a hair from yesterday, but let’s not kid ourselves, this market’s still got the shakes.

Popular crypto analyst Ali Martinez says the $1,770 zone is the line in the sand right now. About 4.5 million wallets snagged 6.36 million ETH between $1,772 and $1,824.

The most critical support level for #Ethereum $ETH is at $1,770, according to on-chain data from @intotheblock! pic.twitter.com/PtEBRaRlWT

— Ali (@ali_charts) May 3, 2025

These holders? They’re finally in the money again. If ETH can keep its head above $1,770, we might see some fireworks. But if it slips? Things could get ugly, fast.

Struggle

So what’s the play here? With less ETH on exchanges, there’s less to sell, which sounds good on paper.

That’s good for price, unless, of course, the bears come out swinging. The next big hurdle? $1,880.

If Ethereum can break through, maybe we get that rally everyone’s whispering about. If not, well, let’s just say you don’t want to be the last one holding the bag.

In this business, you keep your eyes open, your wallet close, and you never bet the house on a hunch.