Imagine it’s the tail end of 2025, and Binance struts into the crypto saloon like a gunslinger who’s just won the whole damn town.

This beast of an exchange now clutches 71% of all stablecoin liquidity across centralized spots, over $49 billion out of a $69 billion in reserves sitting near ATHs.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

That’s from a total stablecoin supply ballooning to 314 billion tokens, mostly Ethereum and TRON flavors flooding in like uninvited guests at a party that never ends.

The exchange turned into a crypto casino banker?

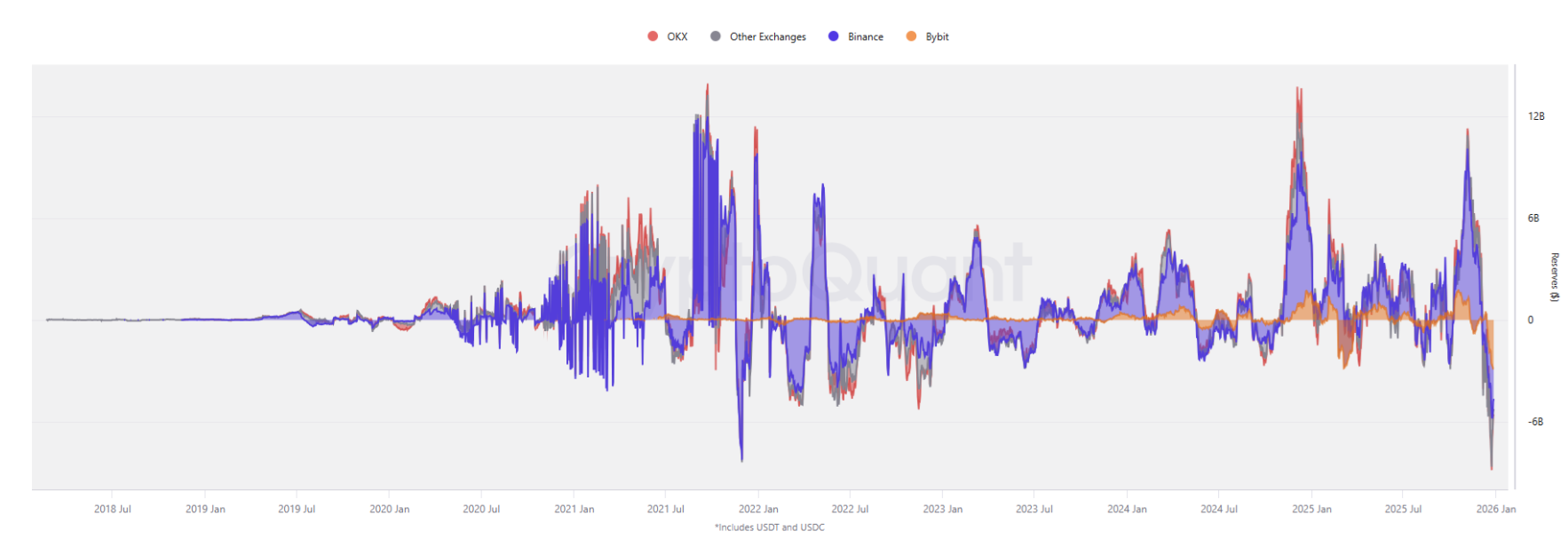

Simply put, Binance dwarfs the competition. OKX? A measly fifth of that liquidity. The top three exchanges, Binance, OKX, Bybit, hoard 94% of the pie, per CryptoQuant data. USDT and USDC? Binance’s playground.

They even slashed FDUSD supply from 2.5 billion to 500 million tokens over the year, like trimming the fat off a greasy burger.

These reserves? Raw buying power for spot markets, sure, but Binance juices them with yield programs for passive income.

Feels like the exchange turned into a crypto casino banker, doling out chips while everyone else scrambles.

Reserves hover near historic peaks

Fast-forward to December, stablecoins bail en masse. Reserves peaked end of November with Binance at $51 billion.

Then, $8 billion flees exchanges in the holiday slump, Bybit bleeds $2 billion, Binance coughs up another $2 billion. Yet reserves hover near historic peaks.

CryptoQuant charts show spot reserves cratering from $5.7 billion to $1.3 billion across boards.

Whales nibble BTC on the spot, but thin holiday volumes and sour sentiment keep the party flat. No new ATHs for Bitcoin, the hype machine sputters.

Liquidity’s ghosting spot markets for derivatives. Derivative desks hold $64 billion as of December 29, peaking at $68 billion mid-November.

Spot’s a graveyard after October’s deleveraging bloodbath briefly revived it. Traders perch cautious, building long and short positions only to watch liquidations feast like sharks in a frenzy.

Anything but guaranteed spot buying

And the main insight that’ll make you chuckle bitterly? Experts say stablecoin minting ain’t the golden ticket to Bitcoin moonshots anymore.

Past bull runs? Mint big, buy big. 2025? Nah. Record supplies chase DeFi yields, payments, whatever, anything but guaranteed spot buying.

Binance’s mega-hoard signals potential buying pressure if sentiment flips, but right now, it’s a sleepy dragon piled on gold, waiting for the spark.

Crypto’s evolved into this bizarre beast, where liquidity lurks in derivatives, whales whisper, and the market shrugs like it’s nursing a hangover.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: December 30, 2025 • 🕓 Last updated: December 30, 2025

✉️ Contact: [email protected]