The author of the popular book Rich Dad, Poor Dad, is sounding the alarm about a potential crisis in the U.S. banking sector.

He believes that a serious downturn already started, and he’s urging everyone to pay attention.

What’s happening?

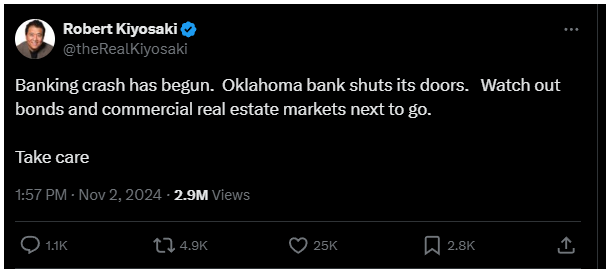

Kiyosaki pointed to the recent closure of a bank in Oklahoma as a sign that trouble is brewing.

He’s particularly worried about the bond and commercial real estate markets, which he thinks are way more vulnerable to strong downturns.

“Banking crash has begun. Oklahoma bank shuts its doors. Watch out bonds and commercial real estate markets next to go.”

He has long been skeptical about the U.S. banking system, and never hesitated to share his thoughts, calling the dollar fake money and criticizing what he sees as a corrupt and unsustainable monetary system.

Kiyosaki warns that the dollar’s declining value, combined with flawed financial practices, could lead to the worst economic crisis since the Great Depression.

Protecting your wealth, protecting yourself?

To safeguard against these risks, Kiyosaki recommends investing in assets that have intrinsic value and limited supply, think gold, silver, and Bitcoin.

He refers to Bitcoin as the people’s money because it’s decentralized and not subject to debasement or inflation like traditional currencies.

Kiyosaki believes these assets can help people preserve their wealth during what he describes as an ongoing firestorm in financial markets.

He’s not just making noise, but genuinely wants people to take control of their financial futures rather than becoming victims of a failing monetary system.

A hidden crisis?

In his newer posts on social media, Kiyosaki highlighted how banking panics can be invisible compared to visible crashes in stocks or real estate.

Most folks don’t realize when their bank is on the verge of bankruptcy until it’s too late.

While FDIC insurance protects up to $250,000 of your savings if a bank fails, Kiyosaki questions whether relying solely on banks is wise given their vulnerabilities.