Ethena is gearing up to launch a new product aimed squarely at traditional finance institutions.

The spotlight is on their TradFi Wrapped iUSDe synthetic dollar, which is set to roll out in February 2025.

Stablecoin with a twist

Ethena’s primary goal for the first quarter of 2025 is to partner with TradFi distribution channels to get iUSDe into the hands of clients, and they’re planning to announce these partners by the end of January.

Based on what we know now, the iUSDe will be built on Ethena’s existing synthetic dollar, sUSDe, but with a difference, with a simple wrapper contract that adds transfer restrictions.

This means traditional financial entities can hold and use it without having step into the crypto space.

Do not touch the crypto market

The new product is aimed at a variety of players in the finance game, including asset managers, private credit funds, exchange-traded products, private investment trusts, and prime brokers.

Currently, Ethena’s sUSDe offers 10% annual percentage yield to over 368,000 investors who have poured more than $5.85 billion into it.

A yield-bearing synthetic dollar like iUSDe could attract serious attention from TradFi participants, especially considering the massive $190 trillion fixed-income market, the largest liquid investment class on the planet.

Ethena believes that demand for a product like this could dwarf the entire crypto market combined.

Growth phase

Per Ethena’s roadmap, this shift towards a dollar savings product is the next logical step for these entities after ETFs.

Guy Young, founder of Ethena Labs, explained that iUSDe generates yield through staking returns and shorting Ether perpetual futures contracts, so Ethena isn’t just sitting around waiting for things to happen, they’ve been making moves.

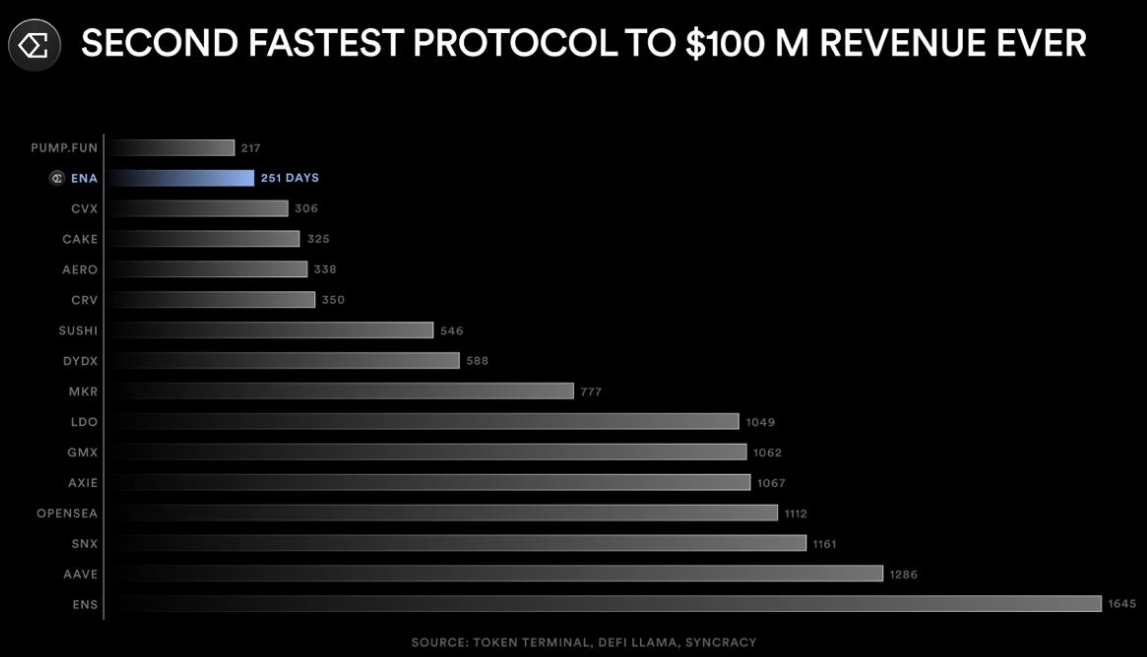

They became the second-fastest protocol in crypto history to hit $100 million in revenue, taking just 251 days to reach that milestone.

Their USDe product quickly became the third-largest US dollar-based offering in the crypto industry, right behind Circle’s USDC and Tether’s USDt.