Imagine being on a rollercoaster ride, but instead of screaming with excitement, you’re screaming because your crypto investments are plummeting.

That’s what happened to Raydium’s token, RAY, which dropped 25% out of blue. So, what’s behind this sudden fall?

Words on the street about a new exchange

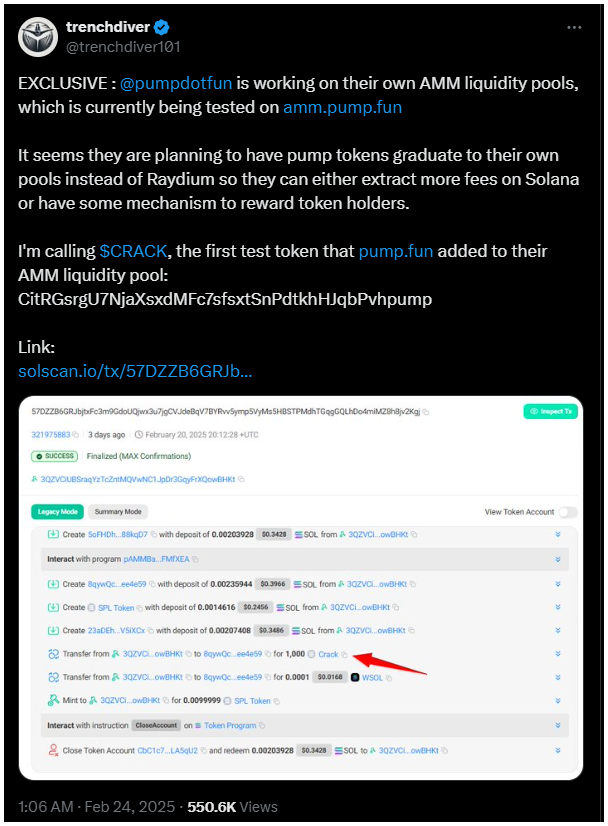

It all started with a rumor, after a crypto influencer known as “Trenchdiver,” spilled the beans on X that Pump.fun, a popular memecoin launchpad, might be cooking up its own automated market maker feature.

This could be a game-changer, allowing users to trade crypto directly against liquidity in smart contracts instead of relying on a counterparty.

The rumor included a sneak peek at Pump.fun’s AMM interface, which is still in beta.

The token launch, bonding curve, Raydium trading path will be disrupted?

Here’s the kicker, if Pump.fun indeed launches its own AMM pools, it could cut off a significant revenue stream for Raydium.

Right now, when a Pump.fun token gains enough traction, reach the bonding curve, as they say, it gets listed on Raydium for further trading.

But if Pump.fun decides to keep those tokens in its own pools, Raydium could lose out on some serious fees.

Trenchdiver suggested that Pump.fun might be planning to extract more fees or reward token holders in a different way.

This is the program ID for their AMM pool feature:https://t.co/c4RwQHLe33

If you look at the first transfer transaction, that points to the first test token added to a https://t.co/Hko8ObYG38 amm pool#pumpfun pic.twitter.com/CG5oypvNGv

— trenchdiver (@trenchdiver101) February 24, 2025

Test run

To test the waters, Pump.fun added a token called Snowfall to its AMM pool. The token’s capitalization skyrocketed to $5.4 million shortly after the news broke, only to plummet by about 40% later.

Meanwhile, Raydium’s token continued its downward spiral, with some calling it a cliff moment.

Pump.fun hasn’t confirmed these plans, but the speculation is already causing waves.

If it does launch its own AMM, it could potentially double its revenue by charging higher fees, according to Shoal Research founder Gabriel Tramble.

Have you read it yet? How a Solana ETF could change the game

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.