Listen, let me tell you a story. The SEC suddenly decides to drop its case against Ian Balina, a guy who made his name talking crypto to 140,000 loyal followers on X, running Token Metrics, and stirring up the pot on YouTube.

You gotta ask yourself, what’s changed? Who’s pulling the strings now?

Changing minds

The SEC, they’ve been gunning for Balina since 2022. Why? They said he was running some unregistered securities operation, pushing Sparkster tokens, and getting people to throw their Ether into a Telegram pool.

The government’s argument? Hey, most of those Ethereum nodes are right here in the good ol’ US of A, so we got jurisdiction.

The court, not to be outdone, agreed, SPRK was an investment contract, plain and simple.

If you’re putting your cash in, expecting someone else to make you rich, that’s a security. End of story, right?

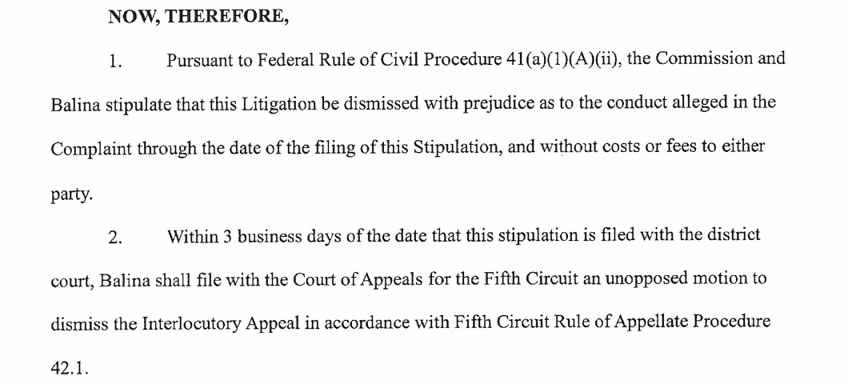

But no. Suddenly, May 1 rolls around, and the SEC strolls into an Austin federal court, arm-in-arm with Balina, saying, you know what? Let’s just call the whole thing off.

No explanation, no apology, just a little wink and a nod to the Crypto Task Force.

They say, this doesn’t mean we’re letting everyone else off the hook. Sure, pal. And I’m the tooth fairy.

Hell yeah

Balina, for his part, is practically popping champagne. He told back in March, the SEC told they’d recommend dropping the case.

New priorities, new sheriff in town. And you know what? He’s not wrong. The winds have shifted, President Trump brings in Paul Atkins, a guy who used to lobby for crypto, to run the show.

Suddenly, the SEC’s not so interested in playing hardball with the industry anymore. And this is good.

Relief

And it’s not just Balina. Over the past month, the SEC’s been dropping cases left and right, Coinbase, Ripple, Kraken, Opensea, even PayPal’s stablecoin gets a pass. It’s like watching the Godfather call off the hitmen after a family dinner.

They say it’s to conserve court resources, but come on. We all know when the boss wants something done, it gets done.

So what does this mean for the rest of us? Maybe you’re thinking about dipping your toes into crypto, or maybe you’re just sick of the government picking winners and losers.

Watch your back, keep your friends close, and your Ether closer. The game’s not over, it’s just getting interesting.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.