The Bitcoin game’s changing, and the big players? They’re not messing around anymore.

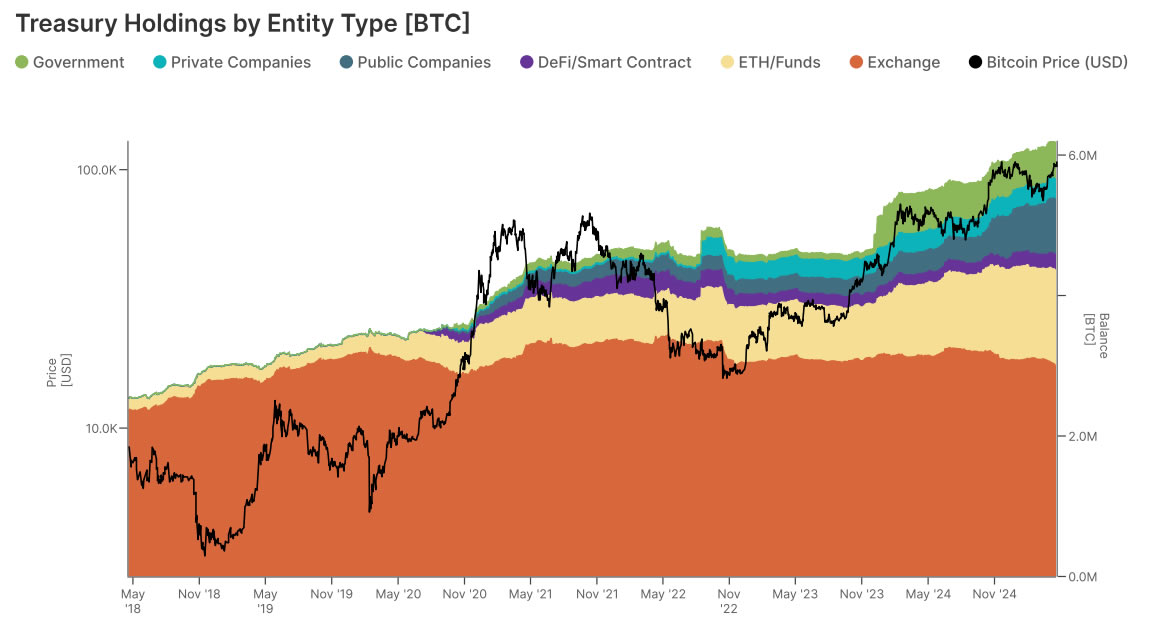

Gemini’s and Glassnode’s new report revealed centralized treasuries, think governments, ETFs, and public companies, now hold almost a third of all Bitcoin out there.

About 6.1 million BTC, worth $668 billion at today’s prices. Is this a full-blown institutional takeover?

Gradually then suddenly

Over the past decade, these centralized entities have boosted their Bitcoin stash by 924%. Back when Bitcoin was under $1,000, these guys, a few of them at least, were quietly stacking.

Now, with prices past $100,000, it’s clear institutions see Bitcoin as a strategic store of value, not just a wild gamble.

It’s like watching your cautious coworker suddenly become the office’s biggest risk-taker, and winning big.

Bitcoin is for everyone?

6 million BTC sounds a lot, but half of that Bitcoin is sitting on centralized exchanges, which means it’s not all locked away by institutions.

Some of it belongs to retail investors, the everyday guys like you and me. Still, the report points out a key fact, across institutional categories, the top three holders control between 65% and 90% of the Bitcoin in their group.

Early adopters? They’re still calling the shots, especially in DeFi, ETFs, and public companies.

Private companies, on the other hand, show a bit more spread-out ownership, like a team where everyone’s got a piece of the pie.

And there’s a twist, sovereign treasuries, government wallets from the U.S., China, Germany, and the U.K. hold Bitcoin mostly seized through legal actions, not bought on the market.

These wallets don’t move often, but when they do, markets feel it. Think of them as sleeping giants, quiet, but capable of shaking things up when they decide to stir.

Growing up?

This concentration is a big deal. The Bitcoin market is no longer just the so-called wild west of speculation, it’s maturing into a serious institutional playground. Price swings are becoming less about hype and more about solid fundamentals.

The market’s growing up, and with nearly a third of Bitcoin in centralized hands, it’s clear the big players are here to stay.

Maybe the cypherpunks doesn’t like that, but Bitcoin’s no longer just the rebel kid on the block. It’s becoming a cornerstone asset for institutions worldwide.

For investors, that means more stability, more legitimacy, and maybe, just maybe, a smoother ride ahead.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.