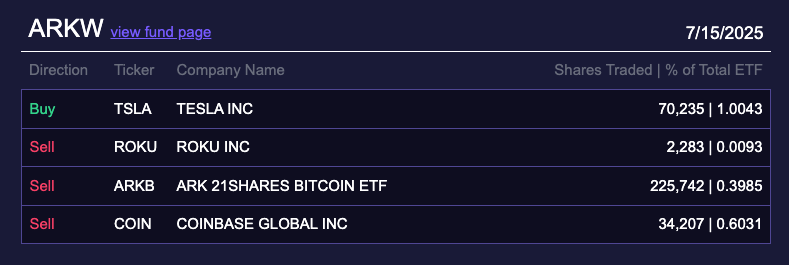

Cathie Wood’s ARK Invest sold 225,742 shares of the ARK 21Shares Bitcoin ETF (ARKB) on July 9, 2025, according to the firm’s daily trading report.

The sale came through the ARK Next Generation Internet ETF (ARKW). At ARKB’s closing price of $38.70, the trade generated $8.7 million.

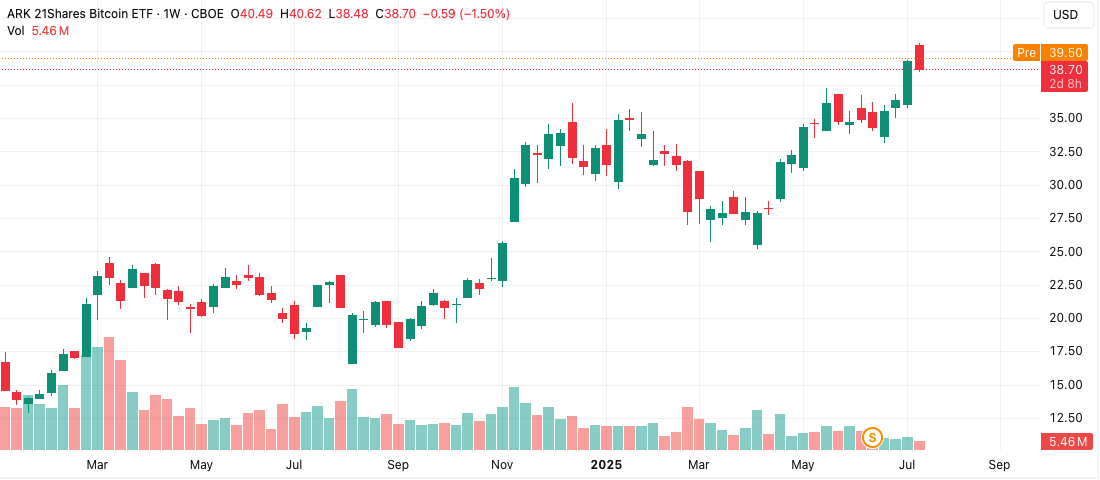

This marked the largest ARKB transaction by share count for ARK Invest. The sale followed ARKB’s recent rise to a post-split high of $39.30 on July 6, which equates to about $117.90 on a pre-split basis.

In comparison, ARK Invest sold 159,496 ARKB shares for $12 million in April 2024, a smaller trade by volume but higher in dollar value.

Bitcoin ETF Adjusted After Stock Split in June

In mid-June 2025, ARKB underwent a 3-for-1 stock split. This move increased the total number of shares threefold while reducing the per-share price by two-thirds.

The price dropped from around $90 to $30, but the total market value stayed the same.

The Bitcoin ETF now trades between $36 and $39, with its post-split high recorded at $39.30. TradingView charts show this is the highest level since the ETF’s launch.

ARK Invest disclosed the ARKB sale through its usual daily update. The firm has previously sold ARKB when the price reached key levels.

ARKW Also Sells Coinbase Stock Worth $13.3 Million

Alongside ARKB, Cathie Wood’s ARK Invest sold 34,207 shares of Coinbase (COIN) stock on the same day. This trade also came from the ARK Next Generation Internet ETF (ARKW) and brought in $13.3 million.

This followed two smaller COIN stock sales in the previous week. On July 4, ARK sold $2 million worth of COIN.

The next day, it offloaded another $2 million from its ARK Innovation ETF (ARKK).

The repeated sales show ARK Invest continues to reduce its exposure to COIN stock during periods of price strength.

ARK Innovation ETF Trims Robinhood and Block Holdings

On July 5, ARK Innovation ETF (ARKK) sold 58,504 Robinhood shares for $5.6 million. It also offloaded 24,780 Block stock shares (ticker: XYZ) for $1.7 million.

The moves are part of ARK Invest’s broader rebalancing across its crypto and fintech holdings. The firm adjusts its positions frequently and discloses them through daily trade reports.

These sales followed earlier transactions across multiple digital asset companies.

No Recent Sales of Circle Shares After June Exit

ARK Invest has not reported any new transactions involving Circle shares (CRCL) since June 23. On that date, the firm sold 415,844 CRCL shares worth around $110 million.

This was one of ARK’s largest liquidations in the crypto sector this year. Since then, Circle shares have remained untouched in ARK’s disclosed trades.

As of now, ARK Invest continues to hold other crypto-related positions while taking profits from select assets like Bitcoin ETF, COIN stock, and Robinhood shares.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.