Out of blue, JPMorgan Chase says, hey, we’re connecting our 80 million customers directly to Coinbase. Sounds like the kinda move that shakes up the game, right?

Dimon the skeptic

Jamie Dimon, JPMorgan’s CEO, has been the grumpy old man in the crypto playground for years. Not as hard like Peter Schiff, but almost.

Calling Bitcoin a fraud and speculative nonsense, he wasn’t exactly the biggest crypto cheerleader.

It was like watching the boss guy roast his own employees’ startup ideas every week.

But guess what? Times change, and the banking kingpin’s doing a complete 180, teaming up with Coinbase to make crypto simple and accessible for millions.

Starting this fall, if you’re a Chase credit card user, you’ll be able to fund your Coinbase account directly with your plastic.

Quick heads-up though, some purchases might get treated like cash advances, the kind of fees that make your wallet wince. Still, this is just the appetizer.

Come 2026, JPMorgan and Coinbase will roll out features allowing customers to link their Chase bank accounts straight to Coinbase.

And Ultimate Rewards points? Yeah, those points you usually ignore, soon, you’ll be able to turn ‘em into Circle’s USDC stablecoin.

That’s right, loyalty points morphing into digital dollars on Coinbase’s own Base Ethereum Layer 2 network.

Onboarding the next billion

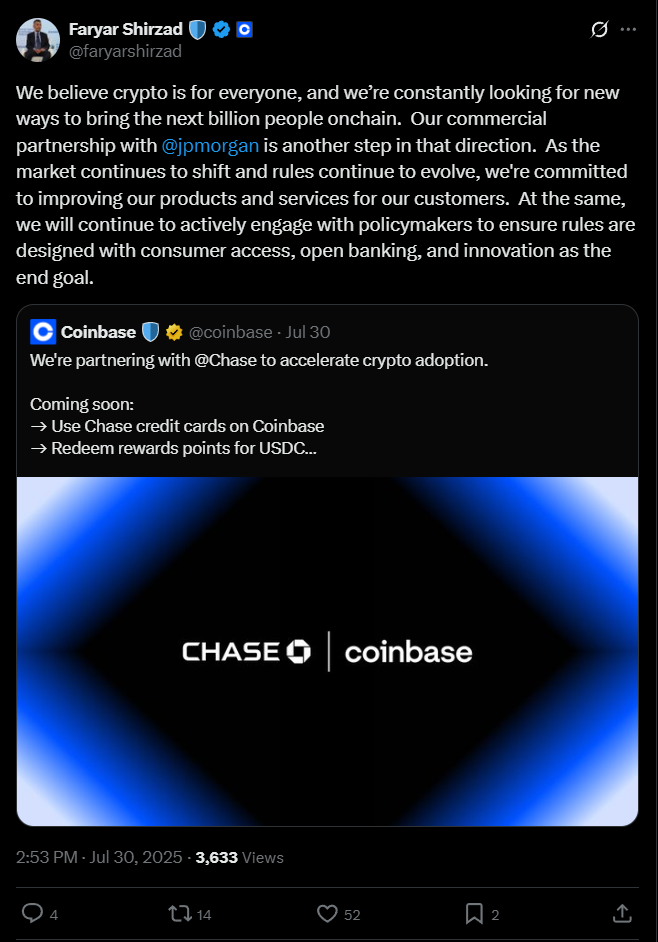

Faryar Shirzad, Coinbase’s chief policy officer, calls this a meaningful step toward putting the next billion people on the blockchain.

The goal? Make crypto as everyday as your morning Starbucks run, mixing traditional banking with crypto assets. It’s about bringing Wall Street and Main Street closer, with less fuss and more access.

But as always, the buzz isn’t all champagne and confetti. Some voices raised eyebrows, like Bloomberg’s Eric Balchunas, who pointed out the high fees when buying crypto with credit cards.

He argues a cheaper Bitcoin ETF might be a smarter play for most people.

Big deal?

Either way, JPMorgan’s partnering with Coinbase says loud and clear, the old guard’s warming to crypto’s future.

Whether you love it or eye-roll it, this move could actually redefine how millions enter and engage with cryptocurrencies.

It’s no longer fringe tech for techies, but a mainstream road with rewards, fees, and real-world finance. It’s a big deal.

Frequently Asked Questions (FAQ)

What is the JPMorgan and Coinbase partnership about?

JPMorgan and Coinbase have partnered to offer instant crypto access to over 80 million customers through real-time bank transfers and blockchain integrations.

How many users can now access crypto instantly through this partnership?

More than 80 million JPMorgan users will now have near-instant access to buy and sell crypto assets on Coinbase thanks to real-time settlement integration.

How does the real-time transfer system work?

The partnership enables seamless blockchain-based payments with real-time settlement via JPMorgan’s infrastructure, allowing users to avoid long bank delays.

What impact could this have on the crypto industry?

Analysts believe the move could accelerate mass crypto adoption, especially in traditional finance circles, by bridging the gap between banks and blockchain technology.

Is Coinbase the only exchange using JPMorgan infrastructure?

Currently, Coinbase is the largest U.S. crypto exchange collaborating with JPMorgan for real-time crypto banking. It sets a precedent for future exchange integrations.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 3, 2025 • 🕓 Last updated: August 3, 2025

✉️ Contact: [email protected]