Ethereum sentiment flipped positive after ETH almost touched $3,500 on Thursday. Traders on social media read the bounce as renewed strength for ETH. Meanwhile, the broader crypto market stayed cautious.

According to CoinGecko, ETH traded between $3,251 and $3,451 in the last 24 hours.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Early Friday, Ethereum changed hands near $3,323. The range followed a volatile stretch for large-cap crypto assets.

At the same time, the tone around Ethereum price moved from hesitation to optimism. The shift arrived quickly and tracked the intraday rebound. Therefore, sentiment data became a focal point for traders.

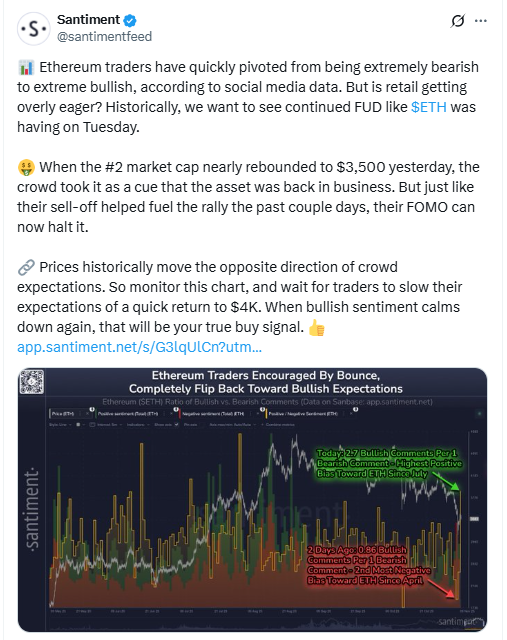

Santiment data shows bullish comments ratio for Ethereum

Market intelligence platform Santiment reported a sharp pivot in Ethereum sentiment.

On average, it recorded 2.7 bullish comments for every 1 bearish comment on ETH, the most positive bias since July. The reading captured a clear move in ETH chatter.

“Ethereum traders have quickly pivoted from being extremely bearish to extreme bullish,”

Santiment said on X. It added that when ETH “nearly rebounded to $3,500 yesterday, the crowd took it as a cue that the asset was back in business.” The quote described how ETH price action influenced social mood.

Earlier in the week, the picture looked different. On Tuesday, with ETH near $3,700, Santiment recorded 0.86 bullish comments per bearish comment. That marked the second-highest negative bias since April, underscoring rapid swings in Ethereum sentiment.

FOMO risk and crowd bias around ETH price

Santiment noted that “prices historically move the opposite direction of crowd expectations.”

It also wrote that a recent “sell-off helped fuel the rally the past couple days.” The sequence linked falling prices, rising pessimism, and then a rebound in ETH.

However, the platform warned that FOMO “can now halt it.” As optimism spikes, Ethereum traders often expect a quick return to previous highs. That expectation can clash with typical market rhythm.

Furthermore, Santiment said when traders “slow their expectations of a quick return” to $4,000 and when “bullish sentiment calms down again, that will be your true buy signal.”

The remarks reflected its historical reading of crowd bias rather than a forecast.

Crypto Fear & Greed Index shows Extreme Fear despite ETH bounce

Across the crypto market, risk appetite remained weak. The Crypto Fear & Greed Index printed 24/100 on Friday, signaling Extreme Fear. Over the previous week, the average sat in the “fear” zone.

On Tuesday, the index fell to 21, its lowest level in nearly seven months. The drop followed a swift move in Bitcoin. BTC briefly traded below $106,000 for the first time in more than three weeks.

Analysts tied the broader pullback to macro pressures. They cited trade tensions between the U.S. and China, alongside other economic factors. As a result, crypto sentiment stayed fragile even as Ethereum sentiment improved.

Bitcoin context and outside voices keep focus on market direction

Bitcoin set the tone for cross-asset crypto flows through the week. Its decline and rebound framed changes in the Fear & Greed Index. Consequently, traders watched BTC levels while tracking ETH momentum.

Meanwhile, Samson Mow, founder of Jan3, argued on X that the Bitcoin bull run has not started yet and still holds “plenty of upside.”

His posts arrived while the index remained in Extreme Fear. The statements added a notable counterpoint to the weak aggregate mood.

Taken together, Ethereum sentiment, Santiment’s crowd metrics, and the Crypto Fear & Greed Index offered a mixed setup. ETH chatter turned upbeat as crypto fear persisted, keeping attention on ETH price and BTC direction.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: November 7, 2025 • 🕓 Last updated: November 7, 2025