Elixir ended support for the deUSD stablecoin after Stream Finance disclosed a $93 million loss.

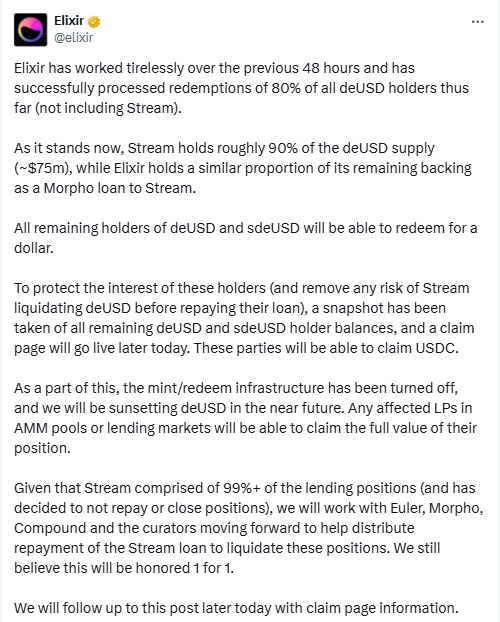

The team announced the deUSD sunset in an X post on Thursday. The move followed rapid redemptions and a sharp depeg.

According to Elixir, it processed 80% of all deUSD redemptions before the peg broke. CoinGecko data showed deUSD trading near $0.015, far from one dollar. That price reflected thin liquidity and concentrated holdings.

Stream Finance halted withdrawals on Tuesday after an external fund manager revealed losses.

The disclosure cited a broader $285 million debt across lenders and an estimated $68 million owed to Elixir. The halt disrupted lending flows and affected the stablecoin market around Stream.

How Stream used deUSD stablecoin to back XUSD

Stream Finance borrowed the deUSD stablecoin to help stabilize Staked Stream USD (XUSD).

After the loss disclosure, XUSD fell as low as $0.10. That low signaled stress in the peg and strained liquidity across pools tied to Stream.

Because deUSD sat inside that structure, pressure moved back to Elixir. The stablecoin faced redemption waves and lower secondary market depth. As a result, the deUSD peg broke while claims continued.

Elixir linked the breakdown to Stream’s open positions and limited repayments. The project described steps to manage exposures and prioritize deUSD holders.

It framed the deUSD stablecoin sunset as a direct response to these unresolved positions.

Redemptions, depeg, and lender coordination on deUSD

Before the incident, deUSD launched in July 2024 as a synthetic stablecoin. It aimed to compete with Ethena Labs’ USDe. The market cap stood near $150 million before the depeg.

Elixir said Stream holds roughly 90% of the remaining deUSD supply, valued around $75 million. That concentration left little freely circulating float after redemptions. It also amplified liquidity gaps once support ended.

Elixir is coordinating with decentralized lending venues Euler, Morpho, and Compound.

The goal is to process remaining deUSD obligations across those protocols. The team emphasized that repayments must align with on-chain positions and risk controls.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Repayments, disabled withdrawals, and Elixir’s stance

Elixir stated that Stream chose not to repay or close the affected deUSD positions. As a result, Elixir is working through other lenders to cover deUSD claims.

The team wrote: “We still believe this will be honored 1 for 1.” That line referred to expected treatment of liabilities.

Elixir also disabled withdrawals to limit adverse selling of the deUSD stablecoin. The team said the pause would “remove any risk of Stream liquidating deUSD before repaying their loan.” The step aimed to protect remaining balances during the unwind.

With support for the deUSD stablecoin now sunset, issuance and market-making are off. Stream Finance had not responded to a request for comment at the time of writing.

Elixir’s updates kept the focus on lending, liquidity, and stablecoin exposures tied to Stream.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: November 7, 2025 • 🕓 Last updated: November 7, 2025