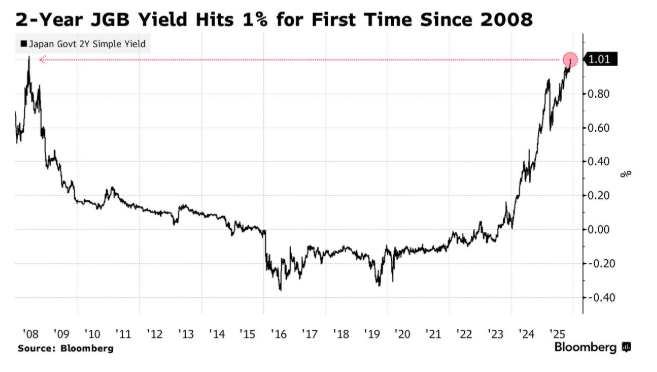

Japan bond yields climbed to a 17-year high on December 1, 2025, as traders priced in a possible BOJ rate hike.

Yields on Japanese government bonds reached levels last seen in 2008, signaling a clear shift in funding costs.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Markets read the move as a sign that the Bank of Japan could soon adjust its long-standing easy policy stance.

Two-year Japan bond yields reached 1 percent, while five-year and ten-year yields stood at 1.35 percent and 1.845 percent.

These numbers marked a sharp change from the low-yield environment that followed years of quantitative easing.

The move in Japanese government bonds showed how quickly expectations around a BOJ rate hike can reshape the curve.

This jump also placed Japan bond yields back near the zone seen before the global financial crisis. In 2008, yields approached similar levels before the Bank of Japan moved into a long phase of near-zero rates and asset purchases.

Now, with inflation concerns and policy debates in focus, investors track whether this phase marks another structural turn.

Bank of Japan Signals Careful Path As Yen Reacts

The BOJ rate hike discussion is already influencing the yen. On the same day, the yen gained 0.4 percent against the U.S. dollar, underlining how currency traders follow Japan bond yields and policy hints together.

A firmer yen changes import costs and export dynamics, so markets watch each move closely.

At the policy level, the Bank of Japan has stressed that any BOJ rate hike would not be rushed. Governor Haruhiko Kuroda stated, “Any decision to raise interest rates would be cautiously evaluated, balancing benefits and risks.”

This line reflects the central bank’s effort to weigh funding conditions, price stability and financial-system resilience at the same time.

In parallel, the Ministry of Finance has increased Japanese government bonds issuance. More bond supply can push Japan bond yields higher even without a formal BOJ rate hike, because investors ask for extra compensation to hold additional paper.

Therefore, bond supply, the Bank of Japan stance and the yen exchange rate now move together in shaping Japan’s overall monetary setting.

Japanese Government Bonds And Global Markets Feel The Shift

The return of Japan bond yields to levels last seen in 2008 matters for global markets.

Japan is one of the largest holders of foreign assets, so higher yields on Japanese government bonds can change how capital flows across borders.

When local returns rise, some investors may see less need to keep funds in overseas bonds.

In this environment, global markets watch both the yield curve and every signal from the Bank of Japan. A sustained rise in Japan bond yields can influence global benchmarks, hedging costs and cross-currency funding.

Even without a confirmed BOJ rate hike, the current pricing already feeds into global risk calculations.

Prime Minister Kaimanao Takai’s stimulus plans add another layer to this picture. Fiscal measures require financing through Japanese government bonds, which ties back to Japan bond yields and any future BOJ rate hike.

As a result, global markets now follow the combination of central bank decisions, fiscal moves and bond issuance when assessing Japan’s role in the world economy.

Ethereum Price Enters The Japan Bond Yields Conversation

The Ethereum price also appears in the wider discussion around Japan bond yields and global markets.

At the time of reporting, Ethereum’s price is $2,818.20, with a market cap of $340.14 billion and 24-hour trading volume of $20.09 billion.

Over the past 30 days, the Ethereum price has declined by 26.97 percent,

A daily Ethereum price chart from CoinMarketCap, captured at 05:15 UTC on December 1, 2025, shows the token trading in a lower range.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 1, 2025 • 🕓 Last updated: December 1, 2025