Chainlink said Tuesday it will roll out Chainlink 24/5 US equities data for on chain US stocks and on chain ETFs.

The company said the upgrade will add US Equities Streams to its market data services for crypto platforms.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Chainlink said the service will deliver market data for “all major US equities and ETFs” for 24 hours per day, five days per week. It said the goal is to provide continuous pricing beyond standard U.S. trading hours.

The company also tied the effort to the size of the market. Chainlink said the product could help bring the $80 trillion U.S. market on chain, as more platforms build products linked to tokenized stocks and tokenized ETFs.

Chainlink 24/5 US Equities Streams Add Bid Ask Prices and Volume Data

Chainlink said its US equities streams will include bid and ask prices and volume data. It said that data can support crypto platforms that list blockchain based stock and ETF exposure.

The company said traders can use the feeds to “buy, sell, or lend” blockchain based versions of US equities and ETFs.

It positioned the product for after hours stock trading through crypto venues that operate beyond standard market sessions.

In simple terms, bid and ask prices show the best visible buy and sell prices at a given moment.

Meanwhile, volume data shows how much trading activity takes place over a period, which can help platforms track market conditions.

Crypto Exchanges Push After Hours Stock Trading as NYSE Develops Tokenized Markets

Chainlink said on chain US stocks remain “significantly underrepresented on chain.” It linked that gap to how US equities trade in defined sessions, while crypto markets run continuously.

The company said equities “trade across fragmented sessions during dedicated market hours,” instead of trading all the time.

It said that difference creates demand for Chainlink 24/5 US equities data that reflects market activity beyond the standard schedule.

Chainlink added:

“As onchain markets mature and global participation grows, such as via equity perps, there is increasing demand for continuous, high fidelity equity data that reflects real world market dynamics at all times, beyond just standard trading hours.”

The company pointed to this demand as a driver for broader tokenized stocks and tokenized ETFs coverage.

Chainlink 24/5 US Equities Data Launch Names Eight Protocol Users and Cites US Regulators

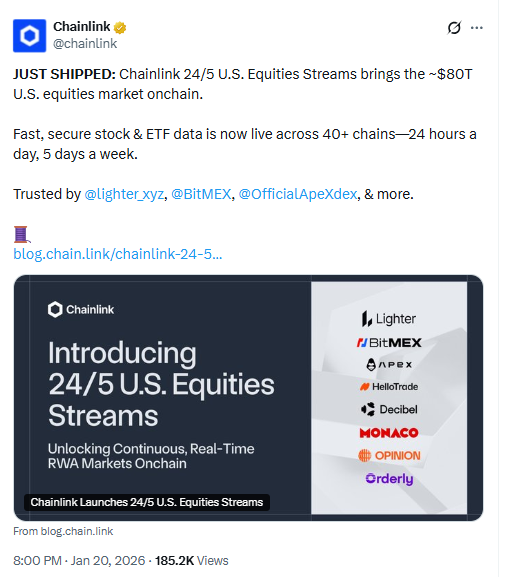

Chainlink said at least eight crypto protocols already use its new data streams. It named Lighter, BitMEX, ApeX, HelloTrade, Decibel, Monaco, Opinion Labs, and Orderly Network.

Traditional exchanges also signaled interest in tokenized markets. The New York Stock Exchange said Monday it is developing a blockchain based platform for 24/7 trading and instant settlement of tokenized stocks and tokenized ETFs.

U.S. regulators have also reviewed always on market structures. The Securities and Exchange Commission and the Commodity Futures Trading Commission said in September they were exploring allowing 24/7 markets.

In April, the CFTC sought public comment on the implications and risks if it allowed 24/7 commodities trading.

Chainlink said its Chainlink 24/5 US equities data “is just the beginning,” and it plans to expand to other asset classes and countries, with possible 24/7 on chain coverage later.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: January 21, 2026 • 🕓 Last updated: January 21, 2026