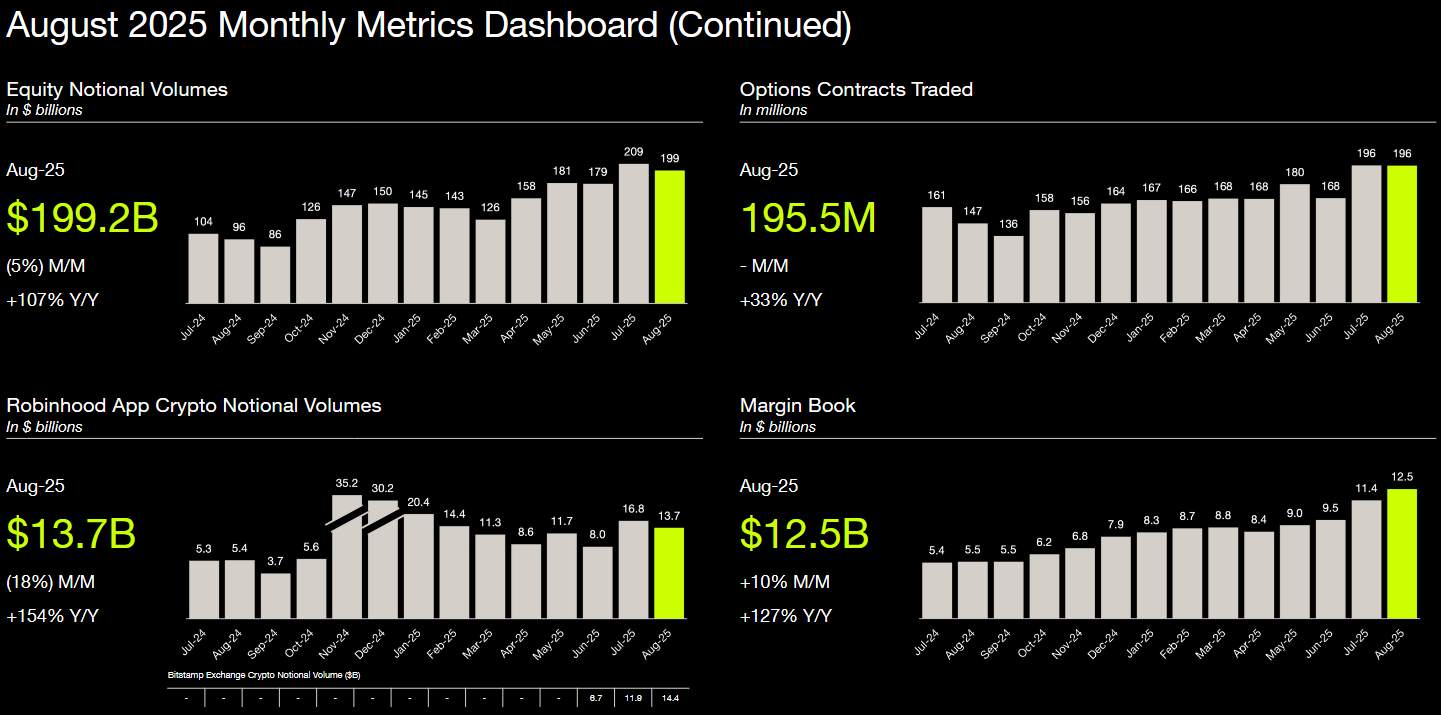

Bitstamp crypto volume ended the month $0.7 billion ahead of Robinhood crypto volume. The gap reflected opposite monthly moves. Bitstamp rose, while Robinhood declined.

The pair’s August trading volumes combined slipped 2.1% from July. That shows softer overall engagement. It also indicates how Robinhood’s drop offset Bitstamp’s gain.

Robinhood’s internal chart shows a downtrend since November 2024. Activity ticked up in July, then fell again in August. The reversal put Bitstamp on top for the first full month after closing.

August trading volumes and Bitstamp by Robinhood integration

Bitstamp by Robinhood now connects to Robinhood Legend and Smart Exchange Routing. This link enables easier order flow across both platforms. It supports routing to deeper books.

The acquisition added over 5,000 institutional clients and 50,000 retail customers to Robinhood’s base. These accounts expand distribution and execution pathways. They also help internal liquidity.

Management places real-world asset tokenization at the center of the plan. Bitstamp’s stack fits that roadmap. The August trading volumes milestone arrives as the integration scales.

Robinhood S&P 500 debut and asset base

Robinhood S&P 500 inclusion arrived this week. HOOD shares rallied over 16% on the day. The index now holds another crypto-active firm.

“This movement expands the index’s exposure and connection to the digital asset economy,” said Edwin Mata, CEO of Brickken. His comment framed the link to tokenization. It highlighted index-level exposure.

Meanwhile, Robinhood’s total assets rose 2% in August to $304 billion. The firm reported about $41 million in crypto within that figure. Asset growth therefore came from outside pure trading.

Tokenization layer 2 and EU perpetual futures via Bitstamp

Around early July, Robinhood launched a tokenization layer 2 for EU users. It offers access to U.S. stocks through tokenized rails. The rollout targets its European base.

Robinhood also introduced perpetual futures EU with up to 3x leverage for eligible users. These trades route through Bitstamp. The setup centralizes derivatives operations where Bitstamp has depth.

Connectivity to Legend and Smart Exchange Routing supports internal best-execution logic. Orders can move to the best venue. The design aims for tighter spreads and better fill rates.

Market context for August trading volumes: quotes and data

The broader market ended August near where it began. Prices were flat, and August trading volumes rose only slightly. Realized volatility stayed contained.

Seasonality also played a role. “As a North America–based platform, trading could have been affected by the summer holiday period,” said Ryan McMillin, CEO of Merkle Tree Capital. He also pointed to macro signals.

“Trump has been pushing for lower rates while Jerome Powell has dug his heels in, now that looks to have changed,” McMillin said. CK Zheng, co-founder and CIO of ZX Squared Capital, expects higher volumes ahead. He cited ETF flows and corporate treasuries as drivers.

Bitstamp by Robinhood routing meets August performance

Bitstamp by Robinhood handled higher activity while Robinhood crypto volume fell. The divergence matched their August trading volumes data. It also aligned with the routing plan.

Cross-venue flow can direct orders to the deepest liquidity. It also helps manage fees and execution quality. The integration makes that coordination possible.

The $14.4 billion result gives Bitstamp the lead for the month. Robinhood crypto volume at $13.7 billion trails after an 18% decline. The pair’s combined activity still slipped 2.1% from July.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: September 12, 2025 • 🕓 Last updated: September 12, 2025