So, the European Central Bank, and the ruler elite had a dream, a shiny, new digital euro that would revolutionize payments across the continent. Financially enslave all the Europeans.

Establish total monetary control over everyone else. But guess what? Europeans just aren’t buying it. Literally.

Social credit score like in China? No, thanks!

A fresh survey from the ECB reveals that most people in Europe see little to no value in this so-called central bank digital currency.

The study, which polled around 19,000 people across 11 eurozone countries, paints a pretty bleak picture for the digital euro’s future.

When asked how they’d hypothetically split €10,000 across various assets, Europeans barely threw a bone to the digital euro.

Instead, they stuck to their trusty cash, savings accounts, and other traditional options. It’s like trying to sell ice to Eskimos, they’re just not interested.

Why need a digital euro?

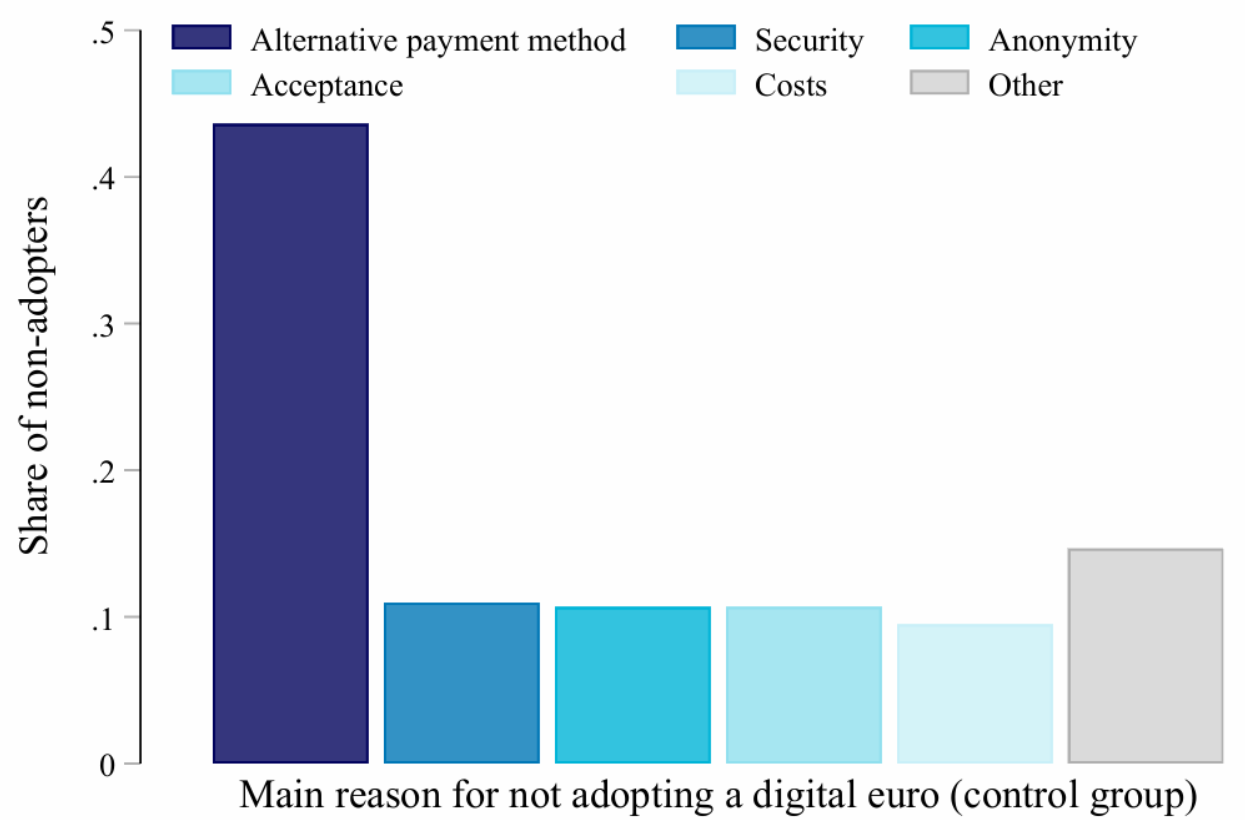

Why? Well, people are creatures of habit. The ECB found that Europeans are perfectly happy with their current payment methods.

Between cash, cards, and online payment systems, they’ve got all they need. Adding another option feels like overkill, like bringing a third dessert to a dinner party when everyone’s already stuffed.

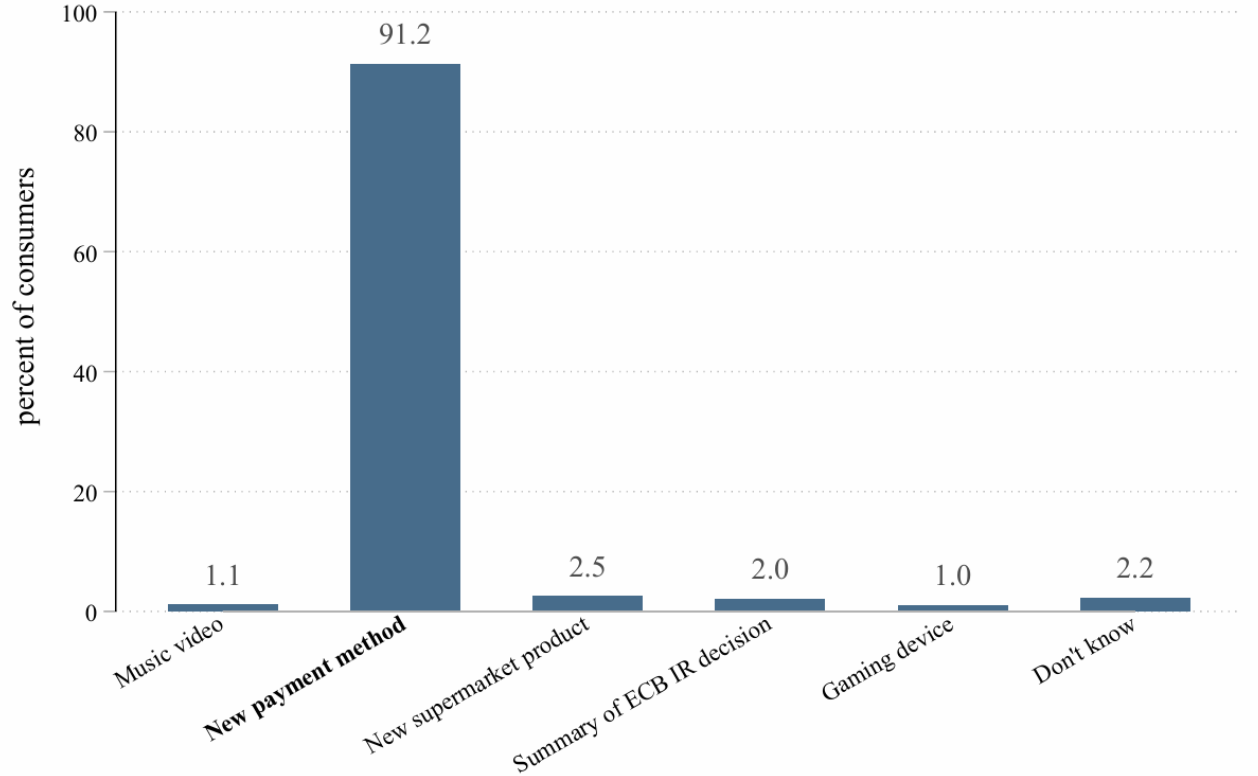

The ECB isn’t giving up without a fight, though. They’re pushing for better communication to convince people of the digital euro’s value.

Their research suggests that short, snappy videos explaining the benefits could help change minds.

Show people how this thing works and why it matters, and maybe, just maybe, they’ll come around.

It’s not called slavecoin in the social media by coincidence

But let’s not ignore the elephant in the room, the global skepticism about CBDCs.

Over in the U.S., lawmakers like Representative Tom Emmer are calling CBDCs inherently un-American, anti-freedom and pushing anti-CBDC legislation.

On the other hand, in Europe, Deutsche Börse CEO Stephan Leithner is urging policymakers to double down on a permanent digital euro to boost financial autonomy.

So here we are, a digital euro that nobody asked for and few seem to want.

The ECB faces an uphill battle convincing Europeans this isn’t just another over-engineered solution to a problem that doesn’t exist. Will they succeed? Who knows.

But for now, it seems like the digital euro is more of a pipe dream than a game-changer. Hopefully, it will remain in this stage.

Have you read it yet? Gold’s golden moment is here, Bitcoin left in the dust

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.