Listen up, because what I’m about to tell you isn’t just another bedtime story about crypto.

No, this is the tale of Sonic, the one formerly known as Fantom, the coin that’s been making more noise this month than a wise guy at a wedding.

Sonic’s up 24% in just a month, and another 1.2% in the last 24 hours. You’d think we’d be popping champagne, right? Don’t hurry!

Impressive, very nice

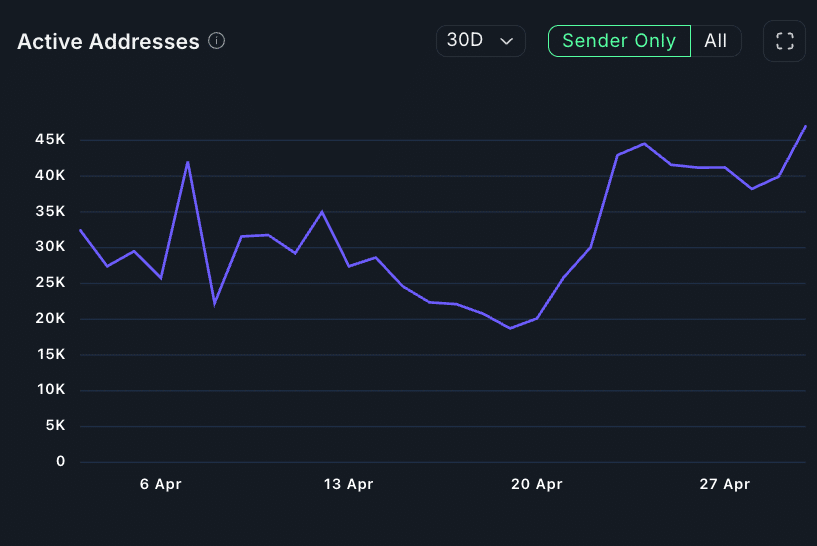

Numbers are clear, Sonic’s got the market buzzing. Active wallets? Doubled last week, over 45,000 now, per Nansen. Most of these guys?

They’re buying, not selling. The result? DEX volume exploded 26% in a week, hitting $788 million. That’s more than Avalanche, Polygon, and Tron.

Liquidity is pouring in like it’s happy hour at the club. Artemis says Sonic’s net inflow hit $37.1 million, the biggest among all blockchains.

You know what that usually means? Somebody’s loading up, and if the cash keeps coming, we could see fireworks.

Something is off

Now, before you start calling your friends to get in on this action, let’s pump the brakes. The big shots on Binance?

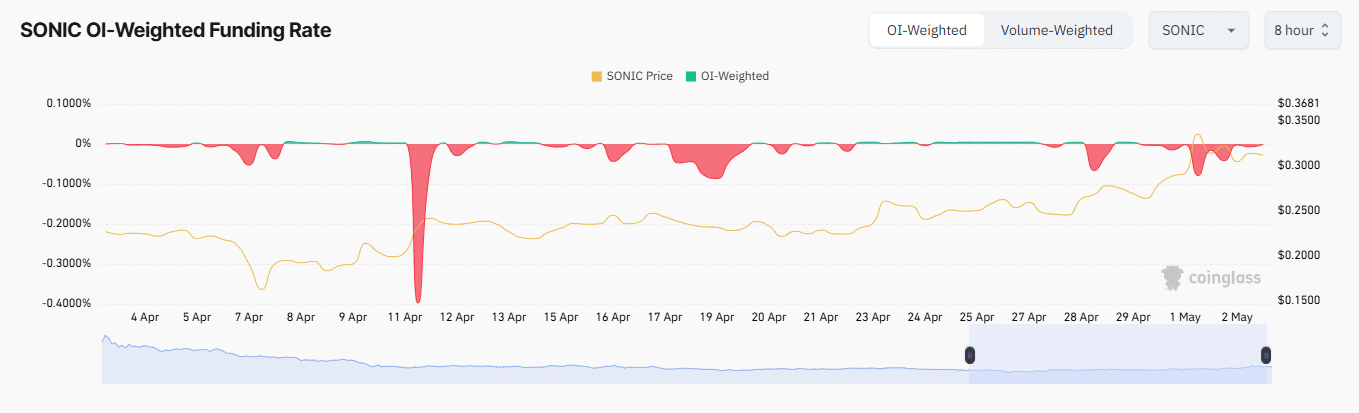

They’re not exactly betting the farm. CoinGlass says the Long-to-Short Ratio is sitting at 0.74.

Translation, the heavy hitters are leaning short, not long. And that’s a huge red flag, my friend. And the funding rate?

Negative. Subtle, but it’s there, a little whisper that maybe, just maybe, the party’s about to get busted.

Value

Still, you gotta respect the hustle. Sonic’s total value locked hit a record $1.54 billion, with dApps like Silo Finance and Avalon Labs raking in millions.

The staking yield? Nearly 6%, and that’s more than Ethereum, more than Sui. Even the memecoin crowd is getting in on the action, with names like Goggles and TinHatCat pulling in millions.

You might wonder what’s next? Is Sonic gonna blast off to the moon, or is this just another pump before the dump?

The big dogs are on the shorting side, and they rarely lose, just saying. The charts are teasing a bullish reversal, but one bad move and we could see a dip.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.