A few years ago, the idea that central banks and governments would openly integrate crypto as strategic asset into their core frameworks sounded like fringe speculation.

Today, it’s happening in real time, and across multiple continents.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

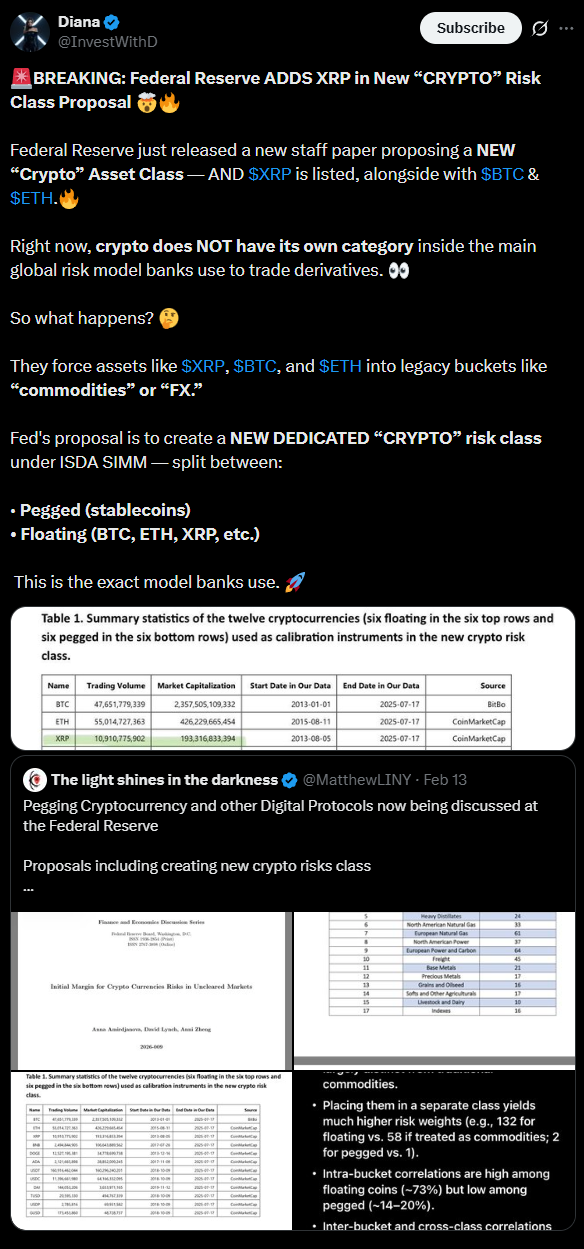

The Fed quietly adds XRP to its risk playbook

The Federal Reserve has formally incorporated XRP into its official risk assessment framework.

This is part of the Fed’s structured methodology for evaluating counterparty and settlement risks in payment systems, not a casual mention in a footnote.

By naming XRP alongside traditional assets, the Fed is signaling that it views certain digital assets as legitimate components of modern financial plumbing, tools to be understood and managed.

This move carries weight because the Fed’s risk models influence everything from bank capital requirements to broader supervisory standards.

When the central bank of the world’s reserve currency starts baking crypto into its foundational risk math, it removes one of the biggest remaining psychological barriers for institutions.

Brazil revives the 1 million BTC strategic reserve push

At the same time, Brazil has reintroduced legislation to build a national Strategic Bitcoin Reserve of up to 1 million BTC over five years.

The bill would allow the government to acquire Bitcoin through budget surpluses, seized assets, or other non-debt mechanisms, treating it as a reserve asset similar to gold or foreign currencies.

🚨 BREAKING: 🇧🇷 BRAZIL REINTRODUCES BILL TO BUY 1 MILLION BITCOIN

Brazilian lawmakers have submitted a bill to create a Strategic Sovereign Bitcoin Reserve (RESBit), proposing the gradual acquisition of up to 1M $BTC over five years.

If approved, Brazil would become one of the… pic.twitter.com/yTM2vp0bK5

— BSCN (@BSCNews) February 13, 2026

This reflects a growing view among emerging-market policymakers that holding Bitcoin can serve as a hedge against currency devaluation, inflation, and geopolitical uncertainty. Symbolic posturing would look different.

If passed, Brazil would join a very short and exclusive, but growing list of nations actively positioning strategic crypto holdings as part of sovereign balance-sheet strategy.

Thailand opens the door to regulated Bitcoin derivatives

Thailand has taken another concrete step, regulators have officially approved Bitcoin and other cryptocurrencies as underlying assets for derivatives trading on licensed exchanges.

This green light allows futures, options, and other structured products tied to BTC, bringing the asset fully into the regulated financial system.

This matters because derivatives markets are where serious institutional liquidity lives.

When a country integrates Bitcoin into that layer, it signals long-term acceptance and creates pathways for more sophisticated participation.

A global shift in perception

Put these three developments side by side and a pattern emerges. The Fed is normalizing crypto in risk models.

Brazil is exploring it as a sovereign reserve. Thailand is embedding it in regulated derivatives.

These developments reflect a broader recognition that digital assets offer real strategic advantages: portability, scarcity, decentralization, and resistance to certain traditional monetary risks.

They’re connected. This is not a 100% unanimous global acceptance yet. Plenty of regulators remain cautious, and implementation will take time.

But the direction is unmistakable, the major players are moving from “crypto is a problem to solve” to “crypto is an asset class to understand and integrate.”

Simpli put, these steps are far more consequential than any single day’s price movement.

They build the institutional scaffolding that eventually makes crypto feel less speculative and more like a permanent fixture in global finance.

The quiet convergence we’re seeing right now, across central banks, emerging nations, and regulated markets, suggests that strategic crypto value is no longer a debate.

It’s becoming a calculation.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: February 15, 2026 • 🕓 Last updated: February 15, 2026

✉️ Contact: [email protected]

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.