Imagine announcing a $1 billion buy-back plan and watching your cryptocurrency slip instead of jump.

That’s exactly what happened with Ripple’s XRP after their reserve news.

The company plans to snatch up $1 billion worth of XRP for its crypto treasury, aiming to become the biggest corporate whale in this top-five crypto league.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Sounds like a surefire rocket fuel, right? Nope. Instead, XRP dropped by 8.75%, keeping its sad little downhill march intact.

Possible pivot?

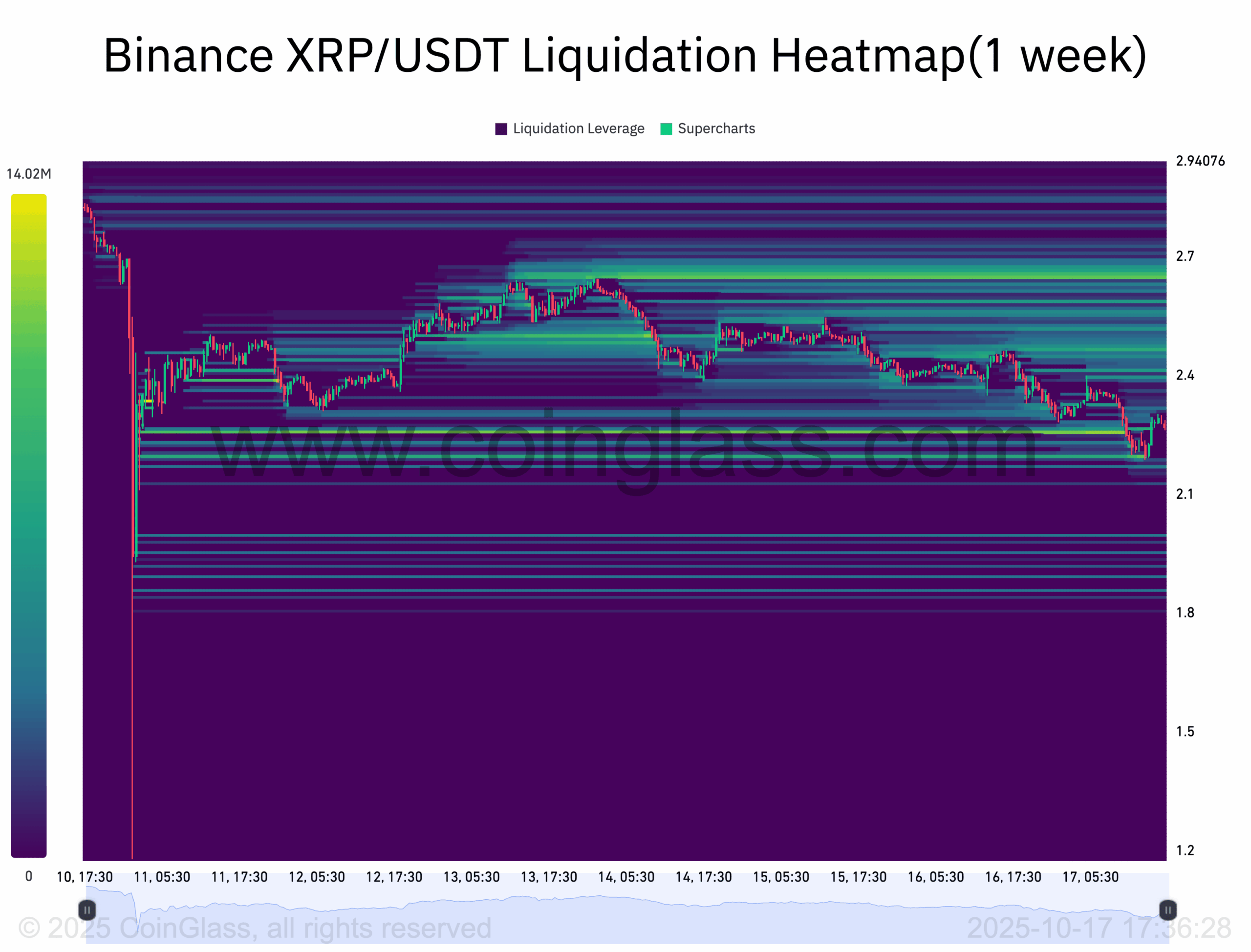

XRP’s tale in October could be a classic underdog story or a slow fade. Analysts say it’s been trapped inside a falling wedge pattern after last week’s savage crypto market bloodbath, where over $20 billion in positions were liquidated in a frenzy.

The plot thickens as XRP teeters around the $2 support level, the wedge’s basement and a possible pivot point for a turnaround.

Now, graph wizards are telling us that if XRP can muscle its way above the wedge’s upper trendline, it might flirt with a recovery zone between $2.36 and $2.75, up to 20% above current prices. But this range houses nearly $119 million in short leverages.

When those shorts start packing up, expect a short squeeze that could push XRP to hit $3, a psychological milestone that also aligns with the upper edge of a descending triangle pattern lurking in the charts.

Crypto black Friday

Should XRP fail this high-wire act and plummet below $2, it would slam the door shut on the wedge breakout dream.

Expect pain as the price could tumble toward $1.65, a key 0.618 Fibonacci retracement level, a fancy way of pointing out another tough support zone. October could get messy.

Fair enough, the longer game looks more promising. Despite last week’s brutal 60% crash, dubbed the crypto “black Friday,” in the social media XRP still clings to an ascending triangle breakout narrative.

Right now, it’s holding above the triangle’s bottom line near $2.25, eyeing a leap toward the upper boundary around $3.55.

Patience

If XRP can break the $3.55 ceiling with good trading volume, the skies open up for a potential rally to about $7.75 by next year.

That’s a really nice 250% jump from here, rewarding those patient enough to stay in the game.

Either way, Ripple’s billion-dollar buy-back couldn’t stop XRP’s bearish slide, but all is not lost.

The next few weeks will test whether XRP can escape its technical traps and head back to the moon, or sink deeper into the crypto abyss.

💬 Editor’s Comment:

Honestly, this feels like one of those classic crypto plot twists — a billion-dollar buyback that somehow sends prices down.

XRP’s been teasing a turnaround for weeks, and despite the frustration, the setup doesn’t look dead yet.

If it can hold the $2 line, we might just be staring at the calm before a surprise rebound. The question is whether traders have enough patience left to ride it out.

Frequently Asked Questions

Why did Ripple’s $1 billion buyback not boost XRP’s price?

Despite the massive buyback announcement, XRP fell nearly 9% as overall crypto market sentiment remained bearish. Traders were likely focused on profit-taking and short positions rather than the long-term implications of Ripple’s move.

What are the key XRP support and resistance levels right now?

The key support lies around $2.00, while resistance sits near $2.75 and $3.55. A break above $3.55 could trigger a sharp rally toward $7.75 in the long term, according to technical analysts.

Could XRP reach $3 again soon?

If XRP breaks out of its falling wedge and short positions unwind, a move toward $3 is possible. A confirmed breakout above $2.75–$3.00 would likely spark a wave of renewed optimism.

What happens if XRP falls below $2?

A drop below $2 could trigger a deeper correction toward $1.65, where the next major Fibonacci support lies. It would likely delay any bullish recovery in the near term.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: October 19, 2025 • 🕓 Last updated: October 19, 2025

✉️ Contact: [email protected]